It was really a banner year with plenty of positive developments to focus on.

On the investment front, I managed to put a fair amount of capital to work and hit the dividend targets I was aiming for.

On a personal level, I’ll provide some colour on a few items that made for an eventful 2022.

Table of Contents

Dividend Summary

I earned dividends in CAD from 25 companies and USD from 11 other businesses. Beyond this, I hold stock in 10 non-dividend payers.

In total, my portfolio has grown to 46 stocks in total. Most are high-quality enterprises with a healthy level of diversification across sectors.

CAD Dividends

| Company | CAD Payments ($) | Div Change (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 712.00 | 12.66 |

| RioCan Real Estate Investment Trust (REI-UN) | 263.66 | 6.25 |

| The Coca-Cola Company (KO) | 308.18 | 4.76 |

| Johnson & Johnson (JNJ) | 368.02 | 6.60 |

| BCE Inc. (BCE) | 799.70 | 5.14 |

| Canadian Imperial Bank of Commerce (CM) | 78.48 | 13.70 |

| Corby Spirit and Wine Ltd. (CSW-B) | 47.00 | -8.33 |

| Bank of Nova Scotia (BNS) | 406.00 | 14.44 |

| TELUS Corporation (T) | 286.38 | 7.08 |

| Rogers Communications Inc. (RCI-B) | 110.00 | |

| Fortis, Inc. (FTS) | 399.08 | 5.61 |

| Canadian Utilities Limited (CU) | 417.56 | 1.00 |

| Canadian National Railway Company (CNR) | 131.84 | 19.11 |

| Canadian Pacific Railway Limited (CP) | 38.00 | |

| Hydro One Ltd (H) | 287.34 | 4.99 |

| Chartwell Retirement Residences (CSH-UN) | 61.20 | |

| Metro Inc. (MRU) | 22.00 | 10.00 |

| Brookfield Renewable Partners L.P. (BEP-UN) | 473.92 | 5.35 |

| Brookfield Renewable Corporation (BEPC) | 216.17 | 5.35 |

| Brookfield Asset Management (BAM-A) | 16.17 | 7.68 |

| Brookfield Infrastructure Partners L.P. (BIP-UN) | 56.12 | 5.88 |

| Brookfield Infrastructure Corporation (BIPC) | 18.07 | 5.88 |

| A&W Revenue Royalties Income Fund (AW-UN) | 74.80 | 3.23 |

| Enbridge Inc. (ENB) | 86.00 | 2.99 |

| Saputo Inc. (SAP) | 21.60 |

All Canadian companies are owned in CAD. JNJ and KO are both held in CAD within my portfolio and so the dividends are received as such.

USD Dividends

| Company | USD Payments ($) | Div Increase (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 110.52 | 13.04 |

| McDonald’s Corporation (MCD) | 101.06 | 10.14 |

| Yum! Brands, Inc. (YUM) | 75.60 | 14.00 |

| Yum China Holdings, Inc. (YUMC) | 15.92 | |

| PepsiCo, Inc. (PEP) | 37.84 | 6.98 |

| Walmart Inc. (WMT) | 28.44 | 1.82 |

| Visa Inc. (V) | 20.08 | 20.00 |

| AbbVie Inc. (ABBV) | 253.80 | 8.46 |

| Microsoft Corporation (MSFT) | 28.10 | 9.68 |

| Mastercard Incorporated (MA) | 11.68 | 11.36 |

| Apple Inc. (AAPL) | 13.65 | 4.55 |

Passive Income Totals

I earned C$5,699.29 and U$696.69, coming together for a currency-neutral sum of $6,395.98. The beauty of this is that this cash flow comes in whether I get up in the morning or not. As a result of having such a wide base of companies, I can be quite certain that this total will increase next year even if I don’t lift a finger.

That’s how dividend growth works.

In comparison to 2021’s dividend total of $5,882.89, I’ve posted an 8.72% growth rate.

