A really quick month. It felt like I only realized it was August around the very end. I guess that’s just a symptom of the indoors-ness of this strange period.

Regardless, I finally got back into the stock-buying mindset after an extended length of inactivity. Always a plus.

A pretty decent month, all things considered.

Table of Contents

Dividend Summary

I brought in cash flow from five different companies—three were north of the border, two south. Every little bit stacks up along the way. Each dollar has the potential to multiply, if invested wisely.

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 |

| Chartwell Retirement Residence (CSH.UN) | 5.10 |

| A&W Revenue Royalties Income Fund (AW.UN) | 4.00 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 44.14 |

| Mastercard Incorporated (MA) | 2.38 |

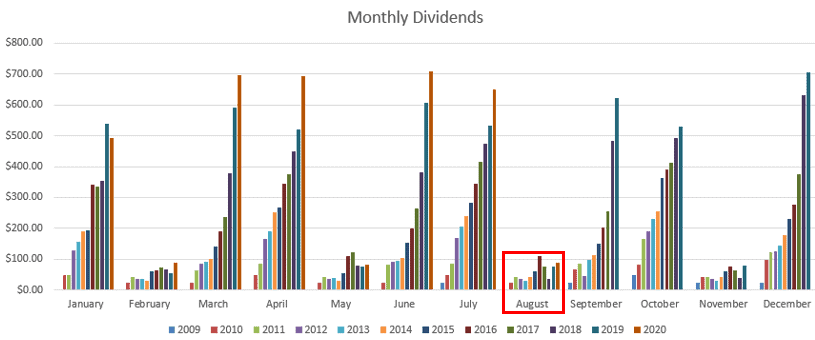

With C$40.42 and U$46.52 for the month, I brought in a currency-neutral total of $86.94 in August. Albeit starting from a low base, this represents growth of 13.89% YOY, as I earned $76.34 in dividends in August 2019.

Here’s how the income stacks up visually:

Year To Date Progress

Taking a look at things over the course of the entire year, I’ve come in just a single penny short of $3,500 to date:

| Month | Dividends ($) |

|---|---|

| January | 494.10 |

| February | 86.82 |

| March | 697.25 |

| April | 691.94 |

| May | 82.94 |

| June | 708.70 |

| July | 651.30 |

| August | 86.94 |

| Total | 3,499.99 |

I feel good about these totals considering that I’m tracking ahead at a faster pace than 2019 despite the pandemic which left a few dents along the way. I still have four months of income to expect and this is already around $500 more than I brought in through all of 2017, a few short years ago.

Compounding is compounding, right?

Market Activity and Cash

I’ve felt like a broken record for the past few months as far as market activity is concerned. I spent well over $10,000 on stocks in March—a personal record in a single month—and then fully halted as I restocked my cash reserves.

Finally, I am pleased to say I’ve invested in two high quality Canadian companies with wonderful dividend growth track records.

I added to my position of Canadian Utilities Limited (CU) with 35 shares at a cost of C$1,158.65 for C$33.10 per share. My dividend yield is 5.26% on these shares and will bring in C$15.24 quarterly or C$60.96 annually.

I initiated a new position in Saputo Inc. (SAP) for a cash outlay of C$1,044.65 at C$34.49 per share. The dividend yield on these shares is 2.03%, which is rather low to start. I am expecting C$5.25 quarterly or C$21.00 annually from these shares.

Taking these two purchases together, I paid a total of C$2,203.30 for a combined dividend yield of 3.72%. My forward dividend income comes to C$20.49 quarterly or C$81.96 annually.

New Company – Saputo Inc.

SAP is one of the top ten dairy processors in the world. It is at least among the top three in its business segments within Canada, the U.S., Australia, and Argentina. Its products are well known to most consumers—some include Armstrong cheeses, Dairyland, and Milk2Go. There’s a good chance some of SAP’s foods are in your fridge right now.

One factor that attracted me to invest in the company is the fact that Lino Saputo’s holding company actually owns 32% of SAP. I love seeing a large interest being retained by the founding family, as it gives additional reassurance that management/ownership have a stake in the game.

Quite simply, I like when my interests are aligned with company leadership.

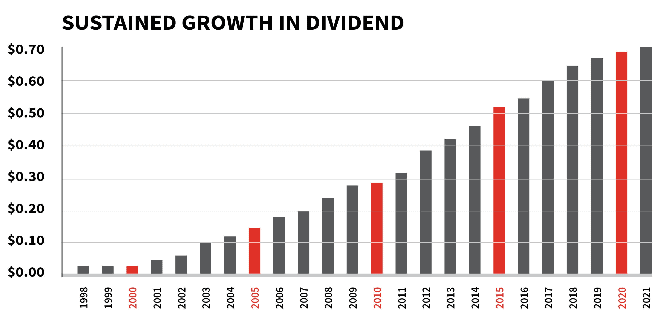

Despite the low yield on my SAP shares, the dividend growth record is stellar. They have increased their dividend each year since their IPO in 1997:

Source: Saputo Website

If the yield is still low despite annual dividend growth, what does that mean? There must have been ample capital appreciation along the way just as the dividend did the same.

This is just an entry-level position at the moment. I would be happy to average down at juicier yields if the price continues to pull back. I wouldn’t mind dipping in further if the yield approaches the 2.75% mark.

COVID-19 and Business

Without a doubt, COVID-19 is the story of 2020. We have seen unprecedented business interruption at least from the end of February through the present day as a result of the pandemic we’re now working through.

