Well, we’ve got another month in the books. It was a relatively normal April—plenty of rain and cool temperatures—aside from the world being on a virtual social lockdown and economic hiatus. The COVID-19 theme remains in the driver’s seat for the time being, though there are cracks of light shining through. Some governments are lightening the strings and moving to a modified lockdown/precautionary environment.

Amid the uncertainty, dividends kept ticking in reliably. There have been a few suspensions/cuts along the way with high profile companies, but on the whole the dividend growth investing strategy remains durable. This is the whole point of the strategy after all, right? We focus on high quality companies so that when the other foot falls, we’re still able to count on a growing income.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Increase (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 158.00 | 6.76 |

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 | |

| The Coca-Cola Company (KO) | 76.70 | 2.50 |

| BCE Inc. (BCE) | 183.15 | 5.05 |

| Canadian Imperial Bank of Commerce (CM) | 17.52 | 1.39 |

| Bank of Nova Scotia (BNS) | 90.00 | |

| TELUS Corporation (T) | 52.43 | |

| Rogers Communications Inc. (RCI.B) | 27.50 | |

| Canadian Pacific Railway Limited (CP) | 8.30 | |

| Chartwell Retirement Residence (CSH.UN) | 5.10 | 2.00 |

| Brookfield Asset Management (BAM.A) | 23.84 | |

| Brookfield Infrastructure Corporation (BIPC) | 11.19 |

USD Dividends

| Company | USD Payments ($) | Div Increase (%) |

|---|---|---|

| Walmart Inc. (WMT) | 6.89 | 1.89 |

Dividend Summary

I received income of C$685.05 and U$6.89 through April, coming to a currency-neutral total of $691.94. Coming off of the $697.25 in March, I have to say I am happy with the cash flow momentum I’m seeing in the portfolio. This month’s success can largely be attributed to the buying spree I went on last month.

Two things really stick out from the tables above. First, the dividend increases on there are remarkably lower than what we would normally see overall. Secondly—and more importantly—we can see that the majority of the companies I receive income from in April have continued paying shareholders. It has never been more important to simply stay the course than it is right now.

The cash received from BAM.A was related to their share split. Since I owned an uneven amount of shares pre-split, I had to be paid out for the half-a-share that I wasn’t able to receive. So, this actually decreases my position in the company by a fractional amount. I shall have to remedy that at some point, price permitting.

The BIPC income was similar, as the company was spun out from my Brookfield Infrastructure Partners L.P. (BIP.UN) stake. I was paid a cash distribution for the odd amount which didn’t fully amount in a share to be received.

I was paid by 13 companies in April. Keeping that foundation wide and solid is key to succeeding through any environment.

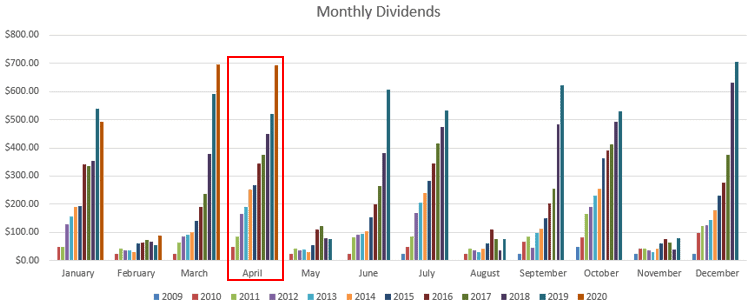

The monthly total is very encouraging. My April income grew by $170.94, representing a 32.81% increase:

Year To Date Progress

It has been a solid start to the year, nearly cracking $2,000 with only four months in the rear view:

| Month | Dividends ($) |

|---|---|

| January | 494.10 |

| February | 86.82 |

| March | 697.25 |

| April | 691.94 |

| Total | 1,970.11 |

Market Activity

After capitalizing on the market weakness in March, I pumped the brakes heavily through April, adding no further stocks to the portfolio. I felt it was best to build my cash reserves back up and take a breather. The market gained back much of what it had lost in March, so the amount of screaming buys was far reduced.

If the opportunity avails, I’ll be happy to continue investing on the cheap.

Cash

I’m at my lowest cash levels in years. I don’t remember the last time my reserves have been this low, but I’m okay with that as I have a steady stream of income filling the coffers back up passively. That’s the beauty of dividend growth investing. As time goes on, the portfolio itself does most of the heavy lifting and there is less of a need to add fresh capital.

My plan is to remain opportunistically poised to buy stocks if they pullback heavily. Aside from deep discounts, I’d rather be conservative. Something tells me we haven’t seen the worst of the downturn in the markets yet. Having cash to deploy will be important to take advantage, should this premonition come true.

Berkshire Hathaway Shareholder Meeting

As I write this at 12h50 on May 2, I am eagerly awaiting the annual shareholder event for Berkshire Hathaway Inc. (BRK.B), broadcasted on Yahoo! Finance from Omaha. I’ll be watching the Berkshire Hathaway Shareholder Meeting live on stream this year, but it brings plenty of fond memories from when I was there in the flesh with my brother last year.