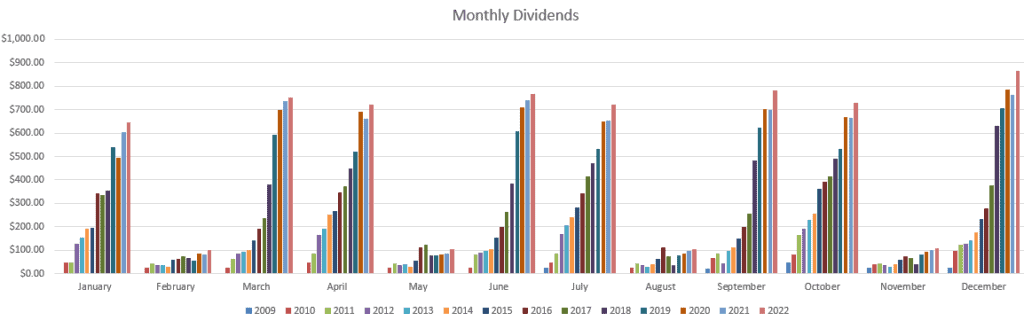

Here’s a quick chart of my overall dividend totals. The year was capped off with an all-time monthly dividend record for December:

Market Activity

It turned out to be an okay year for investing fresh capital. While the market was strong in the early stages, there were a number of significant pullbacks. This afforded the opportunity to invest at better valuations and higher dividend yields.

I managed to invest a currency-neutral total of $13,432.19 in 2022:

| Company | Total Cost |

|---|---|

| Fortis Inc. (FTS) | C$1,048.95 |

| Brookfield Renewable Corporation (BEPC) | C$2,504.60 |

| Brookfield Infrastructure Corporation (BIPC) | C$1,856.07 |

| Shopify Inc. (SHOP) | C$7,048.43 |

| Meta Platforms Inc (META) | U$974.14 |

Similar to 2021, the majority of my investments this year were in non-dividend paying companies. Both SHOP and META are tech companies, albeit operating in different areas of the space.

My goal over the past few years has been to broaden my investment portfolio to include some higher-growth companies. In the short-term, this has played out poorly as prices have pulled back, but I am still satisfied. I am now invested as fully as I need to be across the technology sector which had previously been underrepresented.

My focus moving forward should shift back to dividend growth companies. The bread and butter of my investment philosophy is to emphasize cash flow. That never goes out of style, though it isn’t the only way to put money to work.

Cryptocurrency

I did not increase any crypto positions in 2022. I am content with the positions I already hold at this stage. I may opportunistically make some buys in the future, though there is no guarantee there.

Long story short, I continue to view Web3 as an emerging space to be invested, though it remains very difficult to see who the winners will be. It is less likely to be one connected “Metaverse” (as envisioned by Zuckerberg), and more likely to be fragmented across the space.

Although interoperability exists and there is the potential to put it all on one tech infrastructure—or at least interface it all to feel that way to consumers—there are far too many vested interests which are not aligned. The greater likelihood is fragmentation and continual efforts to connect.

The challenge will be for companies to find investable ways to make use of this space. Likewise, on the advertising space, early adopters will be able to hit some real homeruns.

Having the crypto rainforest effectively burned to the ground this year is going to be good thing in the long run. Let the scammers get smoked out and clear the way for proper regulation. Then, let’s see what can be built on top of the rubble.

Savings Rate

My savings rate is depressed at this stage. Among other things, my two-week vacation to Europe and the purchase of a new home has soaked up the majority of my free cash flow. I don’t mind, as they’ve both been worthwhile investments in their own capacity.

You can’t buy back time as it pertains to great experiences and a proper roof over one’s head. As Andy Dufresne once opined, it’s time to get busy living or get busy dying.

Perhaps in 2023 I’ll be able to focus a bit more on putting cash aside.

Conclusion

Crossing the $6k marker this year feels like something of a dream. I know that it isn’t “life changing” money, but it represents over a decade of investment and strategy. It’s the culmination of a lot of hard word, discipline, and planning.

Bringing in +$500 per month is something I’ve thought about for many years, and I’m already there.

The snowball continues to grow, and it only gets easier from here. Compounding works best when it has a solid foundation. I’ve set that base and now it’s just a matter of continuing to add to it. Getting from $1,000 in passive income is going to be much faster than getting to $500 to start.

It’s the same for everything in life. What we devote energy to is the thing that grows. Spend your energy wisely.

Ryan

Full Disclosure: Long all investments listed in the article.

Congrats on record dividend income in December. You blew right past the $800 mark. I would anticipate at least one $1K month in 2023. That will be a nice milestone.

Also, congrats on a terrific 2022. Your $13K+ investment during the year should lead to a nice boost in dividends in 2023. Now that you are on average collecting $500/month in dividends, you’ll be at $1K/month before you know it. Keep up the steady, consistent efforts! Best of luck in 2023.

Engineering Dividends recently posted…2023 Portfolio Goals

Hey ED,

That’d be awesome. I’d really love to cross that four figure milestone.

And absolutely—the monthly income just keeps rising, so definitely looking to keep that engine pumping.

Take care,

Ryan