Why, then, does the stock market seem to keep hitting new highs?

Quite simply, there’s a disconnect between Main Street and Wall Street. While countless millions of people have seen their work-life situation disrupted, out of the upheaval will rise businesses who are able to adapt and take advantage of the opportunity presented.

Companies which can thrive in this changing environment stand to win big. I wrote about dividend growth investing during the pandemic, but the reality is that most of the names making headlines don’t pay a dividend—or, if they do, the yield is rather low.

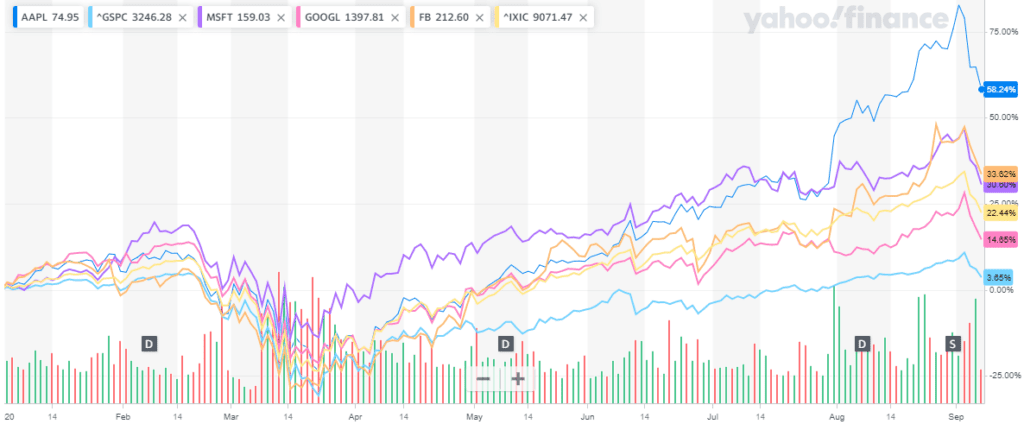

Those making the headlines these days include the like of Apple Inc. (AAPL), Microsoft Corporation (MSFT), along with plenty others:

Source: Yahoo! Finance

While I won’t bother making a prediction on where the market will be in a year from now, it would be hard to deny we’ve seen years, perhaps even a decade of technological progress forced upon us in only a few months.

The transition to remote work has demonstrated both the viability and the necessity for businesses to embrace “the cloud”. Those providing the infrastructure (e.g., MSFT) have a runway for growth that is difficult to quantify.

While I was probably a bit late joining the tech party, my investment strategy does now have plenty of room for getting a piece of that future growth.

Running and Personal Wellness

I purchased a Bowflex C6 Bike so I’d be able to get in some cardio as we approach the snowy season. Aside from the weather, I wouldn’t be surprised if gyms are forced to close down—or impose unattractive restrictions—at some point if we face a second wave. In either case, I figured having a high quality piece of gym equipment right at home was sensible

I hit my 60km running target again in August and haven’t set one for September as I’m looking to see how the bike feels. I’ll be sure to give an update soon.

Conclusion

Getting back to stock buying gives me some positive momentum on which to build as we head into the end of the year. Prices still aren’t where I’d like them to be, but adding some top notch dividend cash flow always hits the right spot.

Predicting where the market will head through the remainder of 2020 is akin to flipping a coin. Nothing is going to surprise me—we could be up 20%, down 20%, dead even, and it would all amount to a shoulder-shrug for me.

The disconnect between global economic carnage and supercharged stock prices persists. There’s nothing to stop that from continuing, at least in the short term. Already having positions in many of the best of breed businesses gives me comfort that my portfolio is durable both to withstand shocks and also to take part in the rising tide.

The important thing is to stick to high quality investments and keep riding the wave.

Thank you for reading.

– Ryan

Full Disclosure: Long REI.UN, CSH.UN, AW.UN, ABBV, MA, CU, SAP, MSFT, GOOGL

This is a very interesting report, thank you! I see that you have some positions that are also in my portfolio. For example, AbbVie Inc. (ABBV) and others. You say COVID-19 is the story of 2020. I’m afraid that this will also be the story of 2021)))

Hey Illia,

Glad you enjoyed the read.

Hopefully the end to the COVID story comes sooner rather than later.

Take care,

Ryan

Ryan – Time is going by too quickly. I think you hit on an important point. There is no sense trying to predict the direction of the market these days. You don’t know how much cash is being pumped in on a regular basis by the Fed. Further, bad econmic news results in green days because the news wasn’t as bad as expected. Man, these sure are some interesting time!

Let’s keep the dividend checks rolling in though!

Bert

Dividend Diplomats recently posted…Dividend Income Summary: Bert’s August 2020 Summary

Hey Bert,

Yeah, worrying about the Fed’s activities is like trying to catch the wind. All we need to do is keep reinvesting the divs and let the rest sort itself out.

Take care,

Ryan

Don’t remind me how fast the year is flying by. I also don’t know where August went. Looks like you are still taking care of business enjoying those dividends despite all the goings on in the world. Take care of finance and take care of body too in case a big shutdown happens again. Nice bike purchase. As you said it’s all a toss of for the rest of 2020. In the meantime all we can do is keep buying stocks, reinvesting and navigate the cuts as best we can.

DivHut recently posted…September 2020 Stock Considerations

Hey Keith,

Yeah, just rolling in the dividends while the chaos unfolds. It’s great having a strategy that doesn’t get too high or too low. And absolutely—keep buying and reinvesting. That’s the main thing.

Take care,

Ryan