In Canada, March is one of the most hopeful of months. As the snow melts, we can finally see the light

As the melt begins and we prepare for that warmer weather, dividend growth investors settle in to count their dividends—which is always the best part.

Table of Contents

Dividend Summary

Through March, I brought in cash flow from 24 companies—17 Canadian and 7 American. Let’s take a look at each individually.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 20.88 | |

| Johnson & Johnson (JNJ) | 81.21 | |

| Corby Spirit and Wine Ltd. (CSW.B) | 63.00 | -4.54 |

| Fortis, Inc. (FTS) | 90.90 | |

| Canadian Utilities Limited (CU) | 103.35 | 1.01 |

| Canadian National Railway Company (CNR) | 27.68 | |

| Hydro One Ltd (H) | 65.94 | |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 109.81 | 4.98 |

| Brookfield Renewable Corporation (BEPC) | 26.97 | 4.98 |

| Brookfield Asset Management (BAM.A) | 3.56 | 8.33 |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 12.94 | 5.15 |

| Brookfield Infrastructure Corporation (BIPC) | 1.29 | 5.15 |

| A&W Revenue Royalties Income Fund (AW.UN) | 5.40 | 35.00 |

| Enbridge Inc. (ENB) | 20.88 | 3.09 |

| Saputo Inc. (SAP) | 5.25 |

USD Dividends

| Company | USD Payments ($) | Dividend Change (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 24.44 | 5.50 |

| McDonald’s Corporation (MCD) | 23.03 | |

| Yum! Brands, Inc. (YUM) | 16.58 | 6.38 |

| Yum China Holdings, Inc. (YUMC) | 3.98 | |

| PepsiCo, Inc. (PEP) | 8.70 | |

| Visa Inc. (V) | 4.08 | |

| Microsoft Corporation (MSFT) | 6.19 |

I earned C$649.16 and U$87.00, coming together for $736.16 in currency-neutral dividends. This represents a March-record for my portfolio.

Standouts

It was a month which showed many dividend increases. Two double-digit raisers were MRU and AW-UN.

MRU really stepped up in this period with just over 11%, showing that the grocery and pharmacy business continue to go strong amid the pandemic. I’m not surprised by this, given their operations are deemed essential. Consequently, they will even do well in a continuous-lockdown period such as the one Ontario is currently in.

AW-UN’s 35.00% boost is nice, but still leaves the payment considerably lower than the pre-pandemic distribution. All the same, I do appreciate the gift horse and will continue reinvesting those dividends in the days to come. Every dollar received amounts to additional firepower in the dividend growth engine.

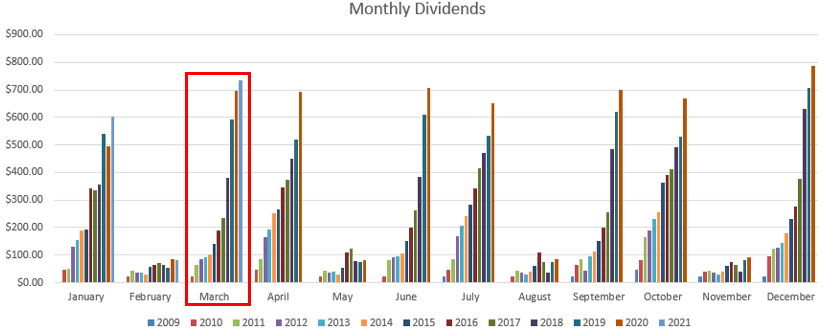

Year To Date Progress

With the first quarter in the books, the total income is stacking up quite nicely:

As always, taller graph lines indicate I’m on the right track.

Here are the full-year totals:

| Month | Dividends ($) |

|---|---|

| January | 602.95 |

| February | 81.22 |

| March | 736.16 |

| Total | 1420.33 |

$1,402.33 through three months rounds out to just over $465 per month in real dollars that could be used to pay current expenses, were I ever to need it. As it stands, I simply use this cash flow to refuel my portfolio.

This is how we compound.

Market Activity and Cash

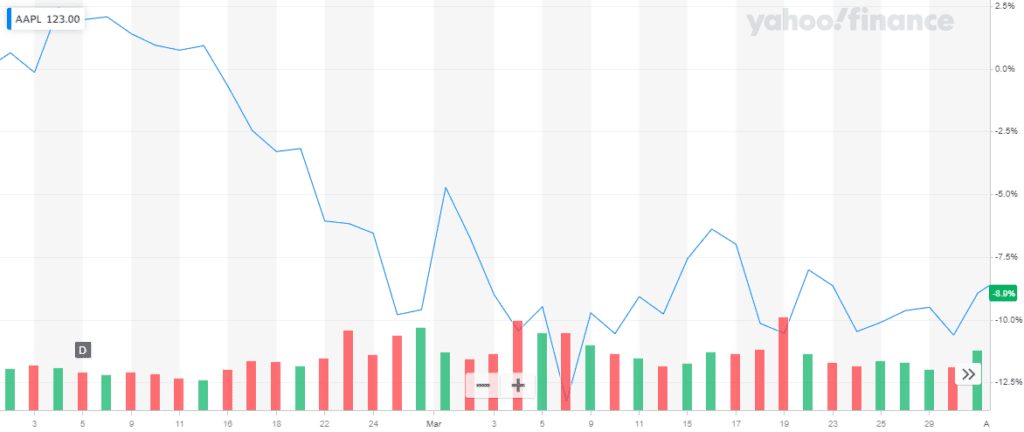

I opened a position in Apple Inc. (AAPL) in February and decided to double down on that with a purchase of U$961.70 total.

The price had declined by over 10%, top to bottom, through February and March:

Source: Yahoo! Finance

Getting a ~$17 discount on additional shares was something I couldn’t pass up. My yield on these shares is 0.68%, which I’m okay with given the growth should be considerable. I’m thinking in decades, not months.

Beyond dividend paying investments, I picked up U$1,100.95 worth of BigCommerce Holdings, Inc. (BIGC). This is a company I opened a position with in late 2020. It is a competitor in the eCommerce space with Shopify Inc. (SHOP).

My general thesis here is that there is a massively rising tide that is going to lift all boats; I want to have a stake in a few to ride that wave. We are only going to see increasing numbers of companies and individuals selling their wares online—BIGC enables that.

Cryptocurrency

The biggest move I made—though tiny in a financial sense—was to open a position in Purpose Bitcoin ETF (BTCC). This is a huge shift in my portfolio as I’ve decided to gain some exposure to the growing cryptocurrency market.

BTCC markets itself as the world’s first Bitcoin ETF. In terms of security, the Bitcoin is physically settled and held in cold storage. Further, one of the most important factors is that being packaged as an ETF has made it possible to hold some crypto within registered accounts. This is how I’ve gone about it.

Having said all of the above, I should note that I do not intend to make cryptocurrency the foundation of my portfolio—I remain firmly committed to dividend growth.

The more I study blockchain technology, the more I believe it will shape many industries in the future. That’s what I am staking a claim on.

Conclusion

March was a great month in terms of dividend income earned. Crossing the $700 mark always feels great, as it is finally getting to a stage where I can actually see it being able to pay for real life expenses. It could easily cover an automobile payment, for example, though my truck is already paid off at this stage.

I was able to make a number of investments this month which should provide ample growth in the years to come. Deepening my connection to AAPL at lower prices than February is great. BIGC and BTCC are more on the speculative side, though they are both in emerging tech spaces which I feel are here to stay.

I appreciate you taking the time to follow my journey.

Full Disclosure: Long REI-UN, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, MRU, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, PEP, V, MSFT, AAPL, BIGC, BTCC