I kicked off my Five Year Plan in August 2015 at a time when I wanted to set some targets and provide more actual guidance around how my stock portfolio was developing. I wanted to chart a course so I would have something to aim for along the way as I put money aside to invest.

Since that time, my portfolio has continued to blossom, growing to 33 companies owned, 31 of which provide regular cash flow in the form of dividend or distributions.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Increase (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 231.20 | 10.45 |

| RioCan Real Estate Investment Trust (REI.UN) | 375.84 | |

| The Coca-Cola Company (KO) | 281.06 | 2.56 |

| Johnson & Johnson (JNJ) | 315.69 | 5.56 |

| BCE Inc. (BCE) | 689.15 | 4.97 |

| Canadian Imperial Bank of Commerce (CM) | 67.20 | 5.88 |

| Corby Spirit and Wine Ltd. (CSW.B) | 319.00 | Special Div in January |

| Bank of Nova Scotia (BNS) | 349.00 | 5.88 |

| TELUS Corporation (T) | 177.56 | 7.14 |

| Rogers Communications Inc. (RCI.B) | 108.90 | 4.17 |

| Fortis, Inc. (FTS) | 292.40 | 6.11 |

| Canadian Utilities Limited (CU) | 338.16 | 7.48 |

| Canadian National Railway Company (CNR) | 42.99 | 18.13 |

| Canadian Pacific Railway Limited (CP) | 17.76 | 27.69 |

| Hydro One Ltd (H) | 248.17 | 5.00 |

| Chartwell Retirement Residences (CSH.UN) | 59.70 | 2.04 |

| Metro Inc. (MRU) | 16.00 | 11.11 |

| Brookfield Renewable Partners L.P. (BEP.UN) | 521.34 | 5.10 |

| Brookfield Asset Management (BAM.A) | 6.34 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 26.72 |

USD Dividends

| Company | USD Payments ($) | Div Increase (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 87.16 | 10.22 |

| McDonald’s Corporation (MCD) | 84.45 | 7.76 |

| Yum! Brands, Inc. (YUM) | 55.72 | 16.67 |

| Yum China Holdings, Inc. (YUMC) | 15.92 | |

| PepsiCo, Inc. (PEP) | 30.63 | 2.96 |

| Walmart Inc. (WMT) | 26.91 | 1.92 |

| Visa Inc. (V) | 8.94 | 20.00 |

| AbbVie Inc. (ABBV) | 138.25 | 11.46 |

| The Walt Disney Company (DIS) | 7.48 |

Five Year Plan Passive Income Targets

This year brought in totals of C$4,484.18 and U$455.46, rounding out to a currency neutral sum of $4,939.64. I also earned $475.46 in interest this year, bringing my total passive income for 2019 to $5,415.10.

Setting targets can be challenging; when I first set out on my Five Year Plan, I wanted to set some ambitious, yet reachable targets. What I didn’t anticipate is how fast I could accelerate my dividend growth over the coming years.

Adding the 2019 totals to my chart, it is plain to see that I have already blown through the final target of $5,100, which I was only planning to achieve through the full year of 2020:

| Year | Age | Target Annual (Div + Int) | Actual Annual (Div + Int) | Target Exceeded (%) |

|---|---|---|---|---|

| 2015 | 28 | 2,000 | 2,191.63 | 9.58 |

| 2016 | 29 | 2,500 | 2,713.16 | 8.53 |

| 2017 | 30 | 3,100 | 3,341.80 | 7.80 |

| 2018 | 31 | 3,700 | 4,301.71 | 16.26 |

| 2019 | 32 | 4,400 | 5,415.10 | 23.07 |

| 2020 | 33 | 5,100 |

An annual income of $5,400 equates $450 on a monthly basis. This is a stimulating mark to be striking as it feels very much like a modest pension already rolling into my coffers. I am, of course, reinvesting all of these proceeds back into high quality cash flowing stocks, as that is the surest way to get the compounding effect flowing.

