Investing in the stock market can be difficult when there are so many options available. To simplify this problem, I am going to list what I believe are the 10 best Canadian stocks to hold forever.

In writing this article, my plan is to highlight the top Canadian companies I feel deserve a core portfolio position. In other words, these are companies worth buying and holding, not trading.

Let’s begin by reviewing some basic criteria and then check out the stocks.

Table of Contents

What Qualifies the 10 Best Canadian Stocks to Hold Forever?

Investors have different reasons for putting their cash to work. Some people want to turn a quick profit, while others want to hold for the long term and collect cash flow from rising dividend payments.

My favourite way to invest is to receive regular dividend cheques that increase faster than inflation. This is a strategy that can help with achieving financial freedom, as the dividend payments can eventually be used to cover all living expenses.

Each of the companies listed here are traded on the Toronto Stock Exchange. I will be focusing on TSX blue chip stocks.

Here’s an infographic with a breakdown of each of the companies discussed in this article:

Investing for Quality

Given that this article will cover the absolute 10 best Canadian stocks to hold forever, there will be a few key stock features I will prioritize:

- Low-to-moderate dividend yields. Extremely high yields can signal that investors don’t trust the cash flow.

- High dividend growth. A company with an average dividend yield and high growth can produce great returns over the course of decades.

- Recurring revenues in all market conditions. Companies that can make money no matter what happens in the world are the best. Cyclical companies can be great for a while, but then eventually let you down.

- Decent size. All of the companies on this list have a market capitalization of at least $10 billion. It is intended to be solid, with each business being built to last. Therefore, penny stocks have no place here.

Taken together, this will be representative of a portfolio that I would be happy to start out with as a beginning investor and keep forever.

Diversification

I am aiming to provide a sufficient level of diversification for the overall list of companies. This can be difficult in the Canadian stock market as it is not as robust as in the US.

However, within a healthy cross-section of 10 companies, I am not concerned with some redundancy. I would rather own two high-quality companies in similar lines of business than diversify for the sake of it at the cost of owning a weaker business.

10 Best Canadian Stocks to Hold Forever: The Full List

These are my top picks from the Canadian stock market for long-term growth and safety.

Given the holding period is for life, only the best made the cut.

1. The Toronto-Dominion Bank (TD)

TD Bank is known as the second largest bank in Canada and the sixth largest in the US. It made itself famous by advocating for longer branch hours and branding itself as “America’s Most Convenient Bank”.

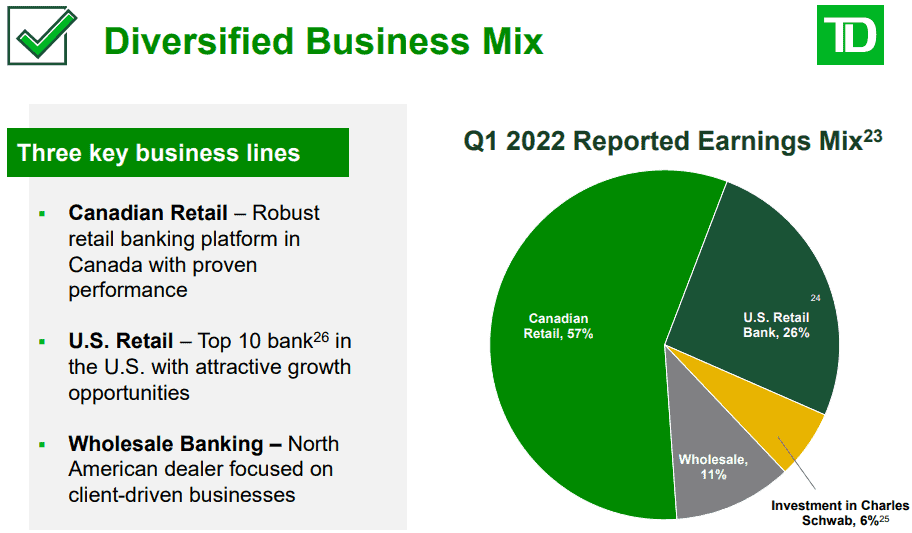

TD Bank operates in three business segments:

- Canadian Retail

- US Retail

- Wholesale Banking

The company offers everything you would expect from a full-service bank, including credit, wealth management and investment options, along with basic and business banking.

