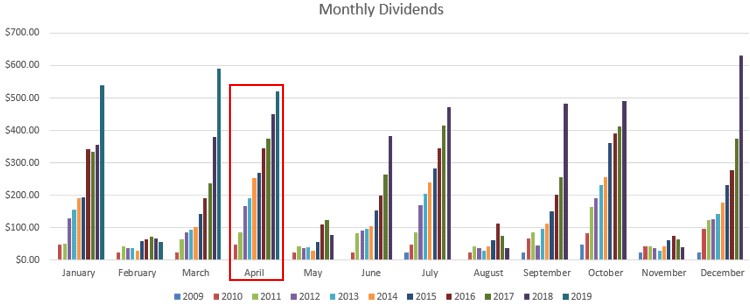

The rainy month of the year tends to bring with it healthy dividend totals, and this April was certainly no exception. Getting five hundred reasons to invest in dividend paying companies is enough for me to remain on track.

I also managed to add to one of my core holdings this month at a somewhat reasonable valuation.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Increase (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 59.20 | 10.45 |

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 | |

| The Coca-Cola Company (KO) | 71.02 | 2.56 |

| BCE Inc. (BCE) | 174.35 | 4.97 |

| Canadian Imperial Bank of Commerce (CM) | 16.80 | 2.94 |

| Bank of Nova Scotia (BNS) | 87.00 | 2.35 |

| TELUS Corporation (T) | 38.15 | |

| Rogers Communications Inc. (RCI.B) | 27.50 | 4.17 |

| Canadian Pacific Railway Limited (CP) | 3.90 | |

| Chartwell Retirement Residence (CSH.UN) | 5.00 | 2.04 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| Walmart Inc. (WMT) | 6.76 |

Dividend Summary

April saw totals of C$514.24 and U$6.76. This means I was able to once again earn the better part of a thousand dollars with a currency-neutral total of $521.00. This exceeds last April’s total by $70.99:

Quite a few of my companies rang the cash register with higher totals based on the modest, previously announced dividend raises. It always feels great to be making steady progress forward at a rate that exceeds inflation as this is how wealth is generated in real terms.

Market Activity

I made a single stock purchase in April which came from accumulated dividends which had been sitting idle in my trading account.

I added to my position in T with 20 more shares for a total cost of $999.95. This should bring in $11.25 quarterly or $45.00 annually based on the current quarterly dividend of $0.5625. I feel I paid a bit too much for the shares, but I wanted to keep the forward progress going. Further, from a business standpoint, I believe that T has huge opportunities in healthcare which are rarely discussed.

Since T is a telecom, most analysis focuses on the wireless business (which, of course, is a huge part of what the company does) while missing the opportunity for offering Electronic Medical Record (EMR) solutions. Canada is years behind other countries such as the U.S. when it comes to developing digital solutions to previous/current paper health records and so the opportunity to get in at this time is considerable. Further, T is able to leverage its strong brand name when entering into negotiations to earn contracts.

I see a long runway for growth with T both on the telecom side and within the healthcare field. As a result, I am okay with “paying up” a bit for the shares when I know that I fully plan to be with the company for decades to come.

Cash

I remain comfortable sitting on a 3% interest rate with my sidelined cash. I would optimally be deploying more than I am into stocks, but I am doing the best I can to be patient as prices don’t seem to be budging downward at the moment in any meaningful way. Perhaps all of this tariff talk between the U.S. and China will yield some opportunities.

Conclusion

April was a solid month for the portfolio. I was once again able to bring in over $500 for the third time this year, whereas I was only able to do so once in 2018. This appears to be the new normal for my portfolio (excluding the Feb-May-Aug-Nov payment schedule) and is now beginning to really get the dividend reinvestment snowball churning.

Adding to my position in T is a move I feel good about based on it being on the proper curve if where business and healthcare are headed in the years to come.

Full Disclosure: Long TD, REI.UN, KO, BCE, CM, BNS, T, RCI.B, CP, CSH.UN, WMT

Big numbers coming in. That’s for sure. Congratulations, crossing the $500 barrier still lies a couple of years ahead for me. I like your positions in BCE and Telus. At this time I only own BNS as a Canadian company but would love to buy BCE, Telus, the Toronto Dominion Bank and maybe Canadian Utilities.

Feel free to give me some advice. I would love that. ?

Hey DC,

Most from the U.S. focus on the Canadian Banks or Telecoms. They’re are the big players in Canada from an international perspective. I’ve built a sizeable position in Canadian Utilities as you mention, but truly it isn’t about a single investment. What will really serve you well is to spend less than you make and invest the difference. Be consistent and stick with it for the long haul. That is what really matters.

What is important to remember is that real investing is about the long game. You’ll make mistakes along the way, but if you stick with it, those will get washed out by your bigger wins. Don’t shy away from the game. Be in it for the marathon.

Take care,

Ryan

Nice month Ryan! I love the large Canadian Bank holdings! It is a sector I need to start investing heavier in, especially since the Big 6 are such strong holdings. Keep up the great work!

Bert

Hey Bert,

Yeah, the Big 6 in Canada are huge. It’s such a different financial system from what you’ve got down South. We have a few large players that ultimately dominate the market in a controlled oligopoly. I own three of them and am happy to be part of the action.

Take care,

Ryan

nice Ryan

solid income right there. Bce throws down a stack for you!

It may be one of my next buys.

keep it up man got to love those totals.

cheers

Hey Rob,

Yeah, BCE is one of my largest positions. I have no intention of adding to it any time soon in my portfolio since I’m already overweight Telecoms (and BCE, particularly), but I believe it is a great Canadian staple. One of the last things people will cut is their cell phone, right?

Take care, brother,

Ryan

Very solid month. That BCE dividend is wow.

Doug recently posted…MAIN Dividend increase

Hey Doug,

Yeah, BCE has been my biggest dividend payer in the portfolio for quite some time. I love seeing the ~5% annual dividend raises keep lifting it closer to $200!

Take care,

Ryan