It seems I’ve really fallen behind on my monthly updates. I sit here on April 13 as I write this one, and I contrast how differently the year began with how it has progressed.

The start of the year marked the real push for COVID vaccinations in my area. With that, the hope had been that there would be a real corner turned in terms of lockdowns and restrictions.

That isn’t how things have turned out in the near term, at least.

We are currently in the midst of a twenty-eight day lockdown, following which another review of the COVID situation will ensue.

It is what it is.

Still, it doesn’t change anything when it comes to my investment thesis. And so, I persist.

Table of Contents

Dividend Summary

I earned income from five companies in February.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 20.88 | -33.33 |

| Chartwell Retirement Residence (CSH.UN) | 5.10 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 4.00 |

USD Dividends

| Company | USD Payments ($) | Dividend Change (%) |

|---|---|---|

| AbbVie Inc. (ABBV) | 48.62 | 10.17 |

| Mastercard Incorporated (MA) | 2.62 | 10.00 |

I earned C$29.98 and U$51.24 through February, coming together for a currency-neutral $81.22 One of the lower totals in recent memory, though not unexpected. February has always been a lower income month for me based on the timing of payments.

For better or worse, this was a month of double digits.

On the Canadian side, I saw REI-UN come in for a big hit. The company reduced its payment to shareholders by a third. While I can’t say this decrease caught me by surprise, it was still a shock to the system, all the same.

REI-UN had been a company I’d come to rely on for high-yield income on a monthly basis. I first bought my shares back in August 2009 and have reinvested the distribution on many occasions over the intervening years. The company has repeatedly expressed the durability of its business model, but the truth is that you learn a lot more about someone by what they do than by what they say—people and companies alike.

My plan at the present time is to keep holding my shares and to continue collecting the income. If they reduce again, I’ll reevaluate.

South of the border, I received double-digit dividend increases from both ABBV and MA. This helps counterbalance the REI-UN blip, to an extent.

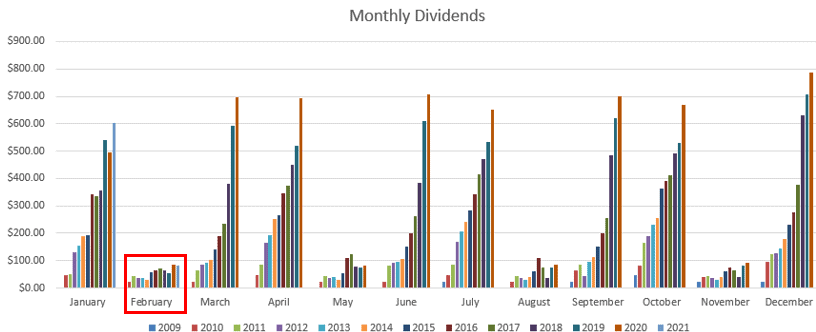

Here’s how the monthly dividend graph looks:

Year To Date Progress

Despite my dividend income total being lower than my February 2020 dividends, the portfolio is still off to a quick start:

| Month | Dividends ($) |

|---|---|

| January | 602.95 |

| February | 81.22 |

| Total | 684.17 |

Taken in comparison to this period in 2020 where I brought in $580.92 worth of dividends, growth amounts to 17.77%. Pretty decent, all things considered.

Market Activity and Cash

As I’ve mentioned on many occasions in the past, one of the goals of my portfolio is to continue increasing my weighting in tech. The largest and one of the globally best known companies of that bunch continues to be Apple Inc. (AAPL).

I decided to take the plunge—at prices I recognized were likely rather elevated—and initiated a starter position in AAPL. My total outlay was U$965.45 and provides a dividend yield of 0.59%.

While the income is paltry, the dividend growth has been steady. Either way, averaging into this one is a plan I feel comfortable with, particularly when looking out over the decades to come.

Despite this minor purchase, I continue to accumulate cash. Should a market dip occur, I’ll be there to buy.

Conclusion

February saw lower passive income totals than I’ve grown accustomed to. Anything less than triple digits at this stage feels like a bit of a drag, but that’s what newly deployed capital is all about.

The portfolio always has room for growth.

On the very bright side, I feel good about staking a claim in AAPL. I’ve been using my iPhone 5S for nearly four years now and it’s still going strong. Likewise, I see consumers clamouring for the new products as they come, so that gives me a good feeling about their overall tech ecosystem.

Thank you for reading.

– Ryan

Full Disclosure: Long REI-UN, CSH-UN, AW-UN, ABBV, MA, AAPL