August was something of a blur. I spent plenty of time barbecuing and relaxing with family, enjoying the good things in life.

That’s how it ought to be, and it feels good when that’s how it goes. At the end of the day, we all decide the life we want to live either by explicitly choosing, or by failing to do so.

In recognition of this being a full year since my vacation in Europe, I’ve included the above AI-generated photo of beautiful Florence.

Table of Contents

Dividend Summary

On the passive income front, cash flow was split evenly between three Canadian companies and three on the State-side.

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 23.49 |

| Chartwell Retirement Residence (CSH.UN) | 5.10 |

| A&W Revenue Royalties Income Fund (AW.UN) | 11.20 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 66.60 |

| Mastercard Incorporated (MA) | 3.40 |

| Apple Inc. (AAPL) | 3.60 |

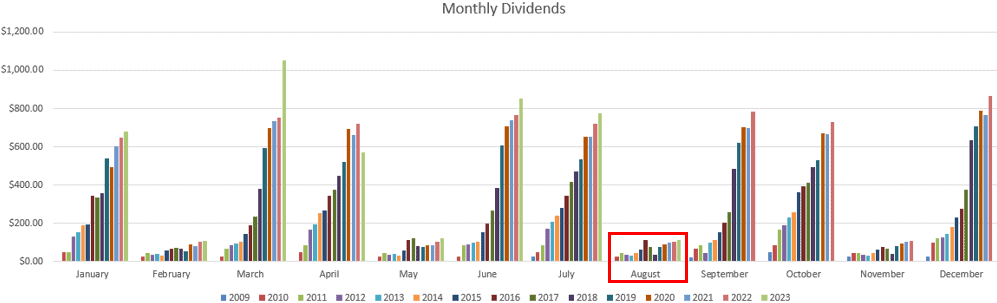

I brought in C$39.79 and U$73.60 through August, combining for a currency-neutral $113.39. This represents an August-record for my dividend income, increasing by 9.76% over my August 2022 dividend totals.

In what is historically one of my slowest months of the year, putting a higher top on the chart is a win:

Year To Date Progress

I’m over $5k in dividends with Q4 still yet to hit the books:

| Month | Dividends ($) |

|---|---|

| January | 680.90 |

| February | 107.14 |

| March | 1,050.94 |

| April | 572.74 |

| May | 118.51 |

| June | 850.14 |

| July | 773.75 |

| August | 113.39 |

| Total | 4,267.51 |

It’s going to be a close photo-finish on whether I can top $7k as a full-year total. This was the rough goal I had set for myself at the beginning of 2023.

The combination of organically growing dividends from companies I already own, coupled with fresh capital being deployed, has provided a solid boon to my passive income. As always, all dividends get selectively reinvested.

Market Activity and Cash

The Bank of Canada continues to threaten the possibility of higher interest rates, though economic data has been mixed. I don’t like to make forecasts, but the truth is that it doesn’t really matter.

Rates will rise and fall like the winter wheat, but a portfolio with a strong foundation can still grow in either condition. Sticking to high quality companies insulates one from the vicissitudes of the market.

At this stage, I’ve been mostly just collecting dividends and keeping my eyes open for opportunities. I could see myself making one or two more stock purchases as the year winds down, setting the stage for healthy growth in 2024.

Conclusion

My portfolio continues to perform well amid choppy markets. My firm strategy of investing in top notch companies and letting them do the heavy lifting remains in place.

This is what has allowed me to really take a hands-off approach for the past month and still wake up to more cash flow.

Even if my dividends were only up ~$10 YOY, it’s important to celebrate the wins, even when they’re minor. And so I do.

Thank you for reading.

Full Disclosure: Long REI-UN, CSH-UN, AW-UN, ABBV, AAPL, MA, MSFT