Quite a lot can change in just a few years.

The genesis of my Five Year Plan goes back to August 2015. To that point, I had been investing with a general strategy of increasing my ownership in high-quality income-producing investments (e.g., dividend paying stocks)—I refer to this as being a net accumulator of assets. In doing so, I hadn’t set any concrete goals.

I decided, however, that I would do my best to look into my crystal ball and see how much passive income I could reasonably expect to be producing within a five year time frame.

I now own 42 companies, 35 of which kick off regular cash flows to be reinvested.

As such, we’ll take a look now at both this year and how the overall plan has fared.

Please note that all Canadian companies are owned in CAD. JNJ and KO are both held in CAD within my portfolio and so the dividends are received as such.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Change (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 533.20 | 6.76 |

| RioCan Real Estate Investment Trust (REI-UN) | 375.84 | |

| The Coca-Cola Company (KO) | 292.73 | 2.50 |

| Johnson & Johnson (JNJ) | 333.81 | 6.32 |

| BCE Inc. (BCE) | 723.80 | 5.05 |

| Canadian Imperial Bank of Commerce (CM) | 69.84 | 1.39 |

| Corby Spirit and Wine Ltd. (CSW-B) | 252.00 | * |

| Bank of Nova Scotia (BNS) | 360.00 | |

| TELUS Corporation (T) | 209.72 | 3.56 |

| Rogers Communications Inc. (RCI-B) | 110.00 | |

| Fortis, Inc. (FTS) | 310.00 | 5.76 |

| Canadian Utilities Limited (CU) | 363.56 | 3.00 |

| Canadian National Railway Company (CNR) | 97.77 | 6.98 |

| Canadian Pacific Railway Limited (CP) | 34.40 | 14.46 |

| Hydro One Ltd (H) | 260.61 | 5.01 |

| Chartwell Retirement Residences (CSH-UN) | 60.90 | 2.00 |

| Metro Inc. (MRU) | 18.00 | 12.50 |

| Brookfield Renewable Partners L.P. (BEP-UN) | 494.98 | 5.34 |

| Brookfield Renewable Corporation (BEPC) | 83.78 | |

| Brookfield Asset Management (BAM-A) | 38.09 | 12.50 |

| Brookfield Infrastructure Partners L.P. (BIP-UN) | 53.04 | 6.97 |

| Brookfield Infrastructure Corporation (BIPC) | 15.06 | |

| A&W Revenue Royalties Income Fund (AW-UN) | 63.08 | ** |

| Enbridge Inc. (ENB) | 81.00 | 9.76 |

| Saputo Inc. (SAP) | 5.25 |

* CSW-B decreased its dividend during the pandemic and then restored it to the original rate for the most recent payment.

** AW-UN suspended its distribution during the pandemic, restored it at a lower rate, and has since made two special payments to begin making up for what was lost.

USD Dividends

| Company | USD Payments ($) | Div Increase (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 92.68 | 6.34 |

| McDonald’s Corporation (MCD) | 89.99 | 3.20 |

| Yum! Brands, Inc. (YUM) | 62.36 | 11.90 |

| Yum China Holdings, Inc. (YUMC) | 7.96 | *** |

| PepsiCo, Inc. (PEP) | 33.64 | 7.07 |

| Walmart Inc. (WMT) | 27.43 | 1.89 |

| Visa Inc. (V) | 14.29 | 6.67 |

| AbbVie Inc. (ABBV) | 176.56 | 10.28 |

| The Walt Disney Company (DIS) | 7.48 | **** |

| Microsoft Corporation (MSFT) | 20.08 | 9.80 |

| Mastercard Incorporated (MA) | 7.14 |

*** YUMC suspended its dividend during the pandemic and has since restored it to the original rate.

**** DIS paid a dividend in January and has since decided to focus its free cash flow on growing the streaming side of the business. As such, I expect no further dividends from the company.

I only list dividend increases if they occur while I own the stock, so there are some cases where a company may have increased its payout, but I have not indicated such.

Five Year Plan Passive Income Targets

I earned C$5,240.46 and U$539.61 in dividends, coming together for a currency-neutral sum of $5,780.07. Including the C$50.72 in interest, my total passive income through 2020 comes out to $5,830.79.