It is worth mentioning that I did receive a special dividend from CSW.B for C$101.20 in January, so that does inflate the totals slightly since this isn’t something that can be depended on each year; since purchasing the company in December 2014, I’ve only received one other special dividend which came back in January 2016. Still, the company has no debt and effectively plans to function in the manner of maintaining a healthy regular dividend and throwing off excess profits to shareholders. I’m glad to be along for that ride.

At this point, I feel it is fair to say the Five Year Plan (which took around four years) has been a remarkable success. The most sensible course at this point is to take some time to reevaluate; I enjoyed establishing the Five Year Plan from the outset and will likely start a new one, with fresh targets, over the coming days.

Market Activity

One of my most important goals I’ve set and stuck to over the past few years has been a recommitment to regular investing. As a novice investor, I always wanted to save up at least a few thousand dollars before purchasing a company (albeit the commissions were higher back then, as they’ve dropped from $30 to $10 at most discount brokers in Canada), though I have found it is nice to nibble with some starter positions and average down where possible.

I stuck to this theme of increasing my investing cadence by purchasing stocks eleven times in ten different companies over the course of 2019:

| Company | Total Cost ($) |

|---|---|

| CSW.B | 1,094.95 |

| T | 999.95 |

| CNR (bought twice) | 2,306.90 |

| CP | 1,119.59 |

| ABBV | 1,929.95 USD |

| DIS | 1,353.24 USD |

| BAM.A | 969.50 |

| BIP.UN | 1,129.95 |

| A&W Revenue Royalties Income Fund (AW.UN) | 1,569.55 |

| Enbridge Inc. (ENB) | 1,303.95 |

This comes to a final tally of $13,777.53 having been invested in currency-neutral terms. As I was going through the year, it didn’t feel I was investing so steadily, but in the final analysis I have to say I am satisfied with this.

The strength of dividend growth investing is that there is a constant influx of capital to be reinvested just by virtue of holding the stocks themselves. It takes some of the heavy lifting off of the investor who doesn’t need to only be adding fresh capital in order to make investments.

My investments in AW.UN and ENB were made only in December, which means they haven’t paid any dividends and will show up as accretive for the full year of 2020.

Savings Rate

I averaged just over 21% in terms of a savings rate for the year. I define this by the percentage of my income that I put toward investing (i.e., the amount I transfer out of chequing to my holding account for the purpose of eventual investment) in comparison to the amount earned from gainful employment.

One of the golden tenets of personal finance is that the higher one’s savings rate, the sooner one becomes financially free. The hard numbers don’t actually matter. A person’s financial fidelity is always measured by weighing their income in direct relation to their expenses; it matters not whether you earn a $1,000,000 annually if you’re spending $1,000,001. Getting ahead in the game of money necessitates developing the habit of putting money aside today with the expectation of compounding it further down the line.

If I was to set one marker for the period ahead, I feel targeting a 25% savings rate would be a worthwhile goal that would challenge me to meet. It would, of course, also mean greater growth on the investment side of the equation as I would be investing a greater portion of my disposable income.

