The month of the groundhog brings with it low dividend totals once more, but plenty of positive developments cooking in the oven. Chief among them is a planned excursion to the Woodstock of Capitalism.

All the same, let’s take a look at the income received through the month.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 |

| Chartwell Retirement Residence (CSH.UN) | 4.90 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 18.19 |

Dividend Summary

February has history been my slowest month of the year and this month past proves to be the rule rather than any exception; I brought in C$36.32 and U$18.19 which brings my total to $54.41 in currency-neutral terms.

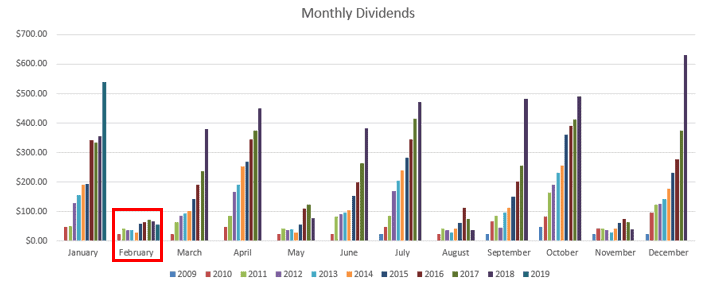

February was exceptionally slow this on a year-over-year comparison due to the loss of cash flow from Jean Coutu which was merged into Metro Inc. (MRU) during 2018. Accordingly, my chart of monthly dividends demonstrates that this is my lowest February since 2014:

Having said this, I am excited about the inclusion of ABBV in my dividend tally for the first time. I made my first purchase of the stock back in November (at which point I also provided my thesis for initiating a position) and then averaged down with it once more in January when the stock took a beating. I believe this is a well-managed biopharmaceutical which has the potential to continue driving its dividend for years to come.

Speaking broadly, I believe the healthcare sector is one with tremendous potential when looking out decades. The populace continues to rely on medical intervention to treat virtually any ailment, lifespans continue to increase, and I foresee no way that these trends will actually halt any time soon.

Market Activity

I did not make any stock purchases in the month of February. I’ve been eyeing the Canadian banks as they had a challenging quarter as a group and have been showing some price weakness. If Toronto-Dominion Bank (TD) should dip back into the $60s as it did recently, I could see myself being tempted to pull the trigger.

I originally opened my position with TD way back in May 2009–it has actually almost been a decade of ownership in the company–and haven’t added to it since that time. I’ve simply enjoyed my position tripling in value as the dividend payment doubled. I’ve also had over 70% of my purchase returned to me passively by way of the quarterly dividends. Needless to say, it has been a fantastic investment and one I would enjoy adding to at the right price. This may be the month of the market prices it generously.

Cash

I am again stockpiling cash at a rate of return of 3% in my high-interest savings account. While it’s a wise saying that “nobody has ever gotten rich holding cash”, that doesn’t change the fact that having a healthy cushion is prudent in any market environment.

Omaha Bound

I previously announced that my brother and I would be making the trek to Omaha in May to attend the Berkshire Hathaway (BRK.B) annual shareholder meeting. We have since then booked our flight and hotel and so are officially going. We’re expecting to have a great time as we plan to be there just short of a week in order to take in the sights and have a relaxed schedule to explore the area.

I’m planning to keep track of the process for going and intend to provide a more substantive update article at some point along the way.

Conclusion

February was again a slow month but shows promise for future growth with my purchase of ABBV late last year and once more in January. It will be good to round out my dividend payments rather than having such a gap on my quarterly payment schedule.

Full Disclosure: Long TD, REI.UN, CSH.UN, ABBV, BRK.B

haha nice Ryan

love the addition of abbvie. This was my first payment from them as well. I agree healthcare should do very well in the future.

very cool about omaha too!

td is solid, one of my largest holdings.

keep it up Ryan

cheers!

Hey Rob,

Yeah, ABBV is an addition to the portfolio I’m pretty pumped about. Doubling down on healthcare is a smart play, I think, and it won’t be the last to make it into the portfolio. Great sector in general with plenty of tailwinds.

I’m semi-kicking myself for not grabbing more TD in December when it was around $67-$68, but the dip happened quick. Hoping for some more opportunities this year, though.

Ryan

Slow or fast month, love the results. The addition of ABBV is nice and I received my first dividend from them as well. Congrats on booking your trip to Omaha. That will be quite the memorable trip for you. Can’t wait to read your thoughts and summary about it all.

Bert

Hey Bert,

Yeah, a lot of things going on even on this slow month. Still waiting to receive my proxy materials for the BRK event, but worst case scenario it’s possible to take care of that on site in Omaha, from what I’ve read. I’m definitely planning to put together a post or two specifically in relation to the trip (including the costs of making the trek).

Take care,

Ryan