Here are the final tallies for passive income going back to 2015:

| Year | Age | Target Annual (Div + Int) | Actual Annual (Div + Int) | Target Exceeded (%) |

|---|---|---|---|---|

| 2015 | 28 | 2,000 | 2,191.63 | 9.58 |

| 2016 | 29 | 2,500 | 2,713.16 | 8.53 |

| 2017 | 30 | 3,100 | 3,341.80 | 7.80 |

| 2018 | 31 | 3,700 | 4,301.71 | 16.26 |

| 2019 | 32 | 4,400 | 5,415.10 | 23.07 |

| 2020 | 33 | 5,100 | 5,830.79 | 14.33 |

From a base of $2,191.63, my annual passive income increased to $5,830.79—nearly tripling over the intervening five years. This works out to a 21.62% compound annual growth rate.

My initial target for 2020 was set at $5,100, but I’ve managed to exceed that by 14.33%.

All things considered, those are numbers I can be incredibly satisfied with.

One of the great lessons of this pandemic is that the dividend growth investing strategy genuinely has staying power. We’re in the middle of the most impactful pandemic in a century and yet my portfolio barely took a dent across the entire year.

While there were a few hiccups, the majority of my companies increased their dividends like clockwork.

What’s Next?

The Five Year Plan which I outlined in 2015 has now reached a happy conclusion. I exceeded the target I set for myself at that time and have remained on track.

It will naturally be more difficult to continue growing at the same rate that I have been; I am now working from a higher starting point. It would be unlikely to roughly triple my passive income again over the next five years or to maintain a compound annual growth rate of +20%.

I grew my passive income by 7.68% this year ($5,415.10 to $5,830.79)—a bit below where I would like to see myself. I believe I can do better than that in 2021 and beyond.

Given that I intend to continue purchasing both cash flowing and non-cash flowing investments, setting a 10% annual growth rate target for cash flow is both achievable and healthy.

Assuming I grow my passive income by 10% per year, here’s what can be projected out to 2025 (approximate values):

| Year | Age | Target Annual Passive Income (Div + Int) |

|---|---|---|

| 2021 | 34 | 6,415 |

| 2022 | 35 | 7,055 |

| 2023 | 36 | 7,760 |

| 2024 | 37 | 8,535 |

| 2025 | 38 | 9,390 |

Considering such lofty totals would have seemed unrealistic back in 2015, but that’s the beauty of compound growth. The cash coming in each year itself will continue to earn returns and those returns will do the same.

The snowball grows as it rolls downhill.

Market Activity

My ideology related to stock buying is that when sales occur, it’s important to double down.

Needless to say, March of this year provided plenty of opportunity to put capital to work at reasonable prices or better.

Here’s a summary of the companies I purchased in 2020, mostly in the first half of the year:

| Company | Total Cost ($) |

|---|---|

| TD (bought six times) | C$7,168.10 |

| CU | C$1,158.65 |

| CNR | C$1,062.95 |

| V | U$1,052.39 |

| MSFT (bought twice) | U$2,173.72 |

| MA (bought twice) | U$2,157.47 |

| SAP | C$1,044.65 |

| Alphabet Inc. (GOOGL) | U$1,274.86 |

| Genius Brands International, Inc. (GNUS) | U$507.20 |

| Shopify Inc. (SHOP) | C$1,304.95 |

| BigCommerce Holdings, Inc. (BIGC) | U$1,027.40 |

This comes together for C$11,739.30 and U$8,193.04, rounding out to a currency-neutral $19,932.34. This is the second most I’ve ever spent in a single year—I invested $26,970.45 back in 2018.

The majority of these companies pay dividends, while GOOGL, GNUS, SHOP, and BIGC do not.

New Stock Buying Focus

The $4,114.41 I spent on non-dividend payers this year represents my largest commitment ever to companies that don’t provide cash flow. I made a conscious decision earlier this year to dip my toes a bit deeper into higher growth industries than I am accustomed to.

Missing out on the growth of fantastic companies simply because they do not pay a dividend can itself be costly. That’s too binary of an approach for me, and so I will act when I deem it wise, dividend or not.

