I spent plenty of time in January on skates, which is one of the best ways to spend time in Canada during the Winter months.

I also brought home a fair amount of dividend income.

Table of Contents

Dividend Summary

I earned CAD income from ten sources, with three more producing USD.

CAD Dividends

| Company | CAD Payments ($) | Div Change (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 204.00 | 6.25 |

| RioCan Real Estate Investment Trust (REI-UN) | 23.49 | |

| BCE Inc. (BCE) | 212.85 | |

| Canadian Imperial Bank of Commerce (CM) | 21.60 | 3.45 |

| Bank of Nova Scotia (BNS) | 106.00 | |

| TELUS Corporation (T) | 107.19 | |

| Rogers Communications Inc. (RCI-B) | 27.50 | |

| Canadian Pacific Railway Limited (CP) | 9.50 | |

| Chartwell Retirement Residence (CSH-UN) | 5.10 | |

| A&W Revenue Royalties Income Fund (AW-UN) | 11.20 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| PepsiCo, Inc. (PEP) | 10.76 |

| Walmart Inc. (WMT) | 7.27 |

| The Walt Disney Company (DIS) | 2.55 |

Passive income was tilted toward the Canadian side, with C$728.43 and U$20.58 combining for a currency-neutral $749.01. This represents a 10.00% growth rate from my January 2023 dividend update.

While it’s nice to see DIS back on the dividend track, it’s really only a token dividend at this point. They also only pay semi-annually, so it’s not a steady cash flow stream. I suppose they want to be able to show some progress as far as rewarding shareholders given the stock has been a dud for the better part of a decade.

Year To Date Progress

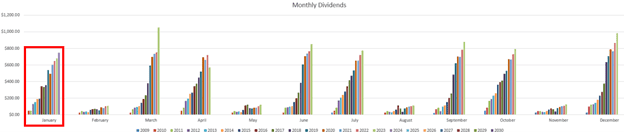

A strong January always sets the groundwork for the year ahead. Posting 10% growth over 2023 suggests I’m already off to a hot start, as double-digits is where I like to be.

The dividend growth bar stretches for the sky:

Dividends should roll in regardless of what is going on in the outside world.

Market Activity and Cash

I held steady with my cash through January. There haven’t been any really hot opportunities catching my interest, so I’m fine sitting aside.

It’s worth mentioning that I’m currently receiving 5.5% on idle cash, so that provides a cushion when not putting money in the markets. This is, of course, due to interest rates which have risen steeply over the past few years.

It seems the Bank of Canada may be looking to decrease at least once this year, though that remains to be seen. They’re still looking to bring inflation back to the 2% target, which is getting closer.

Conclusion

Again, hitting double-digit dividend growth is a healthy sign for my portfolio. It’s always fun at the start of the year to see things begin churning, knowing the best is yet to come.

The plan for the year will be the same as usual. Plenty of consistency and reinvesting the fruits of past labours.

– Ryan

Full Disclosure: TD, REI-UN, BCE, CM, BNS, T, RCI-B, CP, CSH-UN, AW-UN, PEP, WMT, DIS