It has been just about a year since I recall news of a mysterious virus in Wuhan, China. I never expected the ripples that we eventually saw and how they would come to impact us all.

With that said, I begin this year with plenty of optimism. Whether it’s because of vaccines or even just because we have a better sense overall of how to deal with things, I feel this year will trend in a positive direction on all fronts.

Businesses have been tepid with their dividend increases as they deal with an uncertain operating environment, but most in my portfolio have been nimble with adapting. I expect this to continue as we move forth.

Table of Contents

Dividend Summary

I earned dividends from 13 companies in January, 11 of them North of the Border.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 158.00 | |

| RioCan Real Estate Investment Trust (REI-UN) | 31.32 | |

| BCE Inc. (BCE) | 183.15 | |

| Canadian Imperial Bank of Commerce (CM) | 17.52 | |

| Bank of Nova Scotia (BNS) | 90.00 | |

| TELUS Corporation (T) | 56.02 | 6.85 |

| Rogers Communications Inc. (RCI-B) | 27.50 | |

| Canadian Pacific Railway Limited (CP) | 9.50 | |

| Chartwell Retirement Residence (CSH-UN) | 5.10 | |

| A&W Revenue Royalties Income Fund (AW-UN) | 4.00 | |

| Saputo Inc. (SAP) | 5.25 |

I’ve included the TD dividends in January as the TD dividend Payment Date is officially January 31. It also makes it simpler for year-over-year totals to be calculated when such a large payment is held consistently in the same month.

USD Dividends

| Company | USD Payments ($) |

|---|---|

| PepsiCo, Inc. (PEP) | 8.70 |

| Walmart Inc. (WMT) | 6.89 |

I earned C$587.36 and U$15.59, coming together for a currency-neutral $602.95. The big jump in income this January—detailed below—is a result of having increased my position in TD by 150% back in March 2020.

Standouts

The 6.85% dividend increase from T was on the lower end of its range, but makes up for them foregoing their usual increase with the July payment. Not surprisingly, they had held back at that point as they were in the midst of adjusting to the pandemic.

Year To Date Progress

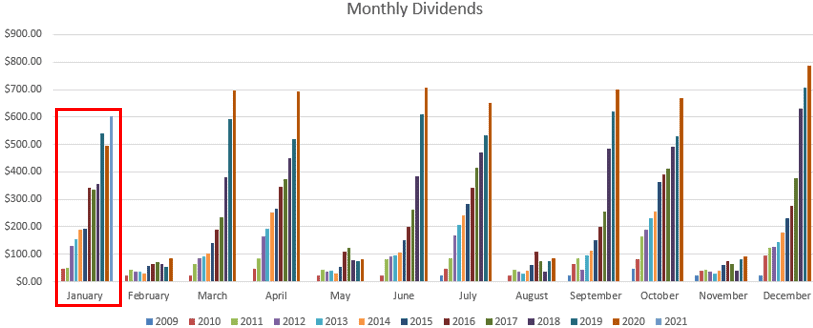

Here’s how the income stacks up visually:

It feels great seeing the lines on the chart stretch continuously higher. My January dividends have jumped by over $100, setting the stage for a big 2021 to come.

With only one month in the bank, there’s no surprise on the monthly progress chart:

| Month | Dividends ($) |

|---|---|

| January | 602.95 |

| Total | 602.95 |

As always, the plan is to simply keep reinvesting and let compounding do its trick.

Market Activity and Cash

We’ve entered another period where I don’t see any hot deals in the markets. Most companies I’d be interested in investing in have effectively recovered from their pandemic-lows, or even blown right through to chart all-time highs.

All the same, I decided to make a small investment in a company I am already well-acquainted with.

I added to my position in Fortis Inc. (FTS) for 20 shares at a cost of C$1,048.95. My dividend yield comes to 3.85% on these shares and should bring in C$10.10 quarterly (C$40.40 annually).

I’ve been invested in FTS since 2015 and have enjoyed the company’s consistency since that time.

One of my favourite things about FTS is the company’s dividend guidance; they are currently projecting 6% annualized dividend increases through 2025. This allows a level of transparency into their dividend increase methodology and allows me to have set expectations around what is coming. When it comes to dividend history, few companies measure up to FTS—they’ve been increasing their payment annually going back 47 years.

Most recently, FTS increases its dividend with the December payment by 5.76%.

Personal Wellness

The lockdowns have persisted in my area, which means I’ve been mostly working out at home. The means plenty of push-ups, pull-ups, and spin-bike activity around here.

On the intellectual side, I’ve been reading through Buckminster Fuller’s “Operating Manual for Spaceship Earth”. It details how we should view our planet as the perfectly designed space capsule to take us through the universe. His manner of thinking involves considering what will bring about benefits to 100% of humanity—I’m not sure it’s even possible, but the thought experiment is worthwhile.

At the same time, I’ve just finished Chris Hadfield’s MasterClass related to space exploration and finding our place in the grand scheme of things. I highly recommend this to anyone who is even remotely interested in space travel. He outlines the many benefits of our pursuing a Mars-flight and beyond.

Conclusion

Dividend cash flow has been solid through January, topping $600 for the first time for the month. It blows my mind when I look back at the figures in my spreadsheet and see that I didn’t earn a penny in January 2009, and then only $47.45 in 2010. Now it’s enough to cover a vehicle payment or the better part of a mortgage payment.

It all just takes time and focus.

I was glad to get some cash invested in FTS, even if it wasn’t a basement-bargain of a deal. To paraphrase Buffett and Munger, it’s okay to buy a fantastic business at a fair price.

Time in the market beats timing the market, and total return relies heavily on starting yield and dividend growth. When you take a ~4% yield and add ~6% dividend growth, expectations can land somewhere in the 10% range over time, adjusted for valuation changes in the share price.

I hope you’ve also kicked 2021 off on the right foot.

Thanks for stopping by.

– Ryan

Full Disclosure: Long TD, REI-UN, BCE, CM, BNS, T, RCI-B, CP, CSH-UN, AW-UN, SAP, PEP, WMT

nice Ryan

Love how chunky that bce dividend is!

It’s always great looking back at where we all started from. Slowly but surely it grows.

keep it up

cheers.

Absolutely, Rob. BCE was one of my earliest picks. I added to it once in 2013 and from there have reinvested dividends a few times along the way. Pretty consistent high yielder with 5% annual dividend growth. Works for my tastes.

Thanks for stopping in.

Ryan

Hi Ryan

I just signed up for your posts from you & your brother.

I also bought more FORTIS in Feb. & also bought my first stocks in Algonquin renewables.

My fitness routine is much like yours as my Pickering rec. centre membership is on old.

Looking foreward to your posts.

Steve

Hey Steve,

Thanks for joining the site. I’m glad you’re enjoying what you’ve been reading.

FTS is definitely one of my favourite companies. I don’t expect any fireworks over the coming decades, but ~6% annual dividend growth compounds nicely.

AQN is a popular one in the dividend growth community, but I don’t have any in my portfolio. Pretty solid yield on it.

Yeah, buying the Bowflex C6 spin bike last year has worked out nicely. Working out at home can be pretty decent if you enjoy calisthenics and such.

Take care,

Ryan