Shorter days and colder weather. November flew by as a bit of a blur and I’m writing this now amid a December snowstorm.

All the same, the dividends never stopped.

Table of Contents

Dividend Summary

I earned passive income from seven companies; four were from Canada, the rest from the US.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 22.19 | |

| Chartwell Retirement Residence (CSH.UN) | 5.10 | |

| Metro Inc. (MRU) | 5.50 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.20 | 3.23% |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 63.45 |

| Mastercard Incorporated (MA) | 2.92 |

| Apple Inc. (AAPL) | 3.45 |

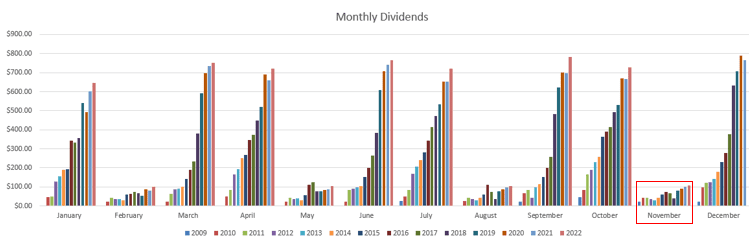

Dividends tallied at C$39.19 and U$69.82. On a currency-neutral basis, this comes together for $109.01. Given that this is an off-month to begin with, it is actually my highest November total ever.

Relative to my dividend earnings in November 2021, my income has increased by 7.29%.

The dividend growth chart thus grows ever higher:

Year To Date Progress

I’ve crossed $5.5k in passive income heading with a month to go in the year:

| Month | Dividends ($) |

|---|---|

| January | 645.55 |

| February | 101.85 |

| March | 750.44 |

| April | 720.76 |

| May | 103.31 |

| June | 765.11 |

| July | 721.84 |

| August | 103.31 |

| September | 782.04 |

| October | 727.35 |

| November | 109.01 |

| Total | 5,530.57 |

I’m expecting December to cross well over $800 in dividends and be my best month ever, so there’s plenty to look forward to as the year closes out.

A Brief History of A&W’s (AW-UN) Distribution

One of the nice highlights was for AW-UN to increase its distribution back to pre-pandemic levels.

As a restaurant company, it wasn’t altogether surprising when they had to pump the brakes in 2020; most of the restaurants were either closed or severely hampered in their ability to do business. These operating conditions were entirely out of their control.

Consequently, they suspended their payout after the March 2020 payment, resuming it in July 2020. The payment had decreased at that point from $0.159 to $0.100 per unit on a monthly basis.

To make up for missed or reduced payments, they did pay some special cash distributions along the way. An additional $0.30 per unit was paid in October 2020 and again in December 2020. A final special cash distribution was also paid in December 2021.

Finally, now in November 2022, the regular monthly payment is at $0.160 per unit, slightly above the original $0.159 payment.

I consider A&W to be one of the best fast food restaurants on the basis of the quality of their food. Likewise—and anecdotally—their restaurants do always seem to have a constant stream of customers.

Seeing them get back to rewarding unitholders on a regular basis is a great thing, and exactly what I would expect from a top quality company.

Market Activity and Cash

I didn’t make any stock purchases in November. I’ve been mostly accumulating idle cash at this point. I did take a close look recently and didn’t find any real bargains sitting there in top-flight dividend payers.

I do expect I’ll make another purchase before 2022 closes out, but it’ll likely be at slightly higher prices than I’d prefer.

It’s difficult to sit on cash on the sidelines, isn’t it?

Conclusion

My portfolio is right where I’d like it to be, heading into the final month of the year. My December dividend totals will comfortably bring the yearly count to +$6,000 in passive income.

The story of A&W serves both as a reminder to own best of breed companies, but also to be aware that during severe cash crunches, passive income can be reduced. Always be sure to live on the conservative side with your own cash positions to be well-capitalized in any situation.

I hope you’re all staying safe and warm as the weather turns. And always keep investing.

Thank you for reading.

Full Disclosure: Long REI-UN, CSH-UN, MRU, AW-UN, ABBV, MA, AAPL