After a full year of paying close attention to my portfolio status—and providing monthly updates—I feel I have improved with capital allocation as I am not allowing dividends to sit idly for as long before putting them back to work to keep the dividend compounding machine firing on all cylinders.

Kicking off 2019, the portfolio remains healthy and growing.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Increase (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 53.60 | |

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 | |

| BCE Inc. (BCE) | 166.10 | |

| Canadian Imperial Bank of Commerce (CM) | 16.32 | |

| Corby Spirit and Wine (CSW.B) | 101.20 | |

| Bank of Nova Scotia (BNS) | 85.00 | |

| TELUS Corporation (T) | 38.15 | 3.81 |

| Rogers Communications Inc. (RCI.B) | 26.40 | |

| Canadian Pacific Railway Limited (CP) | 3.90 | |

| Chartwell Retirement Residence (CSH.UN) | 4.90 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| PepsiCo, Inc. (PEP) | 6.50 |

| Walmart Inc. (WMT) | 6.63 |

Dividend Summary

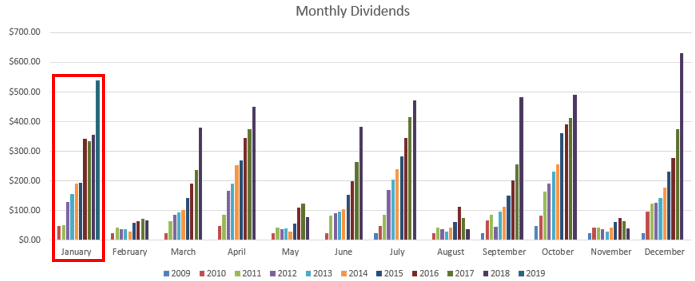

January was a very solid start to the year. I was able to earn $526.89 CAD and $13.13 USD. This brings the total to $540.02 in currency-neutral terms and exceeds 2018’s January total by nearly $185:

The surprise of the quarter came from CSW.B whose $101.20 payment was actually a Special Dividend which is over and above the regular quarterly dividend that the company pays. The company indicated that they felt this payment was warranted based on their surplus cash position which was beyond the company’s needs for funding future growth. Since buying the company initially back in December of 2014, this is the second such extra payment I have received and I have to say it comes as a very welcome gift just for being a shareholder!

Given that it was a special payment and one I do not expect in the coming year, it is likely that this will be my best January at least through 2020.

Market Activity

I made a total of two purchases last month, only one of which pays passive income.

AbbVie Inc. (ABBV): I picked up 24 shares at a total cost of $1,929.95 USD. On the current quarterly payout of $1.07 USD, this should bring in $25.68 quarterly or $102.72 annually. This represents a simple averaging down from the purchase I made back in November where I also outlined my thesis for owning the stock.

After poor results were announced regarding its Imbruvica drug in a late-stage pancreatic cancer study and Q4 2018 results subsequently disappointed the analysts, ABBV’s shares took a nosedive from ~$90 per share to below $76 at the trough. I like a good panic and figured it was a nice opportunity to pick up more shares of a high quality company with seasoned management in an industry that is poised for continued growth over the longer term.

My belief is that if a company isn’t worth buying more of during the rough patches, then I have no business owning it to begin with. After all, every company in the market falls out of favour at some point; just like people, companies experience difficulties whether of their own making or just based on the general business sentiment of the day. This is why it is eminently important to own best of breed companies in the first place.

My other, non-dividend paying purchase this month, came in the form of three shares of Berkshire Hathaway (BRK.B). Tipping the scales at just over $600 in total purchase costs, I had an ulterior motive with this one; my brother and I are planning a trip to Omaha, Nebraska, to the annual shareholder meeting!

While I’ve been to Kansas City on several occasions which is just a few hours down the road, neither of us have been to an annual shareholder meeting and so this marks a great opportunity to take part in an event which will be both educational and provide plenty of enjoyment. I’m most looking forward to seeing Warren and Charlie in person at the event, in addition to a host of other attractions. I’m confident the event will provide plenty of fodder for writing material along the way.

Cash

I continue to earn 3% on my cash sitting on the sidelines. At this point I’m comfortable with sitting on a healthy five-figure stockpile as I feel the markets aren’t offering anything too attractive at the moment. The Canadian banks have risen slightly just when they were getting interesting; I was hoping to put some more capital to work in that area and may well still do so should they oscillate back downward.

Conclusion

The influx of a Special Dividend from CSW.B was a welcome addition to the January income totals. It set the stage for a January total which will be challenging for me to top next year, though it certainly gives me something to aim for.

Adding some BRK.B to the portfolio which doubles as an admission ticket to the “Woodstock of Capitalism” is an exciting piece of news I’m glad to be sharing. It is an idea my brother and I have been tossing around for several years and it’s about time to be pulling the trigger.

Full Disclosure: Long TD, REI.UN, BCE, CM, CSW.B, BNS, T, RCI.B, CP, CSH.UN, PEP, WMT, ABBV, BRK.B

nice Ryan

Congrats on that special dividend. You got some solid big hitters. im jealous of the bns payout. I want to get mine dripping soon enough.

Great buys berkshire events look fun! Im a fan of abbvie and got my first payment last month. I think ill be adding to them in the next couple months.

keep it up. solid month!

cheers.

Passivecanadianincome recently posted…2 Years Online – Thank You.

Hey Rob,

Yeah, BNS was one of my works-in-progress through 2018. High quality company with a steadily rising dividend and a nice yield to start… tough to beat that combo.

I’m definitely looking forward the BRK meet-up in Omaha. I’ve been to Kansas City but never may it all the way to Omaha… beautiful area of the U.S..

There’s ABBV-fever in the divgrowth community right now. We all seem to be picking up bigger slices of the pie!

Take care,

Ryan

Nice month Ryan and excellent results. As you mentioned on my purchase article, great buy with ABBV and you know that I’m clearly a fan!

Bert

Hey Bert,

Absolutely. ABBV is a huge favourite of us divgrowthers. January was a solid month and I’m glad to be getting my first ABBV payment this month!

Take care,

Ryan

Looks like you had a great month. That’s the only bad thing about special dividends they can distort things a bit. But the money is always welcome.. we share Walmart. Like the ABBV pickup. Keep it up

Doug recently posted…January 2019 Dividends

Hey Doug,

Yeah, it’s always great to get some extra income, but it makes for challenging comparables for the next year or two!

I’ve had WMT for a few years and will likely just hang onto it over the long term. I think it’s a solid company which has been showing solid growth online (though not at the pace of AMZN).

ABBV is an interesting one that’s been beaten down recently… exactly the sort of time I really like to get into a company or average down as I’m doing in this case.

Take care,

Ryan

Nice list of companies paying you last month. Like seeing several names we share as well as those strong Canadian banks in the mix. I think there is plenty that’s attractive these days. Why not deploy some cash in T, MO or ABBV? Keep up the good work.

DivHut recently posted…Dividend Income Update January 2019

I did put down some cash in ABBV. I likely won’t do T since I already have the Big Three Telecoms in Canada with a considerable weighting in my portfolio. MO is definitely on my radar, though.

Thanks for stopping in.

Ryan