One of the key drivers for TD Bank going forward is going to be to continue embracing the digitization of financial services. On that front, TD Direct Investing recently ranked top among Canadian banks for Digital Broker Rankings from the Globe and Mail. Persistent innovation will be vital to continue earning market share in this competitive space.

My favourite fact about the company is its dividend track record; TD Bank has paid dividends for 164 continuous years.

I have owned TD Bank since mid-2009 when I purchased it in the midst of the Great Recession. I increased my position by 150% during the March 2020 pullback. Most recently, the company announced a 12.66% dividend increase which was paid with the January dividends.

TD was the first stock I ever purchased and is one I plan to hold onto for life.

Related Article: Doubling my Yield on Cost with TD Bank

2. Canadian National Railway Company (CNR)

Canadian National Railway is a railroad business spanning Canada and the US. It ships virtually all manners of freight, including many of the important natural resources that keep our world spinning round, such as petroleum and chemicals, forest products, and metals.

The company has had a rather brief history as a private company. It was originally Canada’s largest Crown Corporation—owned by the government—before it was listed on the Toronto Stock Exchange in 1995.

These are the three best things about CN Rail as a business:

- The Canadian economy can’t operate without it. The company is integral to the plumbing of the Canadian economy. It ships cargo from coast to coast in a greenhouse-efficient manner. For long-distance hauling, there is no better way to move freight.

- It operates in a duopoly without risk of destructive competition. Along with Canadian Pacific Railway Limited (CP), CNR has a rock solid duopoly in place. Given the physical constraints of developing new rail systems, the companies are insulated from foreign competition.

- The focus on operational improvements and proper use of technology. Since the company is able to consistently earn healthy profits, it is able to then funnel cash flow back into improving operations and integrating meaningful technology. It is able to do this all without compromising returns back to shareholders.

Each year since being available for purchase from regular shareholders, CN Rail has raised its dividend payment. Most recently, the company announced its 26th consecutive dividend increase in the amount of 19.11%.

This company is perpetually on my stock watchlist. Whenever the shares experience a pullback, I love buying more.

CN Rail firmly earns its spot on my list of the 10 best Canadian stocks to hold forever. It has incredible competitive positioning and loves rewarding shareholders.

3. TELUS Corporation (T)

TELUS is one of the key pillars for regular Canadians and businesses alike. It is best known to consumers for its wireless network and commercials with furry animals.

What I personally love most about TELUS is the way it operates its business. In its Q4 2021 results, the company reported an increase of 19,000 Mobile and Fixed customers. As consumers become further hooked on their smartphones and other digital devices, TELUS will continue meeting their needs.

Here are some key differentiators between TELUS and its competitors:

- TELUS Health. They provide digital health services and virtual care. This is a growing market, particularly as we pull through the COVID pandemic.

- TELUS International. The business provides IT services to global clients. As businesses look to outsource so they can focus on their intended lines of operation, this is positioned to grow.

- TELUS Agriculture. This unit optimizes the food value chain, using data to increase efficiency, production, and yields.

By expanding on its digital and data capabilities, TELUS has continuously shown it is willing and able to flourish.

From the standpoint of an investor, a great feature is its straightforward dividend policy. The current dividend growth program from TELUS began in 2019 and runs through the end of 2022. As part of this, the company committed to annual dividend increases of 7 to 10 percent. Getting this sort of guidance from the company allows me to know what to expect from my annual dividend income.

I intend to remain invested and continue to look for opportunities to buy more shares of TELUS.

4. Fortis Inc. (FTS)

Fortis is an electric and gas utility with over 34 million customers. The vast majority of the business is invested in infrastructure which provides the reliable transmission of energy. It operates across Canada, the US, and the Caribbean.

With over 99% of its business being with regulated assets, Fortis has a reliable source of earnings. Its opportunities going forward are plentiful, even just by optimizing present operations for efficiency.

