August is a beautiful month. It’s that last breath of Summer before the leaves turn.

For the first time in a long time, I took a vacation during the warm months; I typically save my extended time off for the snowy season.

Table of Contents

Dividend Summary

I earned dividends from six companies, split equally between Canada and the US.

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 22.19 |

| Chartwell Retirement Residence (CSH.UN) | 5.10 |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.20 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 63.45 |

| Mastercard Incorporated (MA) | 2.92 |

| Apple Inc. (AAPL) | 3.45 |

My dividend sums came in at C$33.49 and U$69.82, combining for a currency-neutral $103.31. Being that this is one of my slow months, it’s at least nice to see it cross into the triple digits.

Compared to August 2021, my dividend income tracked higher at a rate of 9.44%.

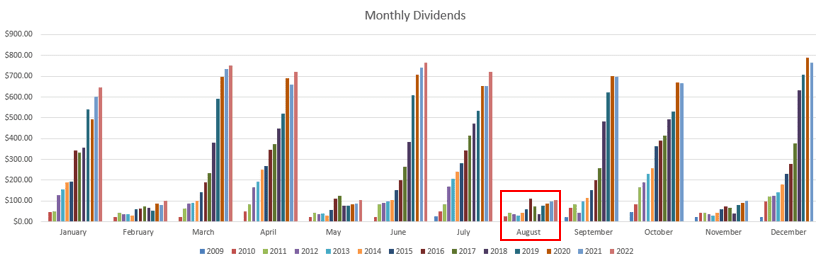

As usual, the main thing is seeing that progress on the dividend growth chart:

After a while, it’s like the bars on that chart begin to grow themselves. As dividends are organically reinvested, the ascent picks up pace.

Year To Date Progress

With eight months in the books, I’m just shy of a solid $4,000 in dividend income:

| Month | Dividends ($) |

|---|---|

| January | 645.55 |

| February | 101.85 |

| March | 750.44 |

| April | 720.76 |

| May | 103.31 |

| June | 765.11 |

| July | 721.84 |

| August | 103.31 |

| Total | 3,912.17 |

Three out of four of the remaining months are going to be big earners. That, coupled with further investment along the way, means I’m virtually assured to cross the $6k mark by the end of the year.

Market Activity and Cash

Banks have finally begun raising their interest rates for parked cash materially. After years of incredibly low rates, it’s finally possible to earn something of a return on idle dollars.

All the same, I did make a relatively small purchase of 13 shares of Brookfield Infrastructure Corporation (BIPC).

I already hold a stake in the company and was simply looking to deepen the relationship. With a dividend yield of ~3%, I figured this was a solid way to put my capital to work.

BIPC has easy access to capital and a proven track record of executing in large-scale infrastructure plays (e.g., pipelines, data centers), meaning they’re positioned to continue thriving as the global landscape evolves. I’d be happy to continue investing in this space.

Vacation in Europe

Around a year ago, a friend indicated he’d be getting married in Lake Como, Italy. This turned out to be the perfect occasion for building a larger trip around this stopover.

The final tour took twelve days. The main destination points were as follows, beginning in Switzerland and finishing in Italy:

- Geneva

- Milan

- Lake Como

- Venice

- Florence

- Rome

I’m still in the process of filtering through all of the photos. I’ll include some in a subsequent update.

Conclusion

I’ve continued making steady progress toward my financial goals. The ultimate plan of generating a meaningful stream of passive income via high quality dividend paying stocks remains firmly in place. It’s the bedrock around which everything else in my financial life is built.

I was fortunate in August to be able to take nearly two weeks and enjoy a wonderful holiday in Europe. There was plenty of time there to really just sit back and soak it all in.

I hope you’re also making the most of your Summer.

Life is a beautiful thing, and there’s so much to enjoy.

Full Disclosure: Long REI-UN, CSH-UN, AW-UN, ABBV, MA, AAPL, BIPC