Another year in the books. Now it’s time to reflect and take inventory of what has transpired.

I presently own 43 companies, 36 of which produce regular income.

Table of Contents

Dividend Summary

I earned Canadian income from 25 sources and USD from 11 others. This provides a nice mix of dividends to be further reinvested, thereby fueling the compounding in my portfolio.

CAD Dividends

| Company | CAD Payments ($) | Div Change (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 632.00 | |

| RioCan Real Estate Investment Trust (REI-UN) | 261.00 | -33.33 |

| The Coca-Cola Company (KO) | 281.61 | 2.44 |

| Johnson & Johnson (JNJ) | 332.50 | 4.95 |

| BCE Inc. (BCE) | 760.65 | 5.11 |

| Canadian Imperial Bank of Commerce (CM) | 70.08 | |

| Corby Spirit and Wine Ltd. (CSW-B) | 148.50 | 9.09 |

| Bank of Nova Scotia (BNS) | 360.00 | |

| TELUS Corporation (T) | 236.94 | 8.57 |

| Rogers Communications Inc. (RCI-B) | 110.00 | |

| Fortis, Inc. (FTS) | 369.00 | 5.94 |

| Canadian Utilities Limited (CU) | 413.40 | 1.01 |

| Canadian National Railway Company (CNR) | 110.72 | 6.96 |

| Canadian Pacific Railway Limited (CP) | 38.00 | |

| Hydro One Ltd (H) | 273.66 | 5.01 |

| Chartwell Retirement Residences (CSH-UN) | 61.20 | |

| Metro Inc. (MRU) | 20.00 | 11.11 |

| Brookfield Renewable Partners L.P. (BEP-UN) | 434.40 | 4.98 |

| Brookfield Renewable Corporation (BEPC) | 106.70 | 4.98 |

| Brookfield Asset Management (BAM-A) | 24.04 | 8.33 |

| Brookfield Infrastructure Partners L.P. (BIP-UN) | 51.17 | 5.15 |

| Brookfield Infrastructure Corporation (BIPC) | 5.11 | 5.15 |

| A&W Revenue Royalties Income Fund (AW-UN) | 67.40 | |

| Enbridge Inc. (ENB) | 83.52 | 3.09 |

| Saputo Inc. (SAP) | 26.55* | 2.86 |

All Canadian companies are owned in CAD. JNJ and KO are both held in CAD within my portfolio and so the dividends are received as such.

* SAP made five dividend payments during the year.

USD Dividends

| Company | USD Payments ($) | Div Increase (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 97.76 | 5.50 |

| McDonald’s Corporation (MCD) | 93.73 | 6.98 |

| Yum! Brands, Inc. (YUM) | 66.32 | 6.38 |

| Yum China Holdings, Inc. (YUMC) | 15.92 | |

| PepsiCo, Inc. (PEP) | 35.68 | 5.13 |

| Walmart Inc. (WMT) | 27.95 | 1.85 |

| Visa Inc. (V) | 17.03 | 17.19 |

| AbbVie Inc. (ABBV) | 214.24 | 10.17 |

| Microsoft Corporation (MSFT) | 25.43 | 10.71 |

| Mastercard Incorporated (MA) | 10.48 | 10.00 |

| Apple Inc. (AAPL) | 9.90 | 7.32 |

Passive Income Totals

I brought in C$5,278.15 and U$614.44, coming together for a currency-neutral $5,892.59. Combined with the C$138.70 I earned in interest, my full-year passive income total has hit an all-time high of $6,031.29.

When viewed over twelve months, this amounts to $500 per month. This is a psychological threshold I’ve been waiting a long time to hit. It is the result of plenty of hard work and patience.

From the very first day when I started on this journey, I’ve held to a simple maxim: Invest less than you make and invest the difference.

This is the magic ingredient to any investment plan.

