This was an eventful month. Whether we’re talking about personal finance, geopolitical destabilization, or the usual pandemic-driven-narrative, flux is the order of the day.

Nevertheless, the dividend growth investing strategy remains strong. It’s a reliable port in any storm.

Table of Contents

Dividend Summary

I received payments from six companies, two of which were bolstered by dividend increases.

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 20.88 |

| Chartwell Retirement Residence (CSH.UN) | 5.10 |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.20 |

USD Dividends

| Company | USD Payments ($) | Dividend Change (%) |

|---|---|---|

| AbbVie Inc. (ABBV) | 63.45 | 8.46 |

| Mastercard Incorporated (MA) | 2.92 | 11.36 |

| Apple Inc. (AAPL) | 3.30 |

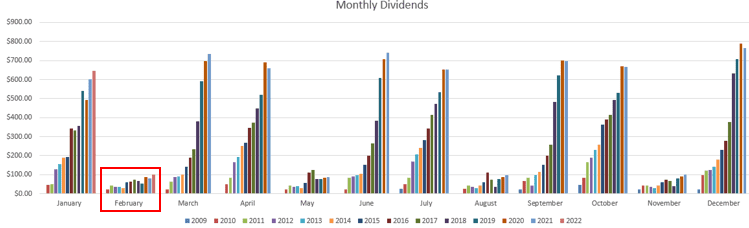

February brought in earnings of C$32.18 and U$69.67, amounting to a currency-neutral sum of $101.85. Given that this is traditionally a lower-paying month for my portfolio, this is actually an all-time high. It’s the first time I’ve hit triple-digits in February.

This is a 25.40% increase over my dividend income from February 2021. Even if the total isn’t gargantuan, what matters most is continuous improvement. Compound growth over time works wonders.

This bar chart shows the increase, as I’m finally hitting that first $100 line:

Steady as she goes.

Year To Date Progress

After just two months to start the year, I’ve raked in $747.40 from dividends:

| Month | Dividends ($) |

|---|---|

| January | 645.55 |

| February | 101.85 |

| Total | 747.40 |

Compared to the $684.17 from the same period last year, this comes as a 9.24% increase. This is a result of investments from 2021 manifesting themselves with cash flow now.

February Developments

As mentioned in the preamble, February brought with it plenty of activity. Given the main topic of this site is investing and learning to get rich, we’ll begin with the financial side of the equation.

Earnings Season

Two of the more notable earnings announcements this month came from Alphabet Inc. (GOOGL) and Meta Platforms Inc (FB).

As an aside, it’s quite in vogue for these companies to rebrand themselves. For our purposes here, I’ll refer to them simply as “Google” and “Facebook”, as they’re commonly known.

The Google quarter had some genuine highlights:

- Revenue, +32.4%

- Google Cloud, +44.6%

- Google Services, +31.3%

- YouTube Ads, +25.4%

- 20:1 stock split to take place in July

The stock popped ~7% after hours when this was announced.

It is mind-blowing to see a company of this size continuing to grow in the healthy double digits. What’s even more impressive is when you consider that the runway ahead of them is even larger than it ever has been.

Think about it. Are people becoming more or less dependent on digital services? What happens when all nations—including third-world—have a fully-developed web infrastructure?

It’s difficult to quantify how much opportunity Google has ahead of it.

As far as the stock split is concerned, it ultimately doesn’t change the value of the company whatsoever. However, it does make it easier to buy into the stock which has become prohibitively priced for small investors. While this isn’t a problem if your broker allows the purchase of fractional shares, this isn’t presently possible for everyone.

While I first opened my stock position in Google in March 2020 and it has risen since, I’d certainly love to own more.

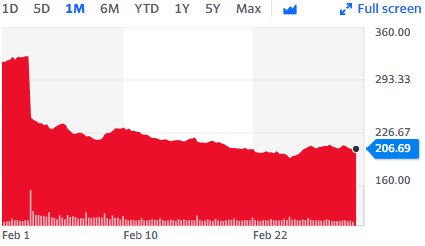

Facebook was a different story from Google. The company cratered by over 20% when it announced earnings on February 2:

On the company’s earnings call, CEO Mark Zuckerberg cited competition from apps such as TikTok as the catalyst for Facebook’s challenges. He also noted that the company is in the middle of a transition to short-form video with its “Reels” solution.

My personal belief is that Zuckerberg called attention to competition in order to alleviate antitrust concerns. If they’re struggling as a result of their competitors, you can’t justify breaking them up, right?

It was a smart play.

Global Destabilization and War

While politics and humanitarian issues aren’t something I cover in great detail on this site, the biggest news toward the end of February was the Russian invasion of Ukraine. The convoy of military vehicles apparently extended beyond 40 miles in length. It’s difficult to fathom.

At this stage, I’m simply hoping for a near-term resolution to the conflict.

The broader economic impacts have already been pronounced. At the time of writing, the Moscow Exchange is closed and Russia has doubled its interest rate in an effort to bolster the Ruble which has been devalued +25%.

What I will say is that this is the first event I’ve really seen overtake COVID since early 2020 as far as media coverage. It has become the new media focus, at the moment.

On that note…

COVID on the Decline

I’m pleased to report that COVID has been receding from the collective consciousness.

Less than two months ago we were in a lockdown which prompted social unrest and protests known as the “Trucker Convoy”. Fast forward to the present day and the virus is drifting further into the rear-view mirror.

Ontario has lifted capacity limits for indoor settings, along with removing its vaccine certificate system. Daily hospitalizations and ICU patients have, fortunately, been declining.

The pandemic isn’t over, but we’re getting to the right side of it.

Market Activity and Cash

No matter what happens in the world, regular investing is important. My favourite way to put capital to work is when the markets offer up a deal.

Through February, I made purchases in two companies.

The first was in Facebook when it dropped on the earnings announcement (mentioned above). The pullback gave me an opportunity to open a position in the company. This will either be a great investment or a poor one—much of it comes down to how well they can execute on their grand vision of the Metaverse.

Facebook also notably changed its name to “Meta Platforms” in late 2021 as it wanted to highlight a new focus on this Metaverse concept. They believe the resulting platforms will be the successor to the mobile Internet.

Either way, I’m happy to wait it out with some skin in the game.

My second purchase was in Shopify Inc. (SHOP). This company has also been tanking in the markets, so I wanted to double down on it. I believe in their long-term vision and overall viability of a company that makes it easy for others to sell products online.

They’re a best-of-breed operator with a fantastic platform. I’ll be buying as others are selling.

Conclusion

The shortest month of the year turned out to be a busy one. The markets have been choppy and the geopolitical environment remains strained, but that doesn’t mean we should hide in cash.

There’s always a place to invest your money. This has been true in every historical time period and I see no reason why this time is any different. We all believe we’re living in the most difficult of times while we’re in them.

It’s part of our human condition.

Keep your eyes facing forward, chin up, and continue putting capital to work.

Full Disclosure: Long REI-UN, CSH-UN, AW-UN, ABBV, MA, AAPL, GOOGL, FB

You said it…. Flux is the name of the game. Of course, that’s why we like our dividends. They seem to roll in more or less each month no matter what is going on in the general world. Nice income for the month. Keep up the good work!

DivHut recently posted…Recent Stock Purchase March 2022

Hey DH,

Absolutely. Steady as she goes.

Take care,

Ryan

nice Ryan. congrats on hitting triple digits for these off months.

All about hitting those milestones along the way.

keep it up.

cheers