As I’ve been reporting on many occasions, the stock market is still rather high—or at least feels that way to me. Rather than make any purchases, I’ve simply positioned my capital in order to be opportunistic when the time comes.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Increase (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 59.20 | |

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 | |

| BCE Inc. (BCE) | 174.35 | |

| Canadian Imperial Bank of Commerce (CM) | 17.28 | |

| Bank of Nova Scotia (BNS) | 90.00 | |

| TELUS Corporation (T) | 52.43 | 3.56 |

| Rogers Communications Inc. (RCI.B) | 27.50 | |

| Canadian Pacific Railway Limited (CP) | 8.30 | |

| Chartwell Retirement Residence (CSH.UN) | 5.00 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.36 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| PepsiCo, Inc. (PEP) | 8.12 |

| Walmart Inc. (WMT) | 6.76 |

| The Walt Disney Company (DIS) | 7.48 |

Dividend Summary

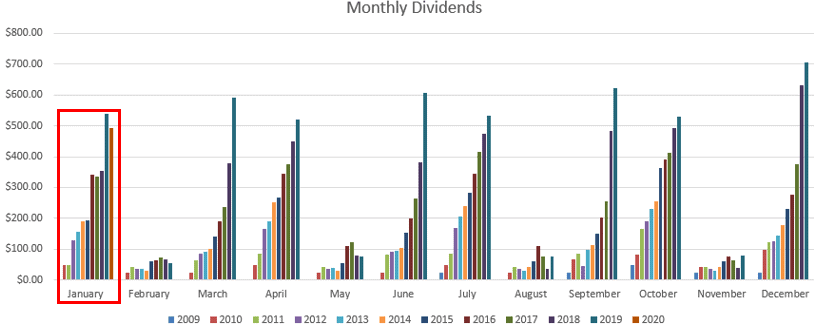

January brought in C$471.74 and U$22.36, rounding out to a currency-neutral total of $494.10. This is a nice way to kick off the new decade.

My January total is down from last year, but this comes as no surprise; Corby Spirit and Wine (CSW.B) paid a Special Dividend of $101.20 last year. So, not accounting for that unusual event, I’ve made progress this year on the regularly scheduled payments:

This was my first month getting paid by AW.UN. I’m optimistic about the opportunity here as I feel the restaurants I’ve been to are well-kept and the food itself is quite good. Having one more company in the portfolio where I can see the actual business being done on a daily basis is great.

Year To Date Progress

While I have been consistently tracking my dividends in monthly articles, I feel it is useful also to provide the higher-level-view within each monthly rundown. Being the first month of the year, I only have one for the chart this time around:

| Month | Dividends ($) |

|---|---|

| January | 494.10 |

| Total | 494.10 |

Market Activity

I made no purchases in the month of January, but did transfer some cash to be ready to make trades through February. At the time of writing, those purchases have already taken place; I’ll save the details for the February article, however.

In general, stocks appear to be at quite lofty valuations. I feel like I’ve been saying this now for the better part of a decade. Since the bottom in March 2009, we’ve seen an unprecedented run-up in prices. While it feels nice to see stock prices rise, the downside is paying more for high quality companies and their dividend cash flow.

While I do have dry powder set aside for a downturn, I believe it is still important to continue investing routinely. Rather than worry about the market this year or next, it is important to take a multi-decade long view when considering an ownership stake in best of breed companies.

Cash

My special interest rate on savings has ended, so I’m back to earning a pittance on my idle cash. I may need to give my bank a call to renegotiate as it’s important to keep every dollar compounding as efficiently as possible.

Conclusion

Starting the new decade with ~$500 in a single month is a good sign of what’s to come. Looking back to January 2010 when I was still in the early stages of this experiment, I had only brought in $47.75. Growing that total more than tenfold in the intervening years demonstrates the power of the dividend growth investing strategy.

Full Disclosure: TD, REI.UN, BCE, CM, BNS, T, RCI.B, CP, CSH.UN, PEP, WMT, DIS, CSW.B