The start of 2022 brought with it another lockdown, otherwise known as “Modified Stage 2”. That put a damper on my usual movie-going.

The bright side is that things open back up tomorrow, to some extent.

It has been a volatile month in the markets as high-flying tech names have seen much of the froth come right off the top. This has presented a few buying opportunities, some of which I’ve jumped on.

Table of Contents

Dividend Summary

I earned income from twelve companies, several that I’ve now held for over a decade. Seeing some of these names has started to feel like seeing an old friend. There’s something pleasantly familiar about them.

CAD Dividends

| Company | CAD Payments ($) | Div Change (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 178.00 | 12.66 |

| RioCan Real Estate Investment Trust (REI-UN) | 20.88 | |

| BCE Inc. (BCE) | 192.50 | |

| Canadian Imperial Bank of Commerce (CM) | 19.32 | 10.27 |

| Bank of Nova Scotia (BNS) | 100.00 | 11.11 |

| TELUS Corporation (T) | 70.39 | 3.54 |

| Rogers Communications Inc. (RCI-B) | 27.50 | |

| Canadian Pacific Railway Limited (CP) | 9.50 | |

| Chartwell Retirement Residence (CSH-UN) | 5.10 | |

| A&W Revenue Royalties Income Fund (AW-UN) | 6.20 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| PepsiCo, Inc. (PEP) | 9.14 |

| Walmart Inc. (WMT) | 7.02 |

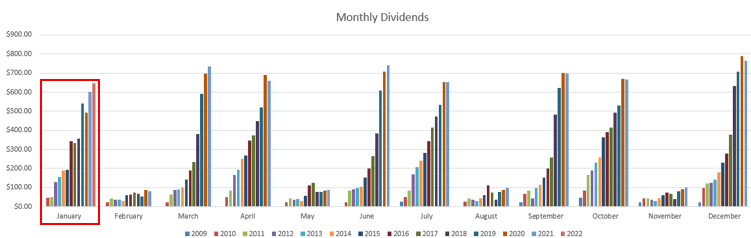

January brought $645.39 in currency-neutral income, split between C$629.39 and U$16.16. This is my best January on record, up 7.01% from my January 2021 portfolio update.

The real standouts this month are those big time double digit dividend boosts. Many of the Canadian banks announced dividend raises in late November 2021, which are finally hitting my account.

While these raises have been a long-time coming, it’s always better late than never. The world feels just a bit more normal when these top-quality companies are increasing their payouts.

My plan with the cash flow is the same as always: reinvest and compound.

Year-over-Year Dividend Progress

As mentioned, this is the most I’ve ever earned in the month of January:

Being able to look back and see how small the bar chart used to be compared to now provides inspiration to continue on this path. With time and consistency, there are really no limits to what is possible.

The biggest challenge these days is finding a healthy balance between high-growth and steady investments. I began making investments in the blockchain and cryptoeconomy in 2021 and do plan to continue with this.

Likewise, I remain committed to dividend growth investing. That is the foundation that fuels everything else.

Microsoft Purchase of Activision-Blizzard

The big acquisition news of the month was Microsoft (MSFT) making an offer to buy Activision-Blizzard (ATVI). Though the deal still needs to be approved by regulators, it is a huge splash in the gaming and entertainment industry.

I covered the reasons I feel Microsoft bought Activision a few weeks ago. As someone who grew up on gaming franchises such as Warcraft, it’s an exciting prospect to have a stake in the company.

From the business side of things, I feel Microsoft will be able to do a great job getting full value from these games. There will be plenty of opportunities to build out the gaming universes, hosted on a top-flight cloud platform.

I’ll be watching this intently in the months to come.

Market Activity and Cash

When the market pulls back, it’s great to put cash to work. Further, this feels even better in January when it means I’ll have the rest of the year to reap the rewards of this early investment.

I bought 60 shares of Brookfield Renewable Corporation (BEPC) across two tranches. My cash outlay was C$2,504.60. The company’s dividend is paid in USD and then converted to CAD, but my dividend yield for these shares should be around 4%.

I also picked up Shopify Inc. (SHOP) when the price dropped just below C$1,200. If you believe in the company’s future as I do, buying around this price is reasonable.

Both with BEPC and SHOP, I am adding onto existing positions. As my portfolio has grown over the years, one of my biggest goals has been to consolidate my investing. Unless the market offers up some fantastic deals on companies I don’t own, I’m content to stay in-house.

Investing in companies I already own offers two huge benefits:

- I don’t need to research or follow a new company. Existing homework continues to apply. Keeping up with something I’m already familiar requires less effort.

- If I decide to passively DRiP (reinvest) my dividends, it’s easier to purchase whole shares.

As we head into February, I remain well-capitalized and ready to pull the trigger. I’d love to continue doubling down.

Conclusion

January was a great month on the investing front. I hit an all-time high for dividend income and managed to get a few thousand dollars invested.

That’s how you draw it up on the chalk board.

Despite having another month of frigid Canadian weather ahead, I am looking forward to businesses reopening. I still want to see the new Matrix film in theatres, so that’s on my radar in the days to come.

I hope you’re also making great use of your time and capital.

Take care.

Full Disclosure: Long TD, REI-UN, KO, BCE, CM, BNS, T, RCI-B, CP, CSH-UN, AW-UN, PEP, WMT, MSFT