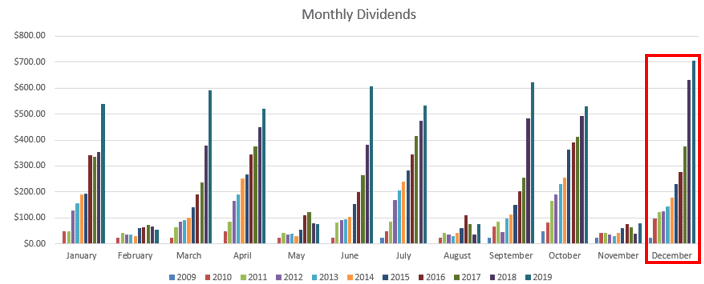

The December Portfolio Update has to be my favourite. The dividends are the highest for my portfolio and it’s that time of year where it just makes sense to take a moment to reflect on the year that was.

I hope you’ll enjoy reading as I extend my heartfelt holiday salutations to you and your family.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Increase (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 | |

| The Coca-Cola Company (KO) | 70.07 | |

| Johnson & Johnson (JNJ) | 79.76 | |

| Corby Spirit and Wine Ltd. (CSW.B) | 66.00 | |

| Fortis, Inc. (FTS) | 76.40 | 6.11 |

| Canadian Utilities Limited (CU) | 84.54 | |

| Canadian National Railway Company (CNR) | 18.81 | |

| Hydro One Ltd (H) | 62.79 | |

| Chartwell Retirement Residences (CSH.UN) | 5.00 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 130.03 | |

| Brookfield Asset Management (BAM.A) | 3.16 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 13.36 |

USD Dividends

| Company | USD Payments ($) | Div Increase (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 21.79 | |

| McDonald’s Corporation (MCD) | 22.32 | |

| Yum! Brands, Inc. (YUM) | 13.93 | |

| Yum China Holdings, Inc. (YUMC) | 3.98 | |

| Visa Inc. (V) | 2.55 | 20.00 |

Dividend Summary

I raked in C$641.24 and U$64.57, amounting to a currency-neutral total of $705.81. This is the first time I’ve crossed the $7xx barrier and I have to say it feels good to write. It seems like these psychological milestones continue to come with increasing frequency, though that does make sense given the dividend snowball tends to roll ever-faster as it goes along.

Looking at the list of companies and their payments, one thing that stands out for me is how robust and diversified my income stream has become. I’m not as top-heavy with names such as BCE or REI.UN anymore; other companies have grown in the ranks to likewise contribute sizeable amounts to my dividend income. This is important as it will also insulate me should there be any disruption from the heavy hitters.

I comfortably topped the December 2018 total by over $70:

Year To Date Progress

A great year for the portfolio. It’s remarkable to be closing in on $5k:

| Month | Dividends ($) |

|---|---|

| January | 540.02 |

| February | 54.41 |

| March | 591.07 |

| April | 521.00 |

| May | 76.34 |

| June | 608.09 |

| July | 533.85 |

| August | 76.34 |

| September | 621.73 |

| October | 530.64 |

| November | 80.34 |

| December | 705.81 |

| Total | 4,939.64 |

I’ve come in with well over $1,000 in gains from last year with this 2019 dividend total of $4,939.64.

Market Activity

Although I have been looking simply to consolidate my holdings and add to pre-existing positions as capital has availed itself, I actually opened two new positions in December.

I first picked up 40 shares of A&W Revenue Royalties Income Funds (AW.UN) for a cash outlay of C$1,569.55. On the current distribution of C$0.159 monthly, this should kick off C$19.08 monthly or C$76.32 annually.

My second purchase was for 25 shares of Enbridge Inc. (ENB) for C$1,303.95. With the current dividend of C$0.81 quarterly (recently bumped to this amount by 9.76%), I am expecting C$20.25 quarterly or C$81.00 annually.

Taken in aggregate, these two purchases total C$2,873.50 invested and represent forward income of C$157.32 through 2020.

Cash

I continue earning 2.75% in interest as a promotional rate on idle cash. This rate extends to the end of January 2020 and so I will soon need to either renegotiate my interest rate or move elsewhere.

Conclusion

This was a very strong finish to the year. Crossing new thresholds is important to both keep the momentum and feel a sense of progress.

Earning over $700 in a single month without needing to lift a finger is incredible. It has me looking forward to the year to come and planning my next investments to drive the total even higher.

Thank you for reading.

– Ryan

Full Disclosure: Long REI.UN, KO, JNJ, CSW.B, FTS, CU, CNR, H, CSH.UN, BEP, BAM.A, BIP.UN, WM, MCD, YUM, YUMC, and V.

I’m not a dividend investor but anyone with significant stock exposure is going to generate dividend income. In our case we had a record month going over $10,000 for the first time ever for one month in dividends from 124 companies. We never take the dividends as income because my one day a week consulting pays all the bills but that reinvestment really adds up over time. I think you are headed for continued and increasing great success. As an older reader I can attest that wealth really snowballs as your time in the market increases. It seemed like it took forever to get to $100k in assets but much less time to go from one million to two.

Hi Steve,

Yes, with significant stock exposure, there is the higher likelihood of generating dividend income. However, there are plenty of non-dividend payers, so the investor must still take a deeper dive as far as what they are expecting from the stocks they own.

It sounds like you had a great month, crossing $10k. Congrats on that! Looking forward to seeing the same, myself.

Take care,

Ryan