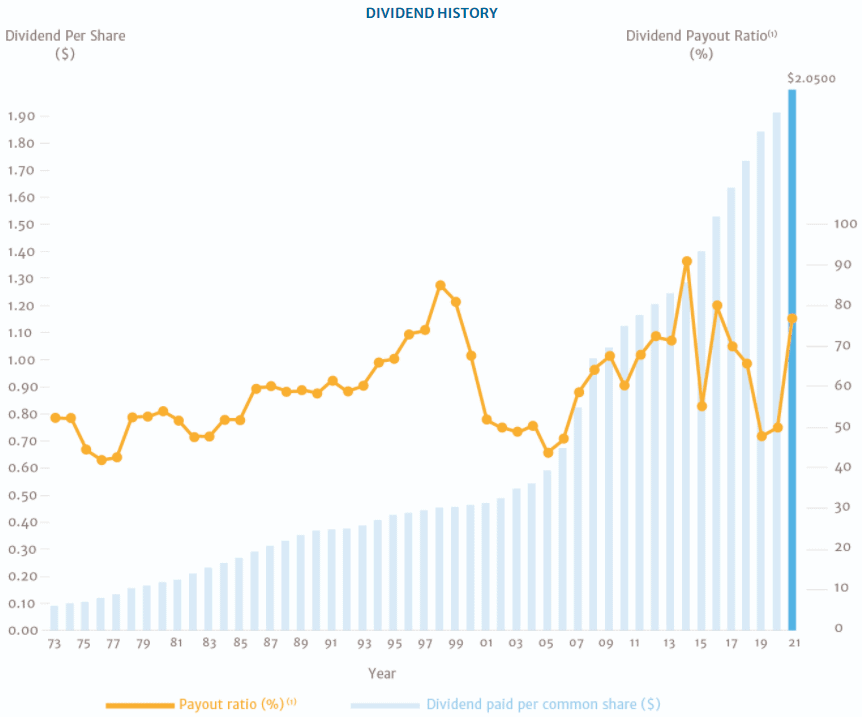

Fortis boasts one of the best dividend growth track records in Canada. It has increased its dividend annually for nearly 50 years, going all the way back to 1973:

The company has also provided guidance that it intends to increase the dividend by approximately 6% annually through 2025. As previously mentioned, this provides the kind of healthy assurance I like as an investor.

This is a company that I have been investing in regularly since 2015. It’s where I go when I want a safe return with a solid dividend yield on top. I fully intend to hold these shares in perpetuity.

5. Brookfield Asset Management (BAM.A)

BAM is one of the world’s largest alternative asset managers with approximately $690 billion in assets under management. Its projects span across real estate, infrastructure, renewable energy, private equity, and credit.

Given the range of investments BAM owns, I consider it very much like an investment fund all unto itself. It is spread across a diverse set of industries, with the capital being managed by a seasoned team.

My favourite part about BAM is the structure it has and relationship with other publicly traded companies which bear the “Brookfield” branding. These include Brookfield Business Partners (BBUC), Brookfield Infrastructure Partners (BIPC), Brookfield Reinsurance Partners (BAMR), and Brookfield Renewable Partners (BEPC).

These relationships provide BAM with a steady stream of earnings and they are also great places for it to deploy capital it needs to invest. It’s a great structure that benefits all companies involved.

Dividend growth has been around 20% for BAM going back to 2001. While it has been lower through the years of the pandemic, the company remains well-positioned for the years to come. Critical infrastructure and asset management will never go out of style.

6. Brookfield Renewable Partners (BEPC)

Brookfield Renewable is one of the world’s largest renewable energy businesses. Its sectors include hydro, wind, solar, and energy transition. These assets extend around the world in diverse geographies.

The hydro business alone spans 87 river systems and has 229 hydro generation facilities.

This emphasis on renewable power continues to increase in value. There are a number of secular growth trends which are increasing the rate at which we move to a digital—energy dependent—future.

As concepts such as the metaverse and cryptocurrencies based on blockchain technology develop, fossil fuels cannot be relied on alone. It is clear that renewable power is here to stay. Top notch businesses with access to capital such as Brookfield Renewable are poised to reward investors.

On the business side of the equation, Brookfield Renewable is quite transparent about how it intends to treat investors. The company is open about its intention to earn 12-15% total returns and provide 5-9% annual distribution growth.

