Following my usual December protocol, I took just over two weeks in vacation time as an annual slowdown. It provides a nice breather to think about the year that was, along with what’s to come.

Table of Contents

Dividend Summary

I again brought in cash flow in Canadian dollars from seventeen businesses, with six more paying me in USD.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 22.19 | |

| The Coca-Cola Company (KO) | 79.19 | |

| Johnson & Johnson (JNJ) | 97.52 | |

| Corby Spirit and Wine Ltd. (CSW.B) | 11.00 | -8.33 |

| Fortis, Inc. (FTS) | 110.18 | |

| Canadian Utilities Limited (CU) | 104.39 | |

| Canadian National Railway Company (CNR) | 32.96 | |

| Hydro One Ltd (H) | 72.70 | |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 123.19 | |

| Brookfield Renewable Corporation (BEPC) | 56.19 | |

| Brookfield Asset Management (BAM.A) | 4.22 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 14.59 | |

| Brookfield Infrastructure Corporation (BIPC) | 7.78 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.40 | |

| Enbridge Inc. (ENB) | 21.50 | |

| Saputo Inc. (SAP) | 5.40 |

USD Dividends

| Company | USD Payments ($) | Dividend Change (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 27.63 | |

| McDonald’s Corporation (MCD) | 27.14 | 10.14 |

| Yum! Brands, Inc. (YUM) | 18.90 | |

| Yum China Holdings, Inc. (YUMC) | 3.98 | |

| Visa Inc. (V) | 5.74 | 20.00 |

| Microsoft Corporation (MSFT) | 7.52 | 9.68 |

Dividend Earnings Totals

Dividend payments tallied for C$774.50 and U$90.91, coming together for a currency-neutral total of $865.41. This is easily the highest amount I’ve ever received in a single month, creeping precipitously closer to the four-figure mark.

In comparison with my dividends from December 2021, I’ve grown my passive income by 13.30%. It’s a higher bump than I was anticipating, reflecting both organic growth of dividend payments, along with some fresh capital I deployed through the year in companies like Fortis (FTS).

The dividend cut from Corby isn’t altogether surprising. They’ve been up-and-down since COVID, not proving to be a reliable source of income. I’ll continue to hold my shares, but have no intention of increasing my position.

Year To Date Progress

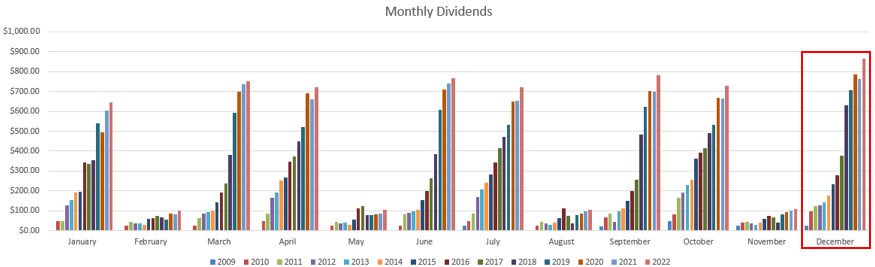

The towers on the chart keep getting taller:

My full-year dividend totals have reached $6,395.98:

| Month | Dividends ($) |

|---|---|

| January | 645.55 |

| February | 101.85 |

| March | 750.44 |

| April | 720.76 |

| May | 103.31 |

| June | 765.11 |

| July | 721.84 |

| August | 103.31 |

| September | 782.04 |

| October | 727.35 |

| November | 109.01 |

| December | 865.41 |

| Total | 6,395.98 |

I comfortably surpassed the goal I had set of $6k in dividend income for the year.

Market Activity and Cash

The additional income from the +$800 in dividends this month gave me plenty of dry powder to be reinvested. Toward the end of the month, I made a final stock purchase to close out the year.

I picked up 20 additional shares of Brookfield Infrastructure Corporation (BIPC). Based on the current dividend rate of $0.54 quarterly and $2.14 annually, this should bring in $10.80 quarterly/$42.80 annually. It’ll then get a foreign exchange bump coming from USD to CAD.

I’m happy to have added to my BIPC stake at lower prices than I paid in August for the same stock.

Aside from the BIPC purchase, I’ve again been accumulating cash and looking for better prices. I wouldn’t be shocked to get some real bargains in 2023 as Central Banks slow down their economies with higher interest rates. If the market takes a dive, I’ll happily pick up more shares.

Conclusion

I’ve had a great December with plenty of rest, relaxation, and gratitude. Taking the time to spend with family and friends, along with some solitude, has been refreshing. Hitting a new record for dividend income makes things even sweeter.

I’ll cover the year in greater detail in a subsequent post about the full year.

All the same, Merry Christmas, Happy Holidays, and all the best in the New Year to come for you and your families.

Full Disclosure: REI-UN, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, V, MSFT

Great stuff man.

Nice growth and your getting some chunky positions in there. Nice addition of bip them and bep seem enticing atm.

I may add to our bep position soon enough.

keep it up

cheers!

passivecanadianincome recently posted…December 2022 Passive Income – Wrapping it up!

Hey Rob,

Yeah, I was actually a bit surprised at the growth. And always feels great to get positions bringing in +$100. Juicy when they hit the account and are ready for reinvestment.

BIPC and BEPC are both on the menu this year for me, as well.

Take care,

Ryan