The story of the past month has been the inflation that is ripping through our economic system. Pretty much everything is costing considerably more than it did a year ago—aside from certain stocks and crypto, of course.

As the war persists in Ukraine, fuel prices at the pump continue soaring. Given that oil is one of the key inputs for pretty much everything that keeps our world ticking, the steep rise has a considerable impact on everything downstream.

All the same, dividends also kept flowing and rising. I love knowing I have a wide foundation of companies that continue working even while I sleep. They’re doing all they can to keep the income hitting my account.

Table of Contents

Dividend Summary

As usual, dividend income was spread across a wide range of companies. Seventeen Canadian companies sent me cash flow, along with eight from the US.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 22.19 | |

| Johnson & Johnson (JNJ) | 90.17 | 6.60 |

| Corby Spirit and Wine Ltd. (CSW.B) | 12.00 | |

| Fortis, Inc. (FTS) | 96.30 | |

| Canadian Utilities Limited (CU) | 104.39 | |

| Canadian National Railway Company (CNR) | 32.96 | |

| Hydro One Ltd (H) | 72.70 | 4.99 |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Metro Inc. (MRU) | 5.50 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 115.35 | |

| Brookfield Renewable Corporation (BEPC) | 52.62 | |

| Brookfield Asset Management (BAM.A) | 3.98 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 13.66 | |

| Brookfield Infrastructure Corporation (BIPC) | 1.37 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.20 | |

| Enbridge Inc. (ENB) | 21.50 | |

| Saputo Inc. (SAP) | 5.40 |

USD Dividends

| Company | USD Payments ($) | Dividend Change (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 27.63 | |

| McDonald’s Corporation (MCD) | 24.64 | |

| Yum! Brands, Inc. (YUM) | 18.90 | |

| Yum China Holdings, Inc. (YUMC) | 3.98 | |

| PepsiCo, Inc. (PEP) | 9.78 | 6.98 |

| Walmart Inc. (WMT)* | 7.14 | |

| Visa Inc. (V) | 4.79 | |

| Microsoft Corporation (MSFT) | 6.86 |

* WMT paid in May, but normally pays in June, so I included it here.

In total, I earned C$661.39 and U$103.72, blending for a currency-neutral $765.11. Compared with my June 2021 dividend sum, I’ve achieved a 3.43% growth rate.

As noted previously, my strategy over the past year or so has been to double down on technology names to broaden my holdings. Most of these companies pay a low dividend or none at all. Accordingly, most of the dividend growth was organic from companies I already own, rather than from fresh capital infusions.

Standouts

The dividend increase from PEP is its 50th consecutive annual increase. This makes the company a Dividend King and is well worth a celebration.

When looking at the global macroeconomic environment, PEP hitting this milestone is all the more impressive. That means they survived and even thrived through the inflationary times of the ‘80s, along with every other bump along the past five decades. Through every single event that had fearmongers calling for the end-of-days, PEP bumped its payout.

Looking forward to the next five decades, people will continue needing food and drink to sustain themselves. This company continues performing and providing core products that consumers absolutely need. I’m glad to be a shareholder and plan to be on board for the very long term.

Year To Date Progress

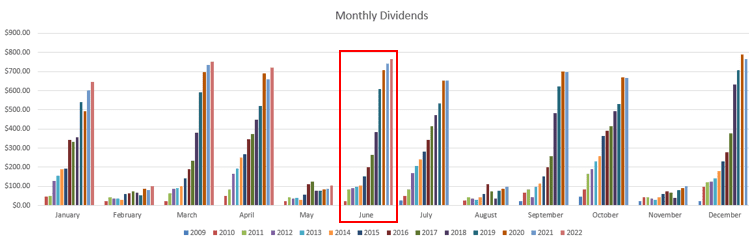

As I’ve said before, it’s all about seeing the towers in the graph get taller:

I’ve firmly crossed the $3k mark as we hit the half-way point of the year. This sets the stage for a solid finale:

| Month | Dividends ($) |

|---|---|

| January | 645.55 |

| February | 101.85 |

| March | 750.44 |

| April | 720.76 |

| May | 103.31 |

| June | 765.11 |

| Total | 3,087.02 |

Market Activity and Cash

There were a lot of stocks pulling back through June. I decided to simply double down on Shopify (SHOP) for another three shares below C$400. Nothing too flashy—just simple averaging down into a company I believe has a long runway for growth.

At the end of the day, eCommerce is going to continue flourishing in the years to come. SHOP which makes it easy for regular people—along with megacap corporations alike—to sell their goods online. The fee structure is simple and it’s easy to get onboarded.

That business model isn’t going out of style any time soon. In fact, it’s far more likely that it will continue mushrooming in the years to come as our lives become increasingly digital.

Conclusion

June was a simple month from a portfolio perspective. I raked in +$750 in dividend income while also adding more shares of SHOP.

I like to focus in life as much as possible on what I can control, rather than the things I can’t. Inflation in the system and interest rate hikes by central banks are outside of my control. What I can do, though, is to continue investing in high-quality companies, primarily which pay rising dividends.

That dividend income is a great form of inflation-protection. The key thing is to remain invested and reinvest the dividends as much as possible.

Take care.

– Ryan

Full Disclosure: REI-UN, KO, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, V, MSFT, SHOP