7. Enbridge Inc. (ENB)

Enbridge is an energy infrastructure company. It is best known as a pipeline business, though it develops critical infrastructure across four solid franchises:

- Gas Distribution

- Gas Transmission

- Liquids Pipelines

- Renewable Power

While it is still firmly entrenched in the present-day fossil fuel business, it continues to diversify. It is committed to making investments in low-carbon opportunities such as renewable natural gas, hydrogen, and carbon capture. It will be able to finance this operational pivot by using its steady source of earnings from the current business.

Enbridge is as close as I like to come to a cyclical industry. The oil and gas sector has had plenty of ups and downs over the years, and this isn’t going to change. Still, the future plans are promising and they have a solid track record of delivering on promises.

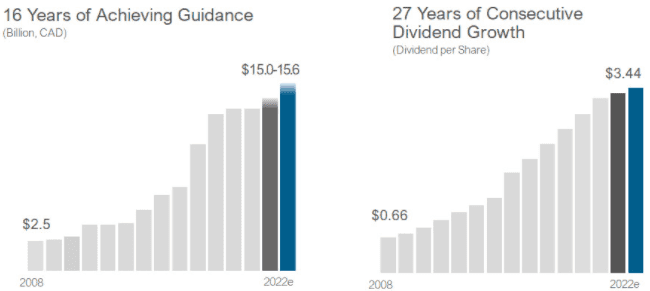

Here are two bar charts depicting Enbridge’s shareholder-friendly attributes:

Going over 16 years without any huge downside surprise for investors shows the reliability of earnings. Further, 27 years of consecutive dividend growth says the company is serious about paying shareholders.

Anecdotally, I know a fair number of people who have worked with Enbridge over the years. They have all spoken highly of the company’s business practices and working conditions.

When people love working with a company, they tend to do a better job. When it comes to critical infrastructure such as pipelines, this is of paramount importance.

8. Metro Inc. (MRU)

Metro is a food retailer which also has a strong pharmaceutical franchise. It is best known for its flagship “Metro” grocery chain, though it has over 1,600 retail outlets under many brand names.

The company’s lines of business have proven incredibly durable. As customers spend time browsing in their local pharmacy or grocery store, there are plenty of opportunities for cross-selling. With Metro’s overall scale, it remains able to compete with challengers such as Walmart.

Likewise, being founded and well-known in Quebec has proven an advantage. The province is known to be fiercely loyal to homegrown businesses, so this provides a foothold from which to grow outward.

I first encountered Metro as a business when it purchased Jean Coutu, a leading pharmaceutical chain in Quebec and Ontario. When I sold my Jean Coutu shares in 2018, I bought Metro with some of the proceeds.

Metro has provided 28 consecutive years of dividend growth. The most recent increase was 10.0% and extends its multi-year double digit increase performance.

9. Shopify Inc. (SHOP)

Shopify is a global eCommerce platform which enables merchants to accept payment for goods and services.

Shopify affords regular people the opportunity to start a business. Average folks can now set up a shop online using a website, social media platforms, and other avenues to earn income. It has democratized the ability to pursue the entrepreneurial dream.

Keeping barriers to entry low for would-be business owners and multinational companies alike will continue to be Shopify’s bread and butter.

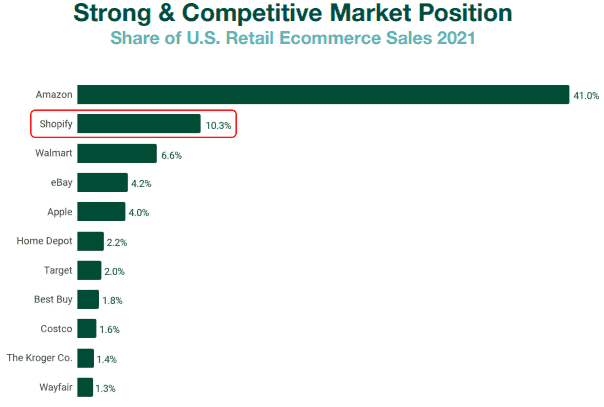

Here is some data on Shopify’s incredible market position relative to competitors, taken from its Q4 2021 Investor Deck:

Coming in second position and yet ahead of Walmart (WMT) is tremendous. It is firmly entrenched in the online marketplace as a leader.