My Portfolio Performance vs. Market Performance

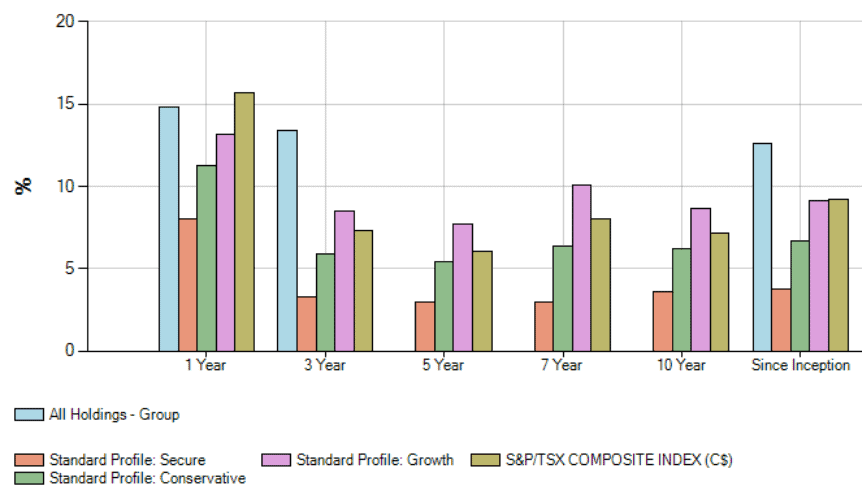

One of the most common endeavours in investing is to compare one’s performance against relevant benchmarks. As a Canadian primarily focused on investing in Canadian companies, the S&P/TSX Composite Index represents a decent comparison tool for my portfolio.

Within my discount brokerage account, the Performance section shows some basic data comparing my portfolio against their Secure, Conservative, and Growth Profiles, along with the S&P/TSX Composite Index. My overall portfolio is the “All Holdings – Group” (blue bar):

The data for “since inception” goes back probably to around 2015/2016 which is when I opened my account with this discount broker, so not necessarily all the way back to when I started investing. Since I don’t put much weight in benchmarking (my goal isn’t to beat the market, necessarily, but to meet my own financial/income needs, balanced against my willingness to accept risk), I review this simply for illustrative purposes. Nevertheless, it is good to know I haven’t caused any harm (and in fact have benefited) by managing my own investments rather than just passive investing in index funds or with a mutual fund manager.

End of the 2010s

Over the course of this decade—which incidentally also covered my first decade of investing in individual equities—I had the opportunity to grow along the way and gain a new perspective on both the financial arena and life itself.

One of my highlights of the 2010s was visiting Omaha with my brother this past May in order to hear from the Oracle of Omaha himself, Warren Buffett, and business partner Charlie Munger as they held court at the annual Berkshire Hathaway Annual Meeting.

From a standing start at the outset of my dividend growth journey, I read all about compound interest and how dividend growth takes time to accumulate before the real rewards start rolling in. My favourite example of this is TD, wherein from my first investment in May of 2009—during the heart of the financial crisis—I was able to double my dividend yield on cost and see now with my own eyes the value of patience and consistency.

During this time I was also fortunate enough to both purchase a new truck (2012) and pay it off (2018), leaving me now with a vehicle that is dependable and in great shape, by virtue of the care I’ve given it over the years. Within the personal finance space, many people say the worst financial decision a person can make is to buy a brand new vehicle because of the loss of value “as it drives off the lot”, but I can say now from personal experience that having a well-maintained one-owner vehicle has its perks as well; I’ve never had an issue or worry about this getting me from Point A to Point B in whatever weather the Canadian environment throws my way. There is a high likelihood I’ll still be driving this truck in another five years, as it is paid off and functioning perfectly.

Another huge bright spot within this decade was the creation of this website itself with my brother back in 2014. While we loved discussing personal finance and sharing our ideas with one another and those around us, it seemed like the perfect vehicle to likewise share that journey with the investing community. We’ve been fortunate to meet hundreds of people online, toss ideas around, and growth together along the way. The other benefit to posting things with such transparency is the accountability to oneself that goes along with it; knowing others will read about my investment decisions makes me less likely to treat the stock market like a casino and more likely to take a well-measured, thoughtful approach.

One of the standout lessons of the decade and perhaps one I am most proud of, has been a commitment to being what I call a net accumulator of assets. Over the course of the past decade, I have sold stocks on only eight occasions (once when I was forced as a result of Jean Coutu merging into MRU).

Six of the occasions I sold stock was when I was liquidating cannabis holdings near the top of the bubble when that was the big craze leading up to Canadian recreational legalization. I was fortunate to recognize some solid profits before the bottom seemed to really fall out of that market.

The only other sale within my portfolio was when I liquidated my holdings of Cedar Realty Trust, Inc. (CDR)—named “Cedar Shopping Centers” at the time—back in 2013 when I lost faith in the company after it had cut its dividend for the February 2012 payment and didn’t seem to be turning things around. Truly, I had gotten involved with the company as a form of piggy-backing on the partnership it had developed with REI.UN. I was a fan of REI.UN’s management team and decided to join them in their venture explicitly by purchasing my own stock, collecting some healthy dividends along the way. Suffice it to say that with the dividends and the sale of the stock itself, I made out with a small profit and a lesson about investing in a company for any reason other than its own fundamentals and prospects within its industry.