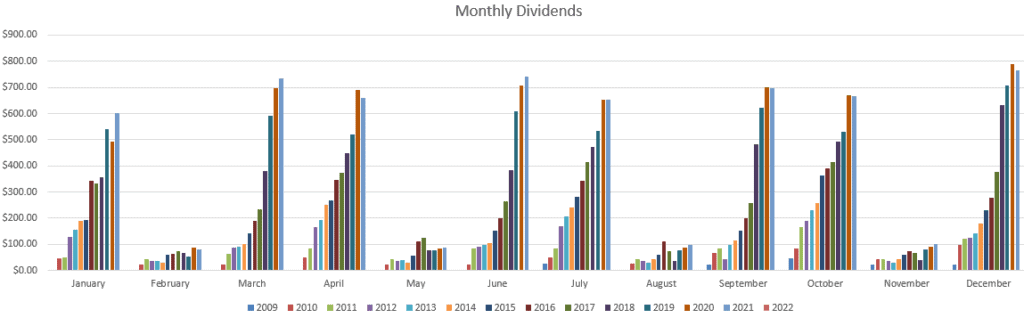

Here’s how my income has stacked up over the years:

Market Activity

When I sat down to write this, I was expecting my final market activity totals to be less than they were. My general feeling has been that the market in 2021 was—at the least—full valued.

All the same, I did put over $20k to work across a variety of investment types:

| Company | Total Cost ($) |

|---|---|

| TELUS Corporation (T) | C$994.15 |

| Fortis Inc. (FTS) | C$1,048.95 |

| Shopify Inc. (SHOP) | C$2,783.74 |

| Apple Inc. (AAPL) | U$1,927.15 |

| BigCommerce Holdings, Inc. (BIGC) | U$1,100.95 |

| Coinbase Global, Inc. (COIN) | U$3,140.79 |

| Block, Inc. (SQ) | U$3,429.68 |

| Cryptocurrencies (various) | C$5,671.55 |

The first thing that stands out is that most of my investments this year were away from dividend growth companies.

To be clear, I do still consider myself a dividend growth investor. The vast majority of my portfolio remains in high-quality dividend paying stocks. I continue to selectively reinvest those dividends with an overall strategy to increase my passive income.

I don’t see that general philosophy changing. Nevertheless, I believe in the future of developments coming from blockchain-related technology and saw this past year as an opportunity to diversify my portfolio.

Technology, Blockchain, Web3

The current pace of technological change is incredible. You barely have time to blink without missing something huge, these days.

The secular growth trend of technology becoming integrated within our everyday lives has an incredibly long runway ahead of it.

Here are a few key terms/buzzwords/themes that are routinely being spoken of by the biggest, best companies in the world:

- Blockchain (Related Post: What is Blockchain Technology?)

- Metaverse

- Non-Fungible Tokens (NFTs)

- Cryptocurrency

- Decentralized Finance (DeFi)

This largely seems to be falling within the broad category of Web3 (or Web 3.0).

While it’s difficult to predict exactly the form that Web3 will take and who the big winners will be, the fact that this is taking place seems to be rather obvious. Just as twenty years ago it would have been hard to predict that virtually everyone would be carrying a smartphone, the items on the list above are likely to be fully integrated in our lives before long.

As human life trends toward a digital future, the need to demonstrate ownership over digital goods increases. Blockchains—digital ledgers—are integral for any conception of a metaverse where goods can move between platforms. Just as we have deeds for physical goods, we need this same mechanism for proof and transfer online.

I intend to continue investing in companies operating across the spectrum of Web3.

This is, for example, one of the reasons I own Amazon, Google, and Microsoft. These companies are three of the biggest cloud computing businesses in the world. All of the data and processing power to drive this digital revolution needs to be maintained somewhere. It is rather predictable that these and other big names will further dominate the landscape, providing the proverbial pickaxes to those digging for gold.

Savings Rate

One of my favourite metrics to determine how effectively I’m putting money aside is the savings rate. I assess this as the difference between my net earnings and what I set aside for investment purposes.

I have managed to keep my savings rate above 20% since 2019. This year, I pulled off 24.27%.

In other words, I put away $24.27 for every $100 in net earnings. This is one of the key factors that drive my overall investment portfolio. Every dollar that gets properly invested has the opportunity to produce many more dollars in the future.

Looking forward to 2022, I suspect my savings rate is going to drop somewhat due to some travel planned for later in the year. Having said that, I still intend to aim for 20% as a healthy target.

