This seemed to be one of the mildest July periods I’ve ever experienced. The typical heat wave never seemed to materialize, which made for a great period to be outdoors on the back deck.

On the investing front, I had one of the most active months since early 2020 when the market cratered. It feels good to be back in the buying game, building passive income.

Table of Contents

Dividend Summary

All cash flow received was in CAD.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| The Toronto-Dominion Bank (TD) | 192.00 | |

| RioCan Real Estate Investment Trust (REI.UN) | 23.49 | |

| The Coca-Cola Company (KO) | 80.95 | |

| BCE Inc. (BCE) | 212.85 | |

| Canadian Imperial Bank of Commerce (CM) | 20.88 | 2.35 |

| The Bank of Nova Scotia (BNS) | 106.00 | 2.91 |

| TELUS Corporation (T) | 89.08 | 3.56 |

| Rogers Communications Inc. (RCI.B) | 27.50 | |

| Canadian Pacific Kansas City Limited (CP) | 9.50 | |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.40 |

I pulled in a very solid C$773.75 in July. There was a bit of dividend growth received, coming in from CM, BNS, and T, all of which is much appreciated. I love income increases as a shareholder as the effort is so low in maintaining a previously purchased stock.

Yes, it is prudent to continue monitoring business health, but this gets easier to do over time. Keeping track of a company you already know well requires far less work than seeking out new investments.

In comparison to my July 2022 dividend totals, this month represents a healthy 7.19% increase. Any time I’m above 6%, I feel satisfied with my progress.

Year To Date Progress

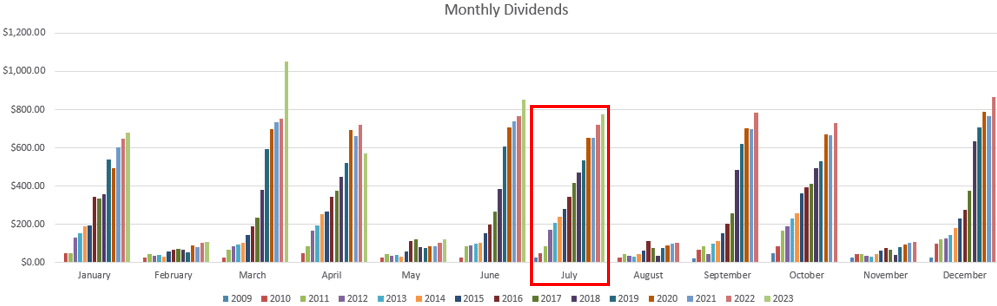

The bars on the chart keep rising. That always has been and continues to be my primary goal. Cash flow truly is king, and dividends are my favourite way to go about earning it:

Crossing firmly into the final few months of the year, I’ve received just over $4k in dividends:

| Month | Dividends ($) |

|---|---|

| January | 680.90 |

| February | 107.14 |

| March | 1,050.94 |

| April | 572.74 |

| May | 118.51 |

| June | 850.14 |

| July | 773.75 |

| Total | 4,154.12 |

Market Activity and Cash

As noted in the opening, I put out a solid cash outlay this month. I spent a total of $4,308.18 combined across CAD and USD investments, with the result being an expected $174.70 in projected annual dividend income.

Shares were purchases in the following companies –

- TELUS Corporation (T)

- Brookfield Infrastructure Partners L.P. (BIP-UN)

- Abbott Laboratories (ABT)

- A&W Revenue Royalties Income Fund (AW-UN)

Acquiring additional shares of TELUS came down primarily to its drop in share price. This offered an opportunity to capitalize on the ~6% dividend yield with an attractive company operating in an oligopoly within Canada.

I’m particularly excited about initiating a position with Abbott. Their dividend yield is low, but the company is firmly entrenched in the healthcare space with an incredibly long track record of rewarding shareholders. This builds on the fact that I had previously picked up AbbVie Inc. (ABBV) which had been spun out of Abbott. Both are companies I plan to stick with.

Conclusion

Responsibly putting capital to work is one of the chief responsibilities of an investor. Doubling down on three of my positions and bringing Abbott into my portfolio feels wonderful.

This should help set the stage for a rewarding finish as we head down the home stretch of 2023.

For interest, the photo at the outset of the article is one I created with Microsoft Designer. It’s incredible what AI can do with a simple prompt.

– Ryan Full Disclosure: TD, REI-UN, KO, BCE, CM, BNS, T, RCI-B, CP, CSH-UN, AW-UN, ABT, ABBV