From what I understand, it will be Warren Buffett and Greg Abel fielding questions from investors this year. Charlie Munger and Ajit Jain will not be on the webcast. This is a disappointment as the plan this year was for all four of them to actually be on the stage together in Omaha. I was looking forward to what our first real look at Abel and Jain was going to be like. How do they think? What is their approach? What’s the team chemistry like?

I am looking forward to hearing how Buffett is faring amid the chaos of the past few months. It should be entertaining and educational, as always.

Personal Goal

In the past I’ve run three full marathons and quite a few half marathons. Running has been something I’ve enjoyed over the years as it feels good to be progressing on longer term goals—running necessarily takes time to improve at because you need to build up incrementally over time through a combination of positive lifestyle habits. Over the past year, however, I’ve let that slip to a fair extent.

I’ve set a goal for myself to run at least a total of 50km through the month of May. Not a lofty goal by any stretch, but it will encourage me to get out of bed in the early mornings to get a few kilometres of roadwork in. What’s handy is that I have a bike path along the St. Lawrence River just a few steps down the street from me that is perfect for the task.

I’ll be sure to provide an update next month as to how this is progressing.

Conclusion

Raking in nearly $700 in consecutive months feels wonderful. Having a reliable source of income whether markets go up, down, or sideways, and whether I get out of bed in the morning, is something I will never take for granted.

We continue to see the impact of COVID-19 and the oil downturn in the markets. Stocks are routinely up or down by several percent on any given day as the sentiment shifts. My belief in the long-term viability of capitalism and all of the great things that come with it remains unshaken. When this thing plays out, people will eventually go back to a normal way of life.

The day will come when we’re back in sporting stadiums, going to concerts, and shaking hands. The line-ups at Walmart will eventually be a thing of the past. We’ll put the bad behind us and take back up with the good. If you have to feel a certain way, my advice is to choose optimism. There’s far too much to be hopeful about to let a short-term problem shake your faith.

Full Disclosure: Long TD, REI.UN, KO, BCE, CM, BNS, T, RCI.B, CP, CSH.UN, BAM.A, BIP.UN, BIPC, and WMT

Congratulations on a solid month. This is my first time here. I like your graphics. In April, I earned only $ 4.33 in dividends. I start by investing in dividends, so I have a long way to go. I look forward to how many dividends you will receive in May.

Hey John,

Glad you enjoyed the article and thank you for the kind words. Just keep being consistent and you’ll grow your income as well.

Take care,

Ryan

Great charts and graphs. Keep up the good work.

I went to the BRK annual meeting too (2016). It was amazing, one of the best experiences of my lifetime!

Glad you liked the charts and graphs. It’s nice to see the progress coming along in pictorial format.

Getting to see Buffett and Munger in the flesh was pretty awesome. Nice that you took the chance to go see them as well.

Take care,

Ryan

What were some things you learned from going to the BRK annual meeting?

Hey Javi,

One of the teachable moments was when Charlie Munger was discussing how he and Buffett have been successful not by being the smartest people or doing the smartest things, but by avoiding dumb things/mistakes. By avoiding big losses and huge errors in judgment, they just needed to stay the course with a strong strategy and let compounding work its magic.

Ryan

I think many companies will be cutting dividends in the near future and their dividends won’t go back up for 18-24 months. I saw one of my portfolio dividends decimated recently – IPL cut their dividend by 72%!

Hey Samantha,

Yeah, we’re going to see plenty of cuts over and above what has already occurred. That’s going to be the reality in many cases over the next period.

Amid the carnage, though, there is sunlight. Consider the recent cases of JNJ and PG, both of which raised their dividends recently. Look to those companies that “work” in any economy. Those companies that produce real products that real people need on a daily basis. Many can be found on the Dividend Aristocrats list, but it’s still important to peer in to the future (as well as you can), as many industries are going to be forever changed by this period with COVID-19.

Take care,

Ryan

Congrats on an outstanding month of income, Ryan. From your chart, you’ve really ratcheted up your dividend income in the past couple of years. That doesn’t happen without some diligent saving and investing… so nice work! Hopefully you are dodging all the dividend suspensions and cuts being announced these days.

Engineering Dividends recently posted…Portfolio Thoughts (Apr. 2020)

Hey ED,

Dodging the cuts and suspensions the best I can. I’ve had two suspensions so far (AW.UN and YUMC), but the rest are still running strong. I was going to comment on this article about it, but I decided to save for a different post.

Yeah, the past few years have seen the income get supercharged. Hoping to keep reinvesting and compounding at lower prices in the next period to springboard further, going forward.

Take care,

Ryan

Congrats on the impressive haul of dividends. Nearly $700 in 1 month is incredible. I can’t wait to reach this level down the road to have more income to support full-time blogging. I like a lot of the names in your portfolio too. I am holding KO, BNS, CM, REI.UN, and RCI.B. However, my positions are much smaller than yours and this was my lowest month for dividend income this year. Nice report!

Reverse The Crush recently posted…Apple (AAPL) – The Next Great Dividend Growth Stock Story – Is AAPL a Buy?

Hey RTC,

Great to see the overlap in our portfolios Most of the names you mention should have nice and secure dividends. The only one I’m really keeping a close eye on is REI.UN. I’ve been holding that one steady since 2009, but there has been plenty of upheaval on the real estate side of things with this pandemic.

Take care,

Ryan