As one example, I picked up Amazon.com Inc. (AMZN) back in 2017. Likewise, I took a stake in GOOGL this year. Both of these companies have a strong hand in the cloud computing revolution, along with many other lines of business where they are also dominant. I use their products and see them continuing to increase their market shares; it is important to participate in their growth in the decades to come.

In the past, I’ve let companies like this slip by. Now that I have a solid foundation already set with my dividend payers, it is sensible to broaden my horizons.

Savings Rate

The key to financial independence comes down to one very simple statement: spend less than you make and invest the difference. This is the secret sauce that breeds long-term gains.

I consider savings rate to be the percentage of net income that is set aside for investment/long-term holdings. This is money that is not intended for immediate consumption.

In other words, if you earn $100 and put aside $10 to buy stocks, then you’ve achieved a 10% savings rate. 10% is the number you typically find recommended in personal finance books.

While I had managed a 21% savings rate in 2019, I upped the ante in 2020 by hitting 25.41%. The higher the savings rate gets, the quicker financial independence is achieved. There is the double effect of investing more money and learning to live on less.

Most people focus their energies entirely on earning more money and getting higher returns from investments. It’s all for nothing, though, if one’s financial ship has a huge leak (i.e., excessive amounts of spending).

I will be aiming again for a 25% savings rate in 2021.

Year-in-Review

It was a turbulent year. While most of what I’ve read has focused on the negatives, I believe there were many positives to be gleaned. To name a few –

- I don’t have an exact figure to quantify this point, but I am sure the medical community has made huge gains in both its understanding of how to rapidly develop reliable treatments and vaccines, and then also how to get those to market in a meaningful time frame. The benefits of what has been learned will propel medical and scientific advancement for decades to come.

- Technology has advanced at hyper speed as businesses have been forced to adopt digital solutions. The ability to teleconference which has been available for years is now actually being properly utilized.

- People were given a chance to pause and reflect on life. Those who took that opportunity and actually spent some time questioning their current practices should be better for it. We should all feel encouraged to be more mindful of our spending—both financial and with our time.

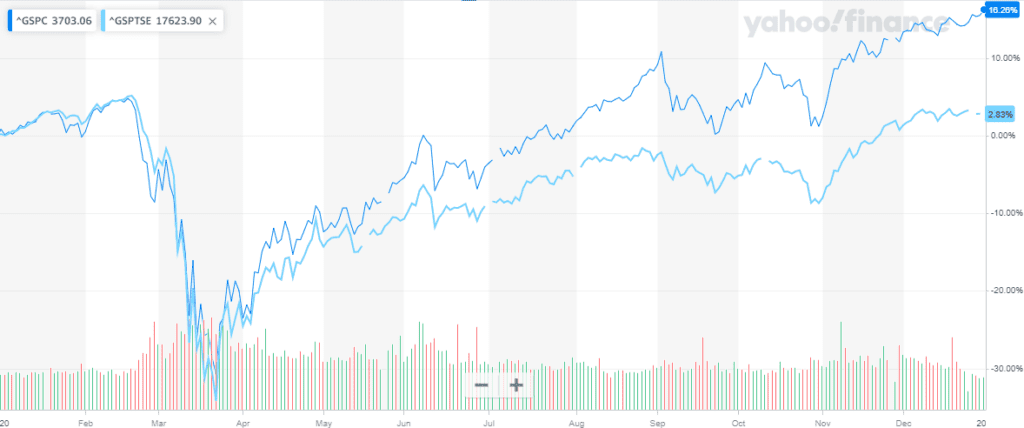

As far as the capital markets themselves, here’s a quick snapshot of how the S&P 500 (GSPC) and S&P/TSX Composite Index (GSPTSE) fared across the past twelve months:

So, despite the ups and downs, simply hanging on from January through December wouldn’t have lost any money.

COVID-19

The largest story of 2020 and arguably one of the most impactful events of the last century has been COVID-19. It began with some murmurs from China of a mysterious bug and proceeded to ravage its way across the globe.

By the time it is done, millions will have lost their lives to this virus. Economies have been hammered, with countless jobs lost or left in limbo.

