We kick off the month with some great news. This post represents 200 blog posts on the Get Rich Brothers website!

My brother and I started this back in 2014 and it has been an interesting ride ever since. Meeting readers and connecting with other writers to share content and collaborate is what it’s all about. It’s a growth journey.

They say everyone should do something in life just for the joy of it, and that has been this blog. It’s gratifying knowing someone is out there reading it, and it’s also about just compiling a history for personal reasons. Doing something instead of nothing.

Table of Contents

Dividend Summary

September brought in income from 26 companies, 18 in CAD and 8 in USD. A healthy split for my purposes.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 23.49 | |

| Johnson & Johnson (JNJ) | 103.02 | |

| Corby Spirit and Wine Ltd. (CSW.B) | 10.50 | |

| Fortis, Inc. (FTS) | 110.18 | |

| Canadian Utilities Limited (CU) | 105.42 | |

| Canadian National Railway Company (CNR) | 35.55 | |

| Hydro One Ltd (H) | 77.06 | |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Metro Inc. (MRU) | 6.05 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 130.15 | |

| Brookfield Renewable Corporation (BEPC) | 59.37 | |

| Brookfield Asset Management (BAM) | 2.16 | |

| Brookfield Corporation (BN) | 2.08 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 41.40 | |

| Brookfield Infrastructure Corporation (BIPC) | 18.63 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 11.20 | |

| Enbridge Inc. (ENB) | 22.19 | |

| Saputo Inc. (SAP) | 5.55 | 2.78 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| Waste Management, Inc. (WM) | 29.75 |

| McDonald’s Corporation (MCD) | 27.14 |

| Yum! Brands, Inc. (YUM) | 20.06 |

| Yum China Holdings, Inc. (YUMC) | 4.31 |

| PepsiCo, Inc. (PEP) | 10.76 |

| Walmart Inc. (WMT) | 7.27 |

| Visa Inc. (V) | 5.74 |

| Microsoft Corporation (MSFT) | 7.52 |

Dividend Earnings Totals

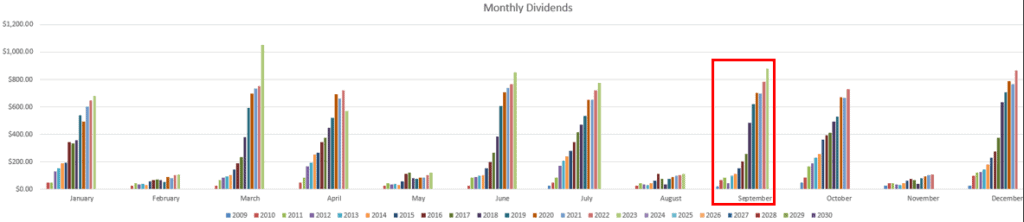

I raked in C$769.10 and U$112.55, coming together for a currency-neutral $881.65. This is by far the most I’ve ever earned in a September, setting an all-time record with a solid 12.74% bump over my September 2022 dividend totals.

I’ve said it before and I’ll said it again: Investing is all about percentage gains. It doesn’t matter how small the base you start with is; if you can sustain high percentage gains over the long-term, you’re going to be successful.

If you take a dollar and double your money each day, it takes less than a month to hit a million. Math is crazy when you set it loose.

Year To Date Progress

The cash flow tower stretches higher yet:

As we close out Q3, my dividend totals are firmly over $5k. The year should close out somewhere in the range of $7k:

| Month | Dividends ($) |

|---|---|

| January | 680.90 |

| February | 107.14 |

| March | 1,050.94 |

| April | 572.74 |

| May | 118.51 |

| June | 850.14 |

| July | 773.75 |

| August | 113.39 |

| September | 881.65 |

| Total | 5,149.16 |

Market Activity and Cash

I made no investments in September. It was a month of waiting and allowing cash to accumulate. I’ll be back in the market at least twice more before the end of the year, I suspect.

All the same, we could do for a nice correction to make the market more appetizing. Some of this will depend on the direction of interest rates, and the rest on the mania of markets.

Conclusion

The real treat this month is crossing the 200-post threshold. Doing something—anything—consistently in life is worth taking note of. I’m proud to have contributed over such a long period and to have compiled a compendium of my thoughts on investing in life.

Here’s to another 200.

Full Disclosure: REI-UN, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, V, MSFT