December may be my favourite month of the year. It’s the culmination of the rest of the year, rolled into a celebration and also a time to slow things down.

Over the past few years, I’ve taken around 2.5 weeks off in December. I did the same this time around, and just spent the time relaxing and with family. There’s nothing better than having time to reflect and enjoy while the days are darker and the weather colder.

Table of Contents

Dividend Summary

As tends to be the case, December was a great month on the dividend front. I earned income in CAD from 18 companies, with another 6 being paid in USD.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 23.49 | |

| The Coca-Cola Company (KO) | 81.93 | |

| Johnson & Johnson (JNJ) | 102.27 | |

| Corby Spirit and Wine Ltd. (CSW.B) | 10.50 | |

| Fortis, Inc. (FTS) | 115.05 | 4.42 |

| Canadian Utilities Limited (CU) | 105.42 | |

| Canadian National Railway Company (CNR) | 35.55 | |

| Hydro One Ltd (H) | 77.06 | |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 130.64 | |

| Brookfield Renewable Corporation (BEPC) | 59.59 | |

| Brookfield Asset Management (BAM) | 2.14 | |

| Brookfield Corporation (BN) | 2.06 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 75.33 | |

| Brookfield Infrastructure Corporation (BIPC) | 18.70 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 11.20 | |

| Enbridge Inc. (ENB) | 22.19 | |

| Saputo Inc. (SAP) | 5.55 |

USD Dividends

| Company | USD Payments ($) | Dividend Change (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 29.75 | |

| McDonald’s Corporation (MCD) | 29.81 | 9.78 |

| Yum! Brands, Inc. (YUM) | 20.06 | |

| Yum China Holdings, Inc. (YUMC) | 4.31 | |

| Visa Inc. (V) | 6.63 | 15.56 |

| Microsoft Corporation (MSFT) | 8.29 | 10.29 |

Dividend Earnings Totals

I collected C$883.77 and U$98.85, coming together for a currency-neutral total of $982.62. Sitting right on the four-figure threshold, this is the second highest dividend figure I’ve ever received, only behind March 2023 where some April dividends were paid early.

In comparison to my December 2022 dividend income, I’ve made a healthy 13.54% bounce. This is higher than I had been expecting.

In other words, this is truly the best dividend month on record for my portfolio. It was well-supported by the huge dividend increases listed above by MCD, V, and MSFT. Even on small bases, the growth really stacks up when the increases are in the double-digit range.

Year To Date Progress

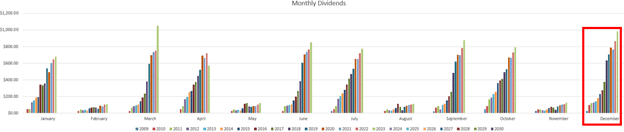

That green bar for December 2023 stretches ever-higher:

I crossed my full-year target of $7k:

| Month | Dividends ($) |

|---|---|

| January | 680.90 |

| February | 107.14 |

| March | 1,050.94 |

| April | 572.74 |

| May | 118.51 |

| June | 850.14 |

| July | 773.75 |

| August | 113.39 |

| September | 881.65 |

| October | 795.17 |

| November | 124.54 |

| December | 982.62 |

| Total | 7,051.49 |

This has been a long time coming and sets the stage for a great 2024.

Market Activity and Cash

I made no stock purchases in December. It was mostly a month of enjoying time at home, and I truly did not give much thought to investments.

That’s the beauty of the dividend growth investing strategy. Even without continual monitoring, you can reap the rewards of prior energy spent. Once a solid portfolio is in place, a lot of it comes down to selective reinvestment (or passive DRiP) and just enjoying life as it comes.

Conclusion

It’s hard to believe my portfolio is now kicking off $7k annually. I remember when I made $24.40 for my first dividend payment back in 2009 and it seemed like a pipe dream that the income would ever be substantial.

Now annual dividend income is enough to cover many staple expenses such as groceries and utilities, if I so desired. Instead, I continue to reinvest.

Let’s see where we can get to next year.

Full Disclosure: REI-UN, KO, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, V, MSFT