I detailed my thoughts on COVID-19 back in May. I anticipated lower levels of dividend increases, along with cuts and suspensions to payouts along the way. This came to fruition, though we’ve already seen the turning of the tide as businesses are stabilizing.

There are a few vaccines already on the market at this point in time, along with a much better understanding of how to therapeutically treat the virus.

My expectation at this stage is that 2021 will not be dominated by COVID-19, though that isn’t to say media outlets won’t continue their fear mongering to drive sales/clicks on their websites.

If I could offer any advice, it would be to be mindful that our best days lie ahead of us and that this thing will be conquered.

Lessons From the Pandemic

One lesson I am taking from this pandemic is that savings matter. We are so driven by statistics and long-term projections of how money invested earns x% over the long term, but plenty of businesses and families were sunk by not having cash-on-hand. The saver-mindset which was drilled into those who endured the Great Depression in the 1930s has all but been lost.

We have now learned that economies can effectively be shut down and millions of jobs can be lost in the blink of an eye.

Regardless of how little interest savings may earn and how inflation may eat away at them, there is still plenty of merit to keeping a war chest full of cash. You won’t thrive in an environment if you fail to survive.

Health and Wellness

Around the middle of the year and after my regular gym had been impacted by the pandemic lockdowns, I decided to invest in a Bowflex C6 stationary bike. Including the purchase of the bike, the shipping, the mat, and assembly, the cost of this came to around C$1,800.

From the time I received it in September, here’s a tally of the time I’ve spent and the kilometres I’ve logged on the bike:

| Month | Time Spent (hrs) | Distance (km) |

|---|---|---|

| September | 11.57 | 416 |

| October | 17.87 | 646 |

| November | 14.93 | 538 |

| December | 14.10 | 511 |

In total, this brings me to 58.47 hours spent covering 2,111km. This averages out to an average speed of 36.10km/hr, which does include warm-up and cool down periods.

I’ve never done a spinning class, but I enjoy just getting on the bike and using it while I’m watching something that I would otherwise be on the couch or sitting at my computer for. It’s a simple way to get in some high-quality cardio without leaving my home.

Conclusion

My portfolio continued to grow both in terms of the underlying capital and with relation to the amount of cash flow it produces.

The $5,830.79 I earned in passive income represents ~$486 on a monthly basis. That’s effectively a pension that serves now to refuel my portfolio as I reinvest it back into other investments. If needed, it could also serve as a cushion should I ever find myself in need of a short-term boost to my income.

Blessings

Sitting here in Canada and writing this article over a lengthy Christmas holiday demonstrates just how fortunate I have been in my life. Beyond that and looking specifically at 2020, my family has been entirely untouched by COVID-19. I was also able to work through the entire period as my employment is in the healthcare field.

Those facts are not lost in the shuffle. I don’t take this for granted.

I count my blessings as we turn the page on what has been a challenging year for many.

I’ll begin 2021 with an unpopular opinion: 2020 was a good year.

It is only through challenges that we ever really learn and grow.

When the lockdowns for the pandemic struck, I read a number of articles demonstrating the benefits to ecosystems and the ozone layer as commerce grinded to a virtual halt. Just as the planet we live on, we also benefit from periods of rest. It is important to remember to take them, and not just when forced upon us.

Thank you for reading and Happy New Year.

Ryan

Full Disclosure: Long TD, REI-UN, KO, JNJ, BCE, CM, CSW-B, BNS, T, RCI-B, FTS, CU, CNR, CP, H, CSH-UN, MRU, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, PEP, WMT, V, ABBV, DIS, MSFT, MA, GOOGL, GNUS, SHOP, BIGC, AMZN

Hi Ryan,

Congratulations for meeting your goals of increasing your passive income and your savings rate.

Happy 2021! If there’s anything that I’ve learned from 2020, it is to save, save, save and invest and to cherish every single day that we’re alive 🙂

Thrifty Hustler recently posted…How to Get a Job Without Applying

Couldn’t have said it any better. Life is fragile and we’re fortunate to each get our one opportunity to make it worthwhile.

As for the investing side of the equation, cash flow remains king in any environment.

Take care,

Ryan

well done Ryan thanks for the guidance

Hi Ken,

Glad you enjoyed the article.

Take care,

Ryan