Year-in-Review

The biggest highlight of 2021 is that businesses began to get back to providing sizeable dividend raises. They had been mostly cautious in 2020 when first learning to navigate the pandemic, but this year was very much different.

It’s important to remember that dividends send signals. They are a great proxy for understanding exactly how confident companies are in their future prospects.

A dividend cut signals concern. A dividend hold or small raise signals caution. A large dividend raise signals strength.

While this may seem a simplistic view, it has been a great barometer for me over the years. Companies that pay dividends endeavour to increase them as a method for rewarding shareholders.

A crucial example of this was in late November, early December, when the biggest Canadian banks all announced dividend increases. Each of them declared double-digit-sized bumps. This alone will juice my 2022 portfolio income with an additional $123.20. Not bad.

COVID-19

As I write this article, the Ontario government has just announced yet another COVID lockdown. Not really sure what I’d like to say about this, other than I’m looking forward to the day when we’re past all of this.

That said, I’m an optimistic person by nature and do feel good about the year to come. Bright days are ahead.

From an investment perspective, there will be opportunities to make the most of the volatility that this causes. As I wrote last year, dividend growth investing during COVID should remain an effective strategy.

Stick to best-of-breed companies and don’t worry about the ups and downs. Just use them to your advantage when prices drop.

As the crypto-crowd would say, just buy the dip.

Health and Wellness

Given the challenges with pandemic-driven lockdowns, I purchased a Bowflex C6 bike mid-to-late 2020. I continued to put this to great use through 2021 and will continue to do so going forward given the current state of affairs.

Across the entire year, I biked 4,861km in 131.88 hours. This comes out to a pace of 36.86km/hr for just about 11hrs/month. That’s a pretty decent total and provides a target for me to surpass in the year ahead.

I also tracked my sessions of calisthenics, finding that I completed 16,275 push-ups and 3,161 pull-ups.

In a break from years past when I’ve completed numerous marathons and half-marathons, I only ran 39km in all of 2021. This can largely be attributed to the comfort of getting cardio from my spin bike. However, I would like to target this for improvement in 2022, as running does give a great, different type of workout.

Beyond physical fitness, it is also necessary to cultivate a strong sense of mental well-being. I recently published an article devoted to exploring the benefits of creating Existential Meaning. This is based around recognizing that the world doesn’t provide any inherent meaning, but that we each can create our own.

I believe this is more important now than it ever has been. In reading through Twitter, people are sharing plenty of things that make them feel poorly about the current state of life. I believe that while there will always be challenges, we need to first start with inward improvement.

Develop a robust framework of mental models that can withstand whatever comes at you. Then you can even learn to thrive when things seem at their darkest. You can’t control everything that happens, but you can always control how you feel and what you do.

Conclusion

The first monthly-$500 passive income target has taken me around 12 years to hit. The hardest part of investing is getting started because there is nothing to compound.

Once you get some capital built up, however, the heavy lifting starts to be done by the investments themselves. I feel this more with each passing year. Each dividend payment that rolls in and which gets reinvested just adds a few more snowflakes to the snowball. And it’s already rolling downhill.

I could say that this year was particularly noisy with media fear mongering, but that is truly always the case. There has never been a year where we, as consumers, weren’t bombarded with distractions. The important thing is to remain grounded.

Have a strategy—and healthy mindset—in place so that, no matter the hot topic of the day, you have a North Star to guide your actions.

I’m looking forward to continue sharing my journey with all of you in the years to come.

Keep well.

Ryan

Full Disclosure: Long all investments listed in the article.

Great stuff Ryan

That’s a solid savings rate! I hear ya with the trend in big tech, this is an undeniable trend. Things are changing so fast. Congrats on breaking the 500$ a month marker, on to the next goal!

cheers man

Passivecanadianincome recently posted…2021 Portfolio Activity Summary & 2022 Target – Let’s Go!

Yeah, feels amazing to cross that $500/month barrier. It’s definitely a psychological threshold I’ve been after for quite a long time.

And absolutely—on to the next!

Ryan