It’s the most wonderful time of the year, right? Yes, it is.

There’s nothing like those sweet Christmas Dividends rolling in as companies finish off the year strong. Naughty or nice doesn’t make a difference when it comes to dividends. You just get paid based on how many shares you own.

Table of Contents

Dividend Summary

I earned income from seventeen Canadian companies and six from the US. Twenty-three sources of income provides plenty of stability for my portfolio.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 20.88 | |

| The Coca-Cola Company (KO) | 71.72 | |

| Johnson & Johnson (JNJ) | 85.84 | |

| Corby Spirit and Wine Ltd. (CSW.B) | 12.00 | 14.30 |

| Fortis, Inc. (FTS) | 96.30 | 5.94 |

| Canadian Utilities Limited (CU) | 103.35 | |

| Canadian National Railway Company (CNR) | 27.68 | |

| Hydro One Ltd (H) | 69.24 | |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 110.74 | |

| Brookfield Renewable Corporation (BEPC) | 27.20 | |

| Brookfield Asset Management (BAM.A) | 3.67 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 13.05 | |

| Brookfield Infrastructure Corporation (BIPC) | 1.30 | |

| A&W Revenue Royalties Income Fund (AW.UN)* | 8.20 | |

| Enbridge Inc. (ENB) | 20.88 | |

| Saputo Inc. (SAP) | 5.40 |

USD Dividends

| Company | USD Payments ($) | Dividend Change (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 24.44 | |

| McDonald’s Corporation (MCD) | 24.64 | 6.98 |

| Yum! Brands, Inc. (YUM) | 16.58 | |

| Yum China Holdings, Inc. (YUMC) | 3.98 | |

| Visa Inc. (V) | 4.79 | 17.19 |

| Microsoft Corporation (MSFT) | 6.86 | 10.71 |

I brought in C$682.55 and U$81.29, combining for a currency-neutral $763.84. As always, this income will be used purely for reinvestment. That’s how we grow the snowball.

* The AW-UN payment includes a special cash distribution of $2.00.

Standouts

What I find particularly encouraging from the tables above is the double-digit dividend raises. This is a great sign of strength from a diverse group of companies. It shows that they feel confident despite the relative uncertainty in the global operating environment.

Reading back through my December 2020 Portfolio Update, the major theme was companies restoring their dividends. When pandemic lockdowns cratered the world economy in March 2020, dividends were sometimes casualties of war. Looking at things this year, it is clear that companies have learned to navigate the waters.

This gives me plenty of optimism for the year to come.

Year To Date Progress

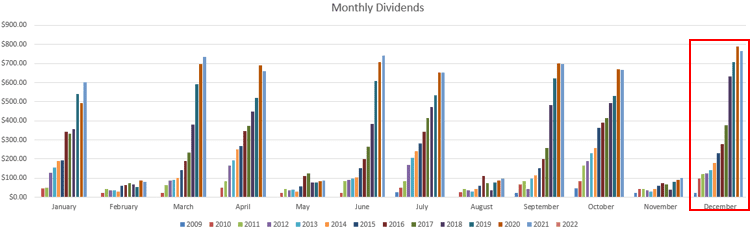

My December dividends were slightly below those from 2020 as I repositioned some of my holdings earlier this year. Specifically, I sold some Corby stock to make a Tax Free Savings Account (TFSA) withdrawal. This was due to an overcontribution to my TFSA that I needed to remedy.

Since I didn’t rebuy that stock with the capital once I removed it, it dealt a hit to my income in this period.

All the same, my December 2021 income is my second highest single-month ever:

I finished the year with $5,892.59 in dividend income:

| Month | Dividends ($) |

|---|---|

| January | 602.95 |

| February | 81.22 |

| March | 736.16 |

| April | 659.56 |

| May | 85.92 |

| June | 739.71 |

| July | 652.45 |

| August | 96.40 |

| September | 697.46 |

| October | 665.62 |

| November | 101.60 |

| December | 763.84 |

| Total | 5,892.59 |

I mentioned in my October Portfolio Update that my $6,000 target for total passive income might be out of reach. As it turns out, I am going to come in just over that, which I’ll cover in my Annual Update article.

$6,000 over twelve months comes out to $500 monthly—a nice, clean number. It reminds me that I wrote back in 2015 about how you can build your own pension plan with dividend income. This is the evidence that it’s actually possible. It just takes time and steady progress.

My December Reset

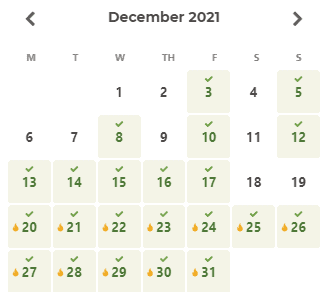

Each year, I enjoy taking an extended holiday through late December and into the early new-year. This vacation reached from December 16 to January 3, inclusively.

I view this as a period to rebalance and take stock both of what has been and what is to come. I devote it entirely to family, friends, reading, writing, and general relaxation.

One of my great joys this year has been to revisit my love of chess. My favourite way to play is Bullet 1/0, which means each player gets one minute for the entire game. It’s fast-paced and requires intuitive decision making.

I also enjoy solving puzzles and have been on a 14-day Daily Puzzle streak:

It has been a great way to get up each morning with something to look forward to.

In life, we should all have something we do just for the enjoyment of it. Doing something for its own sake is important for our sense of creativity, wonder, and fulfillment.

Omicron, Inflation, and Other Macro Concerns

I have spent very little time this month thinking about the macro concerns going on around the world. Perhaps it’s just me, but it seems the media has been demonstrating a shockingly low level of ingenuity in reporting, of late.

If you watched any of these newscasts without the date on display, you wouldn’t be able to tell which month it was from over the past year-and-a-half. More reports of confirmed cases, hospitalizations, and worst-case scenarios. Plenty of fear-mongering, a dearth of rational discourse.

One thing I haven’t done and don’t intend to do, is invest based on what is a good reopening play, which is something I keep hearing. I cannot be bothered to be jumping in and out of investments/trades, trying to time short-term events. That’s a poor game to play.

My overall strategy remains unchanged. I will invest in high-quality businesses that have long-term staying power. This doesn’t change depending on the current COVID Variant of Concern, political landscape, or inflationary environment.

The broad strokes of what is going on in society will always be changing. People, however, will always be people.

I invest based on that.

Market Activity and Cash

I continue to largely stockpile cash in hopes of a market pullback. Prices remain elevated. If sizeable opportunities arise, I’ll be ready to pull the trigger without delay.

My only stock activity this month pertains to U$2,276.43 worth of Block, Inc. (SQ) (recently renamed from “Square, Inc.”) that I acquired. The company operates in the financial services sector, facilitating payment solutions between buyers and sellers. It does not pay a dividend.

CEO Jack Dorsey recently stepped down from Twitter (TWTR), where he was also CEO. I like that he is now focusing more of his energy on SQ and that the company will now be zeroing in on blockchain developments. It isn’t clear who the overall winners will be in this space, but laying the groundwork now will be pivotal. First-mover advantage matters.

Conclusion

I had an amazing December period from a personal perspective. Plenty of rest, relaxation, and merriment.

From a financial perspective, I let my already-established portfolio do the heavy lifting. While I was sipping eggnog, hundreds of dollars kept pouring into my account. I can think of no better investing formula.

And now, a heavy snowfall is making its way through the air as I finish writing. It is quite beautiful.

– Ryan

Full Disclosure: REI-UN, KO, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, V, MSFT