While blockchain technology has been around for well over a decade, it seems to have only begun reaching mainstream public consciousness within the last year or two.

Cryptocurrency applications have received most of the fanfare because of the potential to make huge sums of money. Yet, they represent only one possible blockchain use case.

I am planning to keep this post brief and high-level. It’s an introduction to blockchain.

Table of Contents

Blockchain Technology Fundamentals

A blockchain is a distributed digital ledger which keeps a transparent record of all transactions. In that sense, it is very much the same as what you would typically expect of any other ledger, like those maintained by banks. For example, if Person A sends Person B $10, the bank acts as intermediary and debits Person A to credit Person B.

Where blockchains differentiate themselves is that they are designed to be decentralized and trustless. The bank in the example above becomes unnecessary as the peer-to-peer blockchain network has mechanisms in place to validate each and every transaction.

By keeping all transactions available and transparent, each individual can be sure no one is cheating the system. Therefore, they are able to conduct business without an institutional or individual middleman.

Blockchains take the onus of proof of ownership and security away from centralized organizations. Instead, they distribute the burden of consensus across an entire network.

Famed entrepreneur, Naval Ravikant, refers to blockchains as the third evolution of the internet itself:

Blockchain Standouts

Not all blockchains are created equally. This is one of the least understood aspects of the entire industry.

I will highlight Bitcoin and Ethereum because their cryptocurrencies rank first and second, respectively, in current market value. However, there are likely several thousand presently in existence and many more which will be created in the years to come.

Bitcoin

The Bitcoin blockchain, for example, is designed solely to track the movements of Bitcoin—the cryptocurrency on that network—between different parties. There is no intended purpose beyond financial transactions. Bitcoins themselves are often referred to as digital gold, as they are viewed as a store of value. This is akin to the way physical gold has been considered valuable over the course of millennia past.

Bitcoin was proposed by a person or group named “Satoshi Nakamoto” in 2008. Its principles are outlined in the Bitcoin Whitepaper.

Ethereum

The Ethereum blockchain, on the other hand, was developed to extend beyond the limitations of Bitcoin’s blockchain. Its cryptocurrency is known as Ether. This blockchain’s design is to be the infrastructure on which other applications may be developed. It is a general-purpose blockchain, equipped with a full programming language. This allows for innovative products to be developed which leverage the blockchain and extend beyond finance.

The guiding tenets of Ethereum were laid out in 2013 by the founder, Vitalik Buterin, in the Ethereum Whitepaper.

Use Cases for Blockchain Technology

While the use cases for blockchain technology remain in their infancy, there have already been a number of arenas where it is gaining repute.

Here are four potential use cases for blockchains:

- Smart Contracts

- Cryptocurrency

- Supply Chain

- Voting

Smart Contracts

A smart contract is a computer program which executes a set of instructions based on how it has been designed.

A vending machine is a common example of the sort of thing a smart contract might represent. For example, if someone inserts $1 and then another qualifying input is received (i.e., a certain button is pressed), the vending machine ejects a bottle of water.

What a smart contract can do is automate this process on the blockchain for truly any particular purpose.

I often think of the world of gambling in this context. Currently, an intermediary is necessary to stand between two parties (the two betting against one another), to guarantee that funds will be dispersed based on a given outcome (i.e., which basketball team wins the game). With a smart contract, the parameters can be programmed in, with the outcome being executed based on code.

What this does is provide the potential to bring costs down considerably. It is the reason for the rise of decentralized finance (DeFi), which refers to a global, digital economy which can operate without interference from outside parties.

The Ethereum blockchain is currently the leader when it comes to the development of smart contracts.

Cryptocurrency

Cryptocurrencies are the tokens produced by their respective blockchain networks.

Taking Bitcoin as an example, and without going too deep into the subject, it is possible for individuals around the world to mine Bitcoins. The way this is done is by using one’s computer to sustain the entire network and validate the transactions occurring thereon.

When a new block (a series of transactions) is added to the Bitcoin blockchain, the “miner” who solved the mathematical equation for it is rewarded with some Bitcoin.

Given that these tokens are deemed valuable, there exists the potential for huge reward.

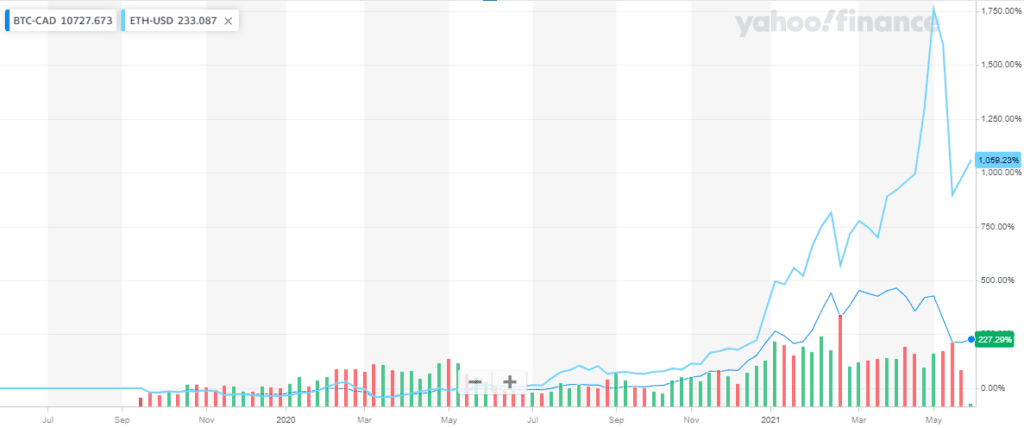

Here’s a quick look at the returns from Bitcoin and Ether over the past two years:

Source: Yahoo! Finance

Most people, though, do not mine for Bitcoins. Instead, they purchase them on cryptoexchanges and trade them in a similar fashion to stocks.

Supply Chain and Voting

As noted, blockchains are useful in transparently maintaining a database of transactions, shared across parties who therefore do not need to trust one another. The validity of the transactions can be proven easily.

Supply chain networks stand to be optimized by using such technology. Using a blockchain to track the movement of products, for instance, would make it possible for all parties to be able to quickly and easily see where things are at. As a purchaser of goods, it wouldn’t be necessary to trust the tracking mechanisms by centralized bodies who may have incentives not to be forthcoming with information.

With voting, it is necessary to track who has been voted for in a reliable manner. At the same time, it is important to maintain voter anonymity. Work is presently underway to leverage blockchains to solve voting issues while maintaining security. Still, it may be some time before this actually goes mainstream for important elections.

Conclusion

While blockchain technology has been around for quite a few years, it remains in the early stages of adoption on Main Street and Wall Street alike.

As I continue exploring blockchain technology and its investable opportunities (e.g., cryptocurrency, non-fungible tokens), I plan to continue writing about it here. This post will serve as a foundation for further exploration.

I do want to note that the risk profile involved with cryptocurrency is far different from my usual—and still preferred—methods of investing such as dividend growth. All the same, I like to write as a method to force myself to articulate my views. We learn by exploring beyond our usual boundaries.

I also look forward to hearing how all of you have been approaching blockchains and crypto.

Full Disclosure: Long BTC, ETH

Probably one of the most useful and informative blog posts Ive come across in a while!

Glad you enjoyed, RIFAT.

Ryan

Thanks for sharing the wonderful information that you have shared on bitcoin. This one is the correct one that you have shared on crypto chat. Great article!! Hope you will publish more content on the crypto chat room soon.

Glad you enjoyed the article, crypto chat.

Ryan