Shopify is the only company on this list of the 10 best Canadian stocks to hold forever which doesn’t pay a dividend. This shouldn’t come as a surprise. Shopify is a great technology company with a solid growth runway ahead of it.

Paying money out as a dividend would impede its ability to reinvest back into the company to expand the business. Given that it is competing with behemoths such as Amazon (AMZN), every dollar needs to be put to good use.

10. Dollarama (DOL)

Dollarama is a leading Canadian value retailer. It is the only national pure-play dollar store chain in the country. The company is best known for its green-and-yellow branded dollar stores.

Dollarama has remained focused on offering its customers great value-for-dollar and everyday goods since its inception in 1992. It provides concept offerings up to a $4.00 price point, which targets thrift-minded shoppers.

The business currently has around 1,400 corporate-operated stores across Canada, though it plans to extend that to 2,000 within the next ten years. Given the relatively small physical footprint of the stores and trusted brand-recognition, I see this as a viable operational target.

Since paying its first dividend in 2011, Dollarama has consistently raised it. However, given the sizeable growth plans ahead for the business, they are targeting only modest dividend growth for the foreseeable future. All things considered, this is a prudent plan that allows investors to continue receiving a payment while participating in the rapid expansion plans.

I don’t currently own any Dollarama stock. I’ve been watching it for a few years and waiting for a great pullback. Given that this hasn’t happened, it remains on my watchlist.

Portfolio Highlights for These Great Stocks

Each of these companies were selected based on their durable business models that can last a lifetime and beyond.

Here is a table listing some quick facts about each of the 10 best Canadian stocks to hold forever:

| Company Name | Industry | Dividend Yield (%) | Price to Earnings Ratio |

| The Toronto-Dominion Bank (TD) | Diversified Banks | 3.56 | 12.5 |

| Canadian National Railway Company (CNR) | Railroads | 1.86 | 22.9 |

| TELUS Corporation (T) | Integrated Telecommunication Services | 4.03 | 26.6 |

| Fortis Inc. (FTS) | Electric Utilities | 3.56 | 23.0 |

| Brookfield Asset Management (BAM.A) | Asset Management and Custody Banks | 1.06 | 22.0 |

| Brookfield Renewable Partners (BEPC) | Renewable Electricity | 3.02 | 16.1 |

| Enbridge Inc. (ENB) | Oil and Gas Storage and Transportation | 6.12 | 19.6 |

| Metro Inc. (MRU) | Food Retail | 1.57 | 20.6 |

| Shopify Inc. (SHOP) | Internet Services and Infrastructure | N/A | 24.2 |

| Dollarama (DOL) | General Merchandise Stores | 0.29 | 34.5 |

When taking all of these companies together, the combined dividend yield is 2.51%. That’s a decent starting yield when you consider Shopify doesn’t even pay a dividend and was included in the calculation.

A quick scan at the Industry column will also show how diversified these businesses are on the whole.

Final Thoughts on the 10 Best Canadian Stocks to Hold Forever

I firmly believe in the long-term potential for holding each of the stocks listed above for life.

The real value of each of these companies is when you take them together as in the case of a total portfolio. On their own, they are just individual companies which have their own company- and sector-specific risks.

In aggregate, they provide a robust way to invest in the Canadian stock market and economy. They are businesses that regular Canadians and business-folk use each and every day. I see this continuing well into the future.

Full Disclosure: All views in this article represent my own opinion. Nothing provided here should be taken as advice. Consult a qualified financial advisor before making any investment decisions.

Long: TD, CNR, CP, T, FTS, BAM-A, BIPC, BEPC, ENB, MRU, SHOP, WMT, AMZN

nice list Ryan!

own most of them, debating starting a position in shop or csu.

cheers

Hey Rob,

Thanks for reading and glad you liked.

Yeah, I think $SHOP is a great one. Planning to be with it long term. I don’t have any $CSU and can’t say I know a whole lot about it, though I do know someone who works for them and like the company.

Take care,

Ryan