My portfolio is weighted toward receiving lower levels of dividend income in August than it sees in most other months. Still, I received a nice payment from one of my recent additions which bolsters the overall totals.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 |

| Chartwell Retirement Residence (CSH.UN) | 5.00 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 40.02 |

Dividend Summary

I received C$36.32 and U$40.02 which brings me to a currency-neutral total of $76.34. This is identical to my totals from May. Since I haven’t added to positions which pay on this monthly or quarterly schedule, this comes as no surprise.

I have been eyeing another purchase of ABBV since the market has dragged it down over the impending Allergan (AGN) acquisition. My current cost basis is in the $83-84 range and so it would be possible to considerably average down on the stock since it has been trading in the $60s for around a month. The dividend has held steady and so lower prices mean a higher entry yield. I haven’t yet made my mind up on how to proceed; on one hand I would love to up my stake while on the other I am cautious of catching a falling knife.

My investment philosophy is generally to double down when the market offers an opportunity (after all, if you liked a stock at a higher price, you should be excited at the chance to buy more at a lower cost). However, the AGN situation changes the game as far as increasing the debt load and introducing execution risk on the part of management. I will nevertheless keep a close watch on the situation.

I would also note that at the time of writing, ABBV has just presented at the Morgan Stanley Healthcare Conference and it was indicated by the CEO, Rick Gonzalez, that ABBV has no exposure to opioid litigation (the unit responsible for the production of OxyContin within Abbott Laboratories (ABT) was entirely separate from the proprietary pharmaceutical business which became ABBV). Further, Rob Michael, CFO, indicated that the company feels very strongly that it will be able to continue with its history of strong dividend increases going forward based on post-AGN acquisition cash flows.

Year To Date Progress

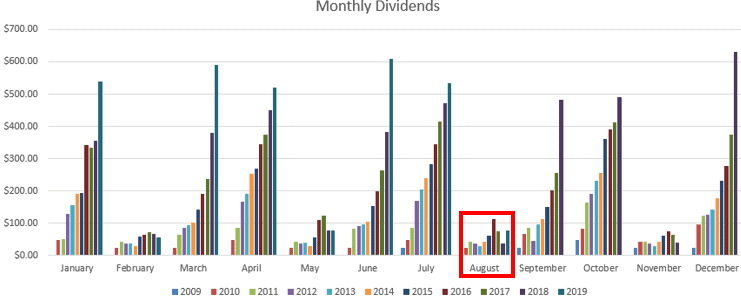

Here’s a quick view of how the portfolio has been growing in dividend-terms over the past decade or so:

| Month | Dividends ($) |

|---|---|

| January | 540.02 |

| February | 54.41 |

| March | 591.07 |

| April | 521.00 |

| May | 76.34 |

| June | 608.09 |

| July | 533.85 |

| August | 76.34 |

| Total | 3,001.12 |

As we cap off two-thirds of 2019, I’ve managed to tip the dividend scales at just over $3,000. This leaves me in a great position to blow through 2018’s full-year sum of $3,752.39 (and $4,306.92 if including interest).

Market Activity

I have been sitting idly over the past month and just accumulating cash. I hate to see a month go by without any stock market purchases, but patience is an important trait as an investor. Making a purchase just to have something to write about would be imprudent. Still, I have been regularly following the daily market gyrations in hopes of an appetizing deal.

Cash

I received a new bonus interest offer from my online bank. They have upped the interest for me to 2.75% until the end of January 2020. While sitting in cash is never my overall goal as I would prefer to be putting most excess capital into stocks, the increased interest does help in the meantime.

Conclusion

I have decisions to make around whether to increase my ABBV position. The company is positioning itself for future revenues, but they have plenty to prove in the interim as far as getting through this acquisition effectively.

I remain well-situated from a cash balance perspective. Should the market offer up a lob of a pitch, I won’t hesitate to capitalize.

Full Disclosure: Long REI.UN, CSH.UN, ABBV

looks like this is the slow month for you the others seem to be rolling along but thats ok. this month will get rolling eventually. Hope you bought some abbv with that price going up a bit.

Doug recently posted…2 Dividend Raises This Week.

Hey Doug,

I was actually away a few days and didn’t wind up getting any ABBV. Should have simply taken action rather than sitting on it, I suppose. Oh well, I figure another opportunity will present itself, whether sooner or later.

Take care,

Ryan