In terms of the decade itself, I am aware that we have witnessed a remarkable bull run from the market crisis of 2008/2009. It has been hard to do anything but make good decisions in the stock market, so long as one remained in and continued to invest in it. I find it unlikely that the decade to come will offer anything remotely resembling this. I believe it prudent to continue building my cash position while still sprinkling investments into the market along the way, opportunistically. The past is indeed no guarantee of future results, though the past does leave clues, and there has never been a bull market of this magnitude which did not eventually either see some reversal or stagnation along the way. It will be important to be ready for when the slowdown occurs.

Conclusion

As 2019 comes to a close, it is easy for me to say that I feel it was both a great year and a fitting chapter to close out my first full decade of investing. Looking forward to the 2020s, as I write this on January 1, I am hopefully optimistic about what is to come. I love learning about new things and, despite a decade of earnest devotion to the field of personal finance, I still have that youthful sensation that comes with embarking at the outset of a voyage.

I am excited about what successes I’ll meet, what failures I’ll need to overcome, and everything in between that is sure to find me along the way. One of the oft quoted remarks about investing is that the greatest asset we have is time. Time to compound, time to invest, time to earn. I remember feeling, as I started out, that I had a seemingly limitless amount of time on my side to do all of these things. Though, I knew then and know now, that isn’t the case.

As I turn the page on the decade-that-was, I am cognizant of the time that has already passed and what that means for what is to come—how it necessarily must influence my approach moving forward. The time already spent has been foundational in that it set the bedrock on which my subsequent investments will be laid. The lessons I’ve learned will shape the course of how I approach future investments. The compounding has begun, but still has much more road to cover. Though snowballs roll downhill and, eventually, of their own volition, they still require tending and care along the way.

Yes, I’m excited by all of it.

What plans have you made for the years to come? What were your standout lessons for the 2010s?

Full Disclosure: Long TD, REI.UN, KO, JNJ, BCE, CM, CSW.B, BNS, T, RCI.B, FTS, CU, CNR, CP, H, CSH.UN, MRU, BEP.UN, BAM.A, BIP.UN, AW.UN, ENB, WM, MCD, YUM, YUMC, PEP, WMT, V, ABBV, DIS

Every day investing teaches a little more about it. Reflecting upon the past investments and their performances is useful. Thank you for sharing with us your financial journey. You have given details of your earnings, dividends you received and your profits. The mention of your passive income targets and portfolio performance gives a great insight on the whole investment technique. The blog would surely enrich investors’ knowledge.

Glad you enjoyed, junaydm.

Ryan

Thank you so much for sharing your growth journey experience as a newcomer with us. CAD Dividends, USD Dividends, and Five Year Plan Passive Income Targets have been explained in detail. It will help us to invest in the stock market.

Hi pran,

Glad you enjoyed the article and found it informative.

Take care,

Ryan

Thank you for constantly sharing update on your five year plan. It is difficult to stay consistent and focused on your goals. But your blogs are truly a motivation to many. I have also started investing in stock market. This might help me plan my finances in a better way.

Hi Shoeb,

Glad you enjoyed the article and find it an inspiration.

Take care,

Ryan

Hi Ryan,

Thanks for sharing your five year plan. As I was reading it, I realized that I really don’t have a clear plan yet on how I’m going to achieve FI. I’m new to FI and I’m also new to blogging. This post gave me an idea on what I should consider aiming for.

Enjoy the rest of your day man!

Cheers,

Alex

The Thrifty Hustler recently posted…How to Earn Money from Selling Thrifted Items

Hey Alex,

Glad this post helped you clarify your own goals. Or, at least, to get you thinking about what you’d like to achieve. That’s always the first step.

Take care,

Ryan