It was a month of leaves turning colours and cooler temperatures for sleeping. My favourite part of the year is when it’s finally possible to keep the window open for the fresh air without the thick humidity that we become accustomed to through the summer.

It was also a great month for collecting dividend payments from a large collection of dividend growth stocks.

Table of Contents

Dividend Summary

I earned income from 23 different top notch companies in this period. The majority were Canadian, though it’s nice seeing the U.S. side of the equation continue marching steadily higher.

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 |

| Johnson & Johnson (JNJ) | 83.70 |

| Corby Spirit and Wine Ltd. (CSW.B) | 60.00 |

| Fortis, Inc. (FTS) | 76.40 |

| Canadian Utilities Limited (CU) | 87.08 |

| Canadian National Railway Company (CNR) | 25.88 |

| Hydro One Ltd (H) | 65.94 |

| Chartwell Retirement Residences (CSH.UN) | 5.10 |

| Metro Inc. (MRU) | 4.50 |

| Brookfield Renewable Partners L.P. (BEP.UN) | 107.54 |

| Brookfield Renewable Corporation (BEPC) | 26.60 |

| Brookfield Asset Management (BAM.A) | 3.48 |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 12.65 |

| Brookfield Infrastructure Corporation (BIPC) | 1.27 |

| A&W Revenue Royalties Income Fund (AW.UN) | 4.00 |

| Enbridge Inc. (ENB) | 20.25 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| Waste Management, Inc. (WM) | 23.17 |

| McDonald’s Corporation (MCD) | 22.32 |

| Yum! Brands, Inc. (YUM) | 15.59 |

| PepsiCo, Inc. (PEP) | 8.70 |

| Walmart Inc. (WMT) | 6.89 |

| Visa Inc. (V) | 3.83 |

| Microsoft Corporation (MSFT) | 5.64 |

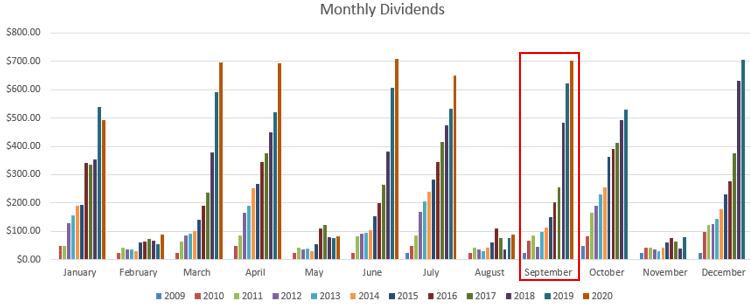

I clocked in with C$615.71 and U$86.14 for a currency-neutral sum of $701.85. This is the second time this year I’ve been able to cross the $700 threshold and only the third time overall. On the back of the ~$620 I pulled in through September 2019, this represents a 12.89% growth rate, year-over-year.

I love knowing that even without lifting a finger, I have the better part of a thousand dollars ready to be reinvested back into the markets.

That’s the magic of compounding at work, when done effectively.

Here’s how the income stacks up visually:

As long as those peaks keep getting higher each year, we’re winning the game. I still remember when $100 in a month felt like a crazy thing.

Year To Date Progress

Although 2020 has been a challenging year outside of the personal finance space, I am happy to report that I’ve already brought in over $4,000 in dividends:

| Month | Dividends ($) |

|---|---|

| January | 494.10 |

| February | 86.82 |

| March | 697.25 |

| April | 691.94 |

| May | 82.94 |

| June | 708.70 |

| July | 651.30 |

| August | 86.94 |

| September | 701.85 |

| Total | 4,201.84 |

Each one of these dollars have either already been reinvested or soon will be. Keeping the investment income rolling over is the secret to high returns in the future.

Market Activity and Cash

As most people have experienced, the interest on my “high-yield savings accounts” had dropped below 1%. Consequently, I did what I normally do when the promotional rate ends at a given bank—I switched the money to a different bank.

Sure enough, shortly after I did that, I received yet another promotional rate for 2% on new savings through the end of February 2021.

So, I finally will be getting something half-reasonable on my savings for the next few months. While it doesn’t sound like much in absolute terms, it’s important to remember that going from 0.8% to 2.0% is an increase of 150%. Not bad for a few seconds of my time to make some transfers online.

COVID-19, The Omnipresent

At the time of writing, we’ve recently learned that Ottawa is moving to a Modified Stage 2 with regard to COVID-19 precautions. In other words, restaurants and bars will be closed for indoor dining, among other rules and regulations.

Likewise, the NFL is constantly juggling the schedules of teams as players are announced as COVID-19 Positive, along with other sporting adjustments. Roland Garros, the French Open in tennis, just finished and I have to say it really feels strange to say so at this time of year. This is a tournament that usually kicks off the warmer weather.

Despite the noise, it is important to remember that top tier companies will continue to perform through the pandemic and for decades to come. Stick to the best names in their respective industries and let them do the heavy lifting to grow your portfolio.

Running and Personal Wellness

The Bowflex C6 bike I purchased last month came in. I’ve been using it more days than not. It has been great to be able to get in a high-quality cardio workout at home. It’s really as simple as getting on and pedaling.

The next part of my wellness I’d like to focus on is a recommitment to reading. I have a few books on the go and would like to finish at least one of them by the end of October.

Conclusion

September was a solid month. I’m closing in on a four-figure payday in a single month. It may take another few years, but it’s coming.

By keeping my dividends reinvested and ensuring I earn reasonable returns on my sidelined cash, the compounding train moves further down the track.

Thanks for reading.

– Ryan

Full Disclosure: Long REI.UN, JNJ. CSW.B, FTS, CU, CNR, H, CSH-UN, MRU, BEP-UN, BEPC, BAM-A, BIP.UN, BIPC, AW-UN, ENB, WM, MCD, YUM, PEP, WMT, V, MSFT

Nice ryan

Some chunky payouts there… Im jealous of that jnj one in particular. One day. haha

I hear you about the books, I got like 3 on the go. Got to just focus on finishing one.

keep it up

cheers.

Passivecanadianincome recently posted…October 2020 Stock Purchases / 1 Sale – Sweet!

Hey Rob,

Yeah, JNJ is one of those positions I bought into back in 2009 or 2010 and have just held onto. Have reinvested the divs elsewhere and just enjoyed the ride.

No doubt. Hard to stop picking up new books when there’s so much out there worth learning.

Take care,

Ryan

great work Ryan

Hi Ken,

Thanks for stopping by.

Take care,

Ryan