Weather-wise, July turned out to be one of the mildest ones I can remember. Getting outside was reasonable most days and I certainly took advantage of that.

On the stock market front, I posted some solid dividend returns in the month.

Table of Contents

Dividend Summary

I earned dividend income from ten Canadian companies and one from the US.

CAD Dividends

| Company | CAD Payments ($) | Div Change (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 178.00 | |

| RioCan Real Estate Investment Trust (REI-UN) | 22.19 | |

| The Coca-Cola Company (KO) | 75.23 | |

| BCE Inc. (BCE) | 202.40 | |

| Canadian Imperial Bank of Commerce (CM) | 19.92 | 3.11 |

| Bank of Nova Scotia (BNS) | 103.00 | 3.00 |

| TELUS Corporation (T) | 72.80 | 3.42 |

| Rogers Communications Inc. (RCI-B) | 27.50 | |

| Canadian Pacific Railway Limited (CP) | 9.50 | |

| Chartwell Retirement Residence (CSH-UN) | 5.10 | |

| A&W Revenue Royalties Income Fund (AW-UN) | 6.20 |

* KO pays its dividends to me in CAD, as this is the currency I purchased it in.

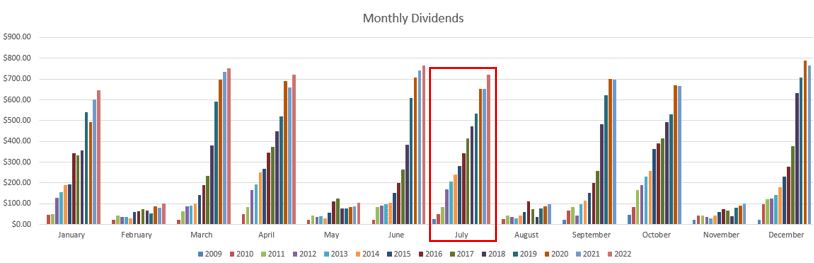

In total, I brought in C$721.84 from dividends. Compared to July 2021, this represents a 10.64% increase. Notching a double digit increase feels amazing, as this is the fuel for compounding wealth over time.

Further, seeing steady dividend growth in the 3% range from Canadian Imperial, Scotiabank, and TELUS provides confidence. While the overall figure may be low, it’s great to see companies getting back to rewarding shareholders with income boosts while comfortably reinvesting back into their own lines of business.

Standouts

I didn’t have any huge standouts this month, but I will mentioned Alphabet/Google (GOOGL) finally splitting its shares. They completed their 20:1 split, making them more accessible to investors with smaller levels of capital who cannot buy fractional shares with their discount brokers.

While a stock split doesn’t add any actual value to a company, it represents that growth has taken place. It’s a signal of things trending in the right direction for investors.

Year To Date Progress

As mentioned above, my July 2022 dividend totals far exceed what I posted in both 2021 and 2020:

The lingering effects of the pandemic continue to recede into the rear view. Companies are finally getting to a place where they feel they’re in the right spot to commit capital and resources to projects. Out of this comes greater opportunity for them to send some additional cash flow to shareholders.

Through July, I’ve accumulated $3,808.86 in dividend income:

| Month | Dividends ($) |

|---|---|

| January | 645.55 |

| February | 101.85 |

| March | 750.44 |

| April | 720.76 |

| May | 103.31 |

| June | 765.11 |

| July | 721.84 |

| Total | 3,808.86 |

This keeps me well on track to exceed $6,000 for the year, as we continue on the home stretch.

Market Activity and Cash

I’ve been keeping cash levels relatively stable. After a market drop earlier in the year, things seem to be leveling out at this point. I have little doubt we will continue to see some turbulence as the year closes out, mind you.

All the same, volatility is the name of the game, so that’s nothing new.

I did decide to reinvest some dividends into a company I already have a stake in.

Brookfield Infrastructure Corporation (BIPC)

Since I had some cash burning a hole in my pocket, I decided to pick up an additional 13 shares of BIPC.

My thesis on Brookfield Infrastructure is based on a rather simple vision of the future. Individual citizens, corporations of all sizes, and governments will all require more:

- Utilities/energy

- Integrated logistics

- Data storage

BIPC develops projects in all of these critical infrastructure areas. One of the things I love about them is their affiliation with Brookfield Asset Management (BAM-A) which provides them a simple pipeline for accessing capital for acquisitions and investment.

Interest Rate Developments

The Bank of Canada has a well-known target for inflation within a 1–3% control range. In July, they renewed their target of 2%, despite the economic backdrop of rampant inflation hitting consumers.

To tackle the consumer price index hitting ~8% in mid-2022 and other related concerns, the Bank of Canada decided to “front-load the path to higher interest rates by raising the policy rate by 100 basis points”.

What this ultimately means is that any variable-rate debt just got considerably more expensive. Likewise, the cost of initiating new loans or renewing old ones will put a damper on economic growth.

Time will tell whether they’re able to orchestrate the sort of soft landing they’re aiming for. Truly, the fact is that the majority of inflationary pressures lie outside of the Bank’s hands. The war between Russia and Ukraine, COVID lockdowns/reopenings in China (along with their related supply chain disruptions), and other factors just cannot be controlled domestically.

All the same, this should be a step in the direction of getting a grip on the overheated housing market and tempering inflation to an extent.

Conclusion

July was an incredible month with +10% dividend growth. This income will find its way back into dividend growth payers, further juicing the compound growth engine.

Adding to my BIPC holdings is something I’ve been meaning to do for quite some time. All of the capital I used was from dividends which had built up in my account. Again, it’s just compounding on compounding. Nothing flashy, just consistent.

Take care.

– Ryan

Full Disclosure: TD, REI-UN, KO, BCE, CM, BNS, T, RCI-B, CP, CSH-UN, AW-UN, GOOGL, BIPC, BAM-A

Congratulations on an impressive year and your quest to hit 6,000 before the end of the year. I have a similar goal myself so it is motivating to see others go after it.

Samuel recently posted…Risk On Risk Off Portfolio | How I Invest with Stefan Schumacher

Hey Samuel,

Thanks for reading and sharing your own goals. Hope to hear more about your journey along the way.

Take care,

Ryan