Another quarter in the books and two more tranches of stock added to the portfolio. Every time I place a Buy order for shares of high quality stock, I inch that much closer to financial freedom.

Let’s take a look at how things have gone.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Increase (%) |

|---|---|---|

| Toronto-Dominion Bank (TD) | 59.20 | 10.45 |

| RioCan Real Estate Investment Trust (REI.UN) | 93.96 | |

| The Coca-Cola Company (KO) | 71.02 | 2.56 |

| Johnson & Johnson (JNJ) | 80.00 | 5.56 |

| BCE Inc. (BCE) | 174.35 | 4.97 |

| Canadian Imperial Bank of Commerce (CM) | 16.80 | 2.94 |

| Corby Spirit and Wine Ltd. (CSW.B) | 50.60 | |

| Bank of Nova Scotia (BNS) | 87.00 | 2.35 |

| TELUS Corporation (T) | 38.15 | |

| Rogers Communications Inc. (RCI.B) | 27.50 | 4.17 |

| Fortis Inc. (FTS) | 72.00 | |

| Canadian Utilities Ltd. (CU) | 84.54 | |

| Canadian National Railway Company (CNR) | 8.06 | |

| Canadian Pacific Railway Limited (CP) | 3.90 | |

| Hydro One Ltd. (H) | 62.79 | 5.00 |

| Chartwell Retirement Residences (CSH.UN) | 15.00 | 2.04 |

| Metro, Inc. (MRU) | 4.00 | |

| Brookfield Renewable Partners L.P. (BEP) | 132.36 |

USD Dividends

| Company | USD Payments ($) | Div Increase (%) |

|---|---|---|

| Waste Management Inc. (WM) | 21.79 | |

| McDonald's Corporation (MCD) | 20.71 | |

| Yum! Brands (YUM) | 13.93 | |

| Yum China (YUMC) | 3.98 | |

| PepsiCo, Inc. (PEP) | 8.12 | 2.96 |

| Walmart Inc. (WMT) | 13.52 | 1.92 |

| Visa Inc. (V) | 2.13 | |

| AbbVie Inc. (ABBV) | 40.02 |

Dividend Summary

My tallies this quarter include C$1,081.23 and U$124.20 which combine for a currency-neutral grand total of $1,205.43. This is my highest quarterly total yet. The Canadian figure is slightly down from Q1, but that was expected since I received a special dividend from CSW.B back in January for just over $100 which wasn’t repeated this time around.

It feels nice seeing the U.S. figure top $100 for the first time ever. Given that I live in a border-town beside the U.S., I have a general goal of earning a few thousand per year in USD which could eventually finance my day excursions and other outings South of the border.

Standout

This was the first dividend boost I have received from RCI.B since initiating my position back in 2015. I had initiated that position at the same time I made my first purchase of T (which since that time has provided eight dividend increases) and been underwhelmed by RCI.B’s dividend growth, despite its capital appreciation. I am hoping this signals a return to dividend growth moving forward, as the company’s management feels more comfortable with its debt position.

Quarterly Buys/Sells

I am pleased to say that I once more did not sell a single stock over the course of this quarter. My goal always has been—and remains—to compound my dividend growth via regular purchases of high quality equities. I view building my portfolio as akin to growing an apple tree. If I expect more, larger apples each year, then it is imperative to keep the tree healthy and avoid cutting from the limbs for short term purposes.

My market activity was tepid overall with only two buys, though it feels good to remain on the buying side of the equation.

TELUS Corporation (T): I grabbed an additional 20 shares for a total of C$999.95. With the quarterly dividend of C$0.5625, I am expecting C$11.25 quarterly or C$45.00 annually from this purchase.

The Walt Disney Company (DIS): Following the announcement to join the streaming arena with Disney+, I initiated a position in DIS with 10 shares at a cost of U$1,353.24. On the U$0.88 semi-annual dividend, I am expecting U$8.80 roughly every six months or U$17.60 annually. I discussed my rationale for this purchase in greater detail in my May 2019 Portfolio Update.

Q3 2019 Stock Considerations

It is easy to feel like a broken record as far as the market’s elevation, but I’ll say it again: real buying opportunities remain difficult to find. I feel like ever since kicking off my dividend growth journey in 2009, the market has been on a relatively unimpeded march higher. There have been a few hiccups along the way, no doubt, but the real bargains aren’t there at the moment where I’d like them.

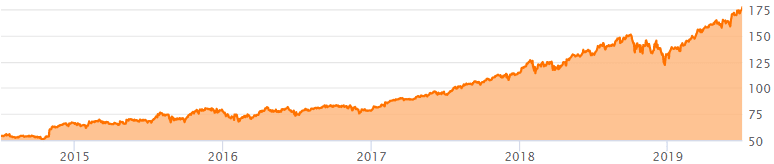

For example, I would love to add more stock to my V position, but over the past five years it has run from the mid $50s to the mid $170s:

Heading into the coming months (and still without a crystal ball), I hope to continue nibbling at growth opportunities while acknowledging the downside to overpaying on a purchase. I can certainly empathize with Warren Buffett’s sentiment that deploying large amounts of capital at the moment is a challenging prospect.

Cash Position

As long as it remains true that the market is strong, I hope to continue building cash while still putting bits of it to work over time. Heading into Q3, I’ll be earning 2.4% on parked capital. I find this to be an acceptable rate of return at the moment given interest rate movements.

Conclusion

It has been a solid quarter on the dividend front. Any time a new high is reached, it feels great. It is important to never take for granted the steady cash flow provided by high quality companies. Good times are great, but there are no givens in the investment world.

Dividend increases remain relatively lower in comparison with 2018 which provided a bonanza of outsized boosts, as it seems the party related to the tax-decrease for U.S. companies last year has calmed.

I have plenty of cash I’d like to invest if the market will provide some favourable opportunities. Even if it doesn’t, I intend to remain active with a few targeted selections along the way. Every dollar deployed is one step closer to financial independence.

Thank you for reading.

– Ryan

Full Disclosure: Long TD, REI.UN, KO, JNJ, BCE, CM, CSW.B, BNS, T, RCI.B, FTS, CU, CNR, CP, WM, MCD, YUM, YUMC, PEP, WMT, V, CSH.UN, MRU, BEP, ABBV, DIS

Where do you get your Canadian stocks? I am down in New York so I have really focused on the Dividend Champion list (25+ years of growing dividends). Is there a similar list for Canada?

Evan recently posted…Undervalued Dividend Watch List – July 2019

Hey Evan,

Some people do track the Canadian companies (i.e., Canadian Dividend Aristocrats) in terms of their dividend growth, but really most of the names in my portfolio I’ve learned from firsthand experience. Our banking situation in Canada is very different from in the U.S. in the sense that we have a few very big names rather than a fragmented banking system.

Take care,

Ryan

nice Ryan

great growth and post overall.

Love the addition to telus. Its a great company and one of my favorite canadian dividend stocks.

While the market may be high there are still some good values out there though.

keep it up man.

cheers

Passivecanadianincome recently posted…June 2019 Passive Income

Hey Rob,

Yeah, I really think T has huge potential in the years to come. It’s already a solid franchise and is doing great business in healthcare as well, which never really gets looked at when people are discussing the investment thesis for it.

Later,

Ryan

We have common companies like ABBV,V,WMT,JNJ,KO,BNS. Congrats on the good Numbers for Q2.

Hey Desi,

Great to have overlap with all of those great names.

Take care,

Ryan