The market has finally started to tumble. There are a few catalysts driving this volatility, not least of which is COVID-19, a virus spreading across the globe and leading to plenty of fear in the capital markets.

I decided to make investments as prices have swayed. That’s the whole point of having a strategy before the tough times come. You always need to be ready for some upheaval.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Increase (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 | |

| Chartwell Retirement Residence (CSH.UN) | 5.00 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.36 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 44.14 |

Dividend Summary

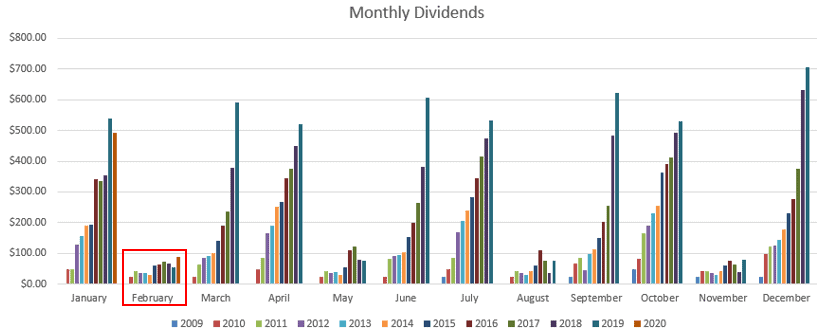

February was a solid month (as Februarys go), pulling in C$42.68 and U$44.14, combining for a total of $86.82 in currency-neutral terms. This is the highest February I have on record, given that the vast majority of my companies pay out in other months. Might be a small win, but it’s a win nevertheless.

Here’s a quick look at how this stacks up:

Year To Date Progress

It has been a pretty solid start to the year. Two months in, things are looking decent:

| Month | Dividends ($) |

|---|---|

| January | 494.10 |

| February | 86.82 |

| Total | 580.92 |

As mentioned previously, this is a slightly slower start to the year than in 2019 due to the Corby Spirit and Wine’s (CSW.B) Special Dividend from January 2019. In real terms and based on regular circumstances, however, this represents healthy progress in my portfolio.

Market Activity

This has been one of my most prolific periods on record; I can only remember one other time where I was buying this aggressively over the course of a short span of time. The turmoil in the markets (see below) has provided ample opportunity to put cash to work at bargain prices, though not all of my purchases were made prior to the downturn.

I grabbed 6 shares of Microsoft Corporation (MSFT) for U$1,047.58. With the current quarterly dividend of U$0.51, I am expecting to bring in U$3.06 quarterly or U$12.24 annually.

I purchased 5 shares of Visa Inc (V) for U$1,052.39. With the current quarterly dividend of U$0.30 quarterly, I should bring in U$1.50 quarterly or U$6.00 annually.

My final company of the month is Mastercard Incorporated (MA), which I bought in two tranches for a total outlay of U$2,157.47. On the current quarterly dividend of U$0.40 quarterly, this will bring in a whopping U$2.80 quarterly or U$11.20 annually.

In aggregate, these purchases cost U$4,257.44 and should produce U$7.36 quarterly or U$29.44 annually. It doesn’t take an expert to recognize that these are all incredibly low-yield dividend paying companies. However, it is in times like these where markets are tanking that it is important to get money invested. The important thing is to always stick to high quality companies and then just ride the waves.

Cash

I continue to invest through this market turbulence and am finding my cash levels to be nearing their lowest over the course of the past several years. While I tend to be relatively risk-averse, I am okay with stretching myself a bit while market prices are low. I intend to continue investing so long as present conditions persist—I love a good fire sale.

Coronavirus (COVID-19)

Over the past few months, the coronavirus disease known as COVID-19 has been leading to widespread uncertainty and fear. Areas of China have been placed virtually on lockdown to try to quell the spread, but over the past few weeks we have readily seen that there is ultimately no stopping this threat from making its way around the globe.

The expected financial impact of this disease manifested itself this week in the stock market as major stock indices plunged, slashing prices on some of the absolute best companies in the world. From the Friday, February 21 closing price of 28,992, the Dow Jones Industrial Average closed out this week at 25,766. The S&P 500 followed suit with a drop from 3,337 to 2,954 over the same period.

I’m not day trader, though, and I’m not planning to sell my stocks. So, what’s the bottom line with all of this?

Rather than answer that question, I’ll instead ask you, the reader, a series of questions:

- Do you believe we will still be talking about COVID-19 in a meaningful way in two years from now?

- Do you anticipate that we will still be quarantining huge blocks of the populace six months from now?

- Will the impact from COVID-19 still be felt in the earnings of high quality companies such as The Coca-Cola Company (KO) and Canadian National Railway Company (CNR) in a few years?

I’m not going to answer these for you, but working through them on your own might be a fruitful exercise. These are the considerations long-term investors must take in order to stay grounded amid hysteria.

Conclusion

I have had an incredibly fruitful buying experience in the stock market through February. The market has been decimated on a level I don’t recall even going back to the financial crisis of 2008-2009, when considering it over the course of a single week. Regardless, these are the opportunities we wait for. It is time to capitalize and I fully intend to do so.

The COVID-19 scare will be playing itself out over the next few months. I’ve chosen to remain poised amid the media’s fear-mongering. Throughout my life, I have found it beneficial to ask myself what the crowd is doing and then to ask myself whether the opposite approach might be the best one. Buying while others are selling suits me and is one of the best ways to profit from a contrarian approach not just to investing, but to life itself.

Full Disclosure: REI.UN, CSH.UN, AW.UN, ABBV, KO, CNR

Thanks for sharing! Hope you are staying safe!

Hi Medit,

Thanks for reading—stay safe on your side, as well.

Ryan

hey Ryan

nice month and great Buys. 3 solid companies. Love that you got riocan dripping now too.

Will we still remember covid in 2 years? I think so. This has been the craziest thing of my life. Both me and my wife aren’t working atm and the whole world is shutting down. We will remember this for sure.

Will the market be making new highs in 2 years? I have no clue but in 20 years we should be up! Covid has become more serious and delayed than I originally thought, but there’s a lot of learning lessons im picking up as well.

All the best man

Look forward to Marchs Report

Hey Rob,

Yeah, no question we’ll remember COVID-19 in two years, but it won’t be impacting us in the way that it is now. It’s going to be in the rear view, I believe, though this is a generational experience that will always be with us.

Yeah, it’s horrible hearing about all of the people who are forced out of work, like you and your wife. Everyone just wants to get “back to normal”, and I believe that day is coming soon. We just have to weather this a bit longer.

March report should be coming out soon (hopefully today).

Take care,

Ryan

GRB –

You picked up shares in the highest quality of companies. People will be still using their MA/V Cards and working on-site or remotely with software from Microsoft. Great moves!

-Lanny

Hey Lanny,

Exactly. These companies are here to stay, regardless of how COVID-19 shakes out over the next few months. They’re all set to gain from the secular shift to a cashless, digital society.

Take care,

Ryan

It’s hard to predict the short term of months or even a year or two. But I doubt Corona will sound much different than other past virus incidents in five years. Maybe it will be nearly forgotten in two years or less. I’ve seen huge net worth dips over a forty year investing career. And I can attest, if you just stick with any good system, and yours is outstanding, you will end up with more money than you need.

Hey Steveark,

Thanks for reading and I appreciate the kind words. I have no doubt over the course of your investing lifetime that you’ve come to appreciate these downturns, and to recognize that they come to pass, they do not come to stay. Finding the opportunities amid that volatility is what makes a successful investing career.

Take care,

Ryan