Seems hard to believe the first half of the year is entirely in the books.

We did finally get the warmer weather that eluded us in May, though. There were plenty of beautiful mornings to get out for a run and patios even finally opened up, albeit with a few restrictions.

On the dividend front, all is looking well and healthy.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 | |

| Johnson & Johnson (JNJ) | 85.69 | 6.32 |

| Corby Spirit and Wine Ltd. (CSW.B) | 60.00 | -9.09 |

| Fortis, Inc. (FTS) | 76.40 | |

| Canadian Utilities Limited (CU) | 87.08 | |

| Canadian National Railway Company (CNR) | 25.88 | |

| Hydro One Ltd (H) | 65.94 | 5.01 |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Metro Inc. (MRU) | 4.50 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 142.11 | |

| Brookfield Asset Management (BAM.A) | 3.58 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 13.37 | |

| Brookfield Infrastructure Corporation (BIPC) | 1.34 | |

| Enbridge Inc. (ENB) | 20.25 |

USD Dividends

| Company | USD Payments ($) | Div Increase (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 23.17 | |

| McDonald’s Corporation (MCD) | 22.32 | |

| Yum! Brands, Inc. (YUM) | 15.59 | |

| PepsiCo, Inc. (PEP) | 8.70 | 7.07 |

| Walmart Inc. (WMT) | 6.89 | |

| Visa Inc. (V) | 3.83 | |

| Microsoft Corporation (MSFT) | 5.64 |

Dividend Summary

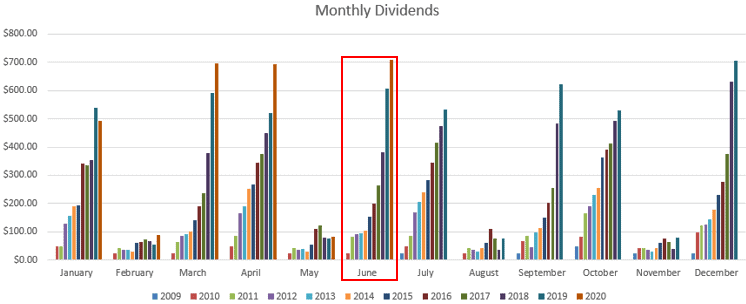

June saw totals of C$622.56 and U$86.14, combining on currency-neutral terms for $708.70. I exceeded my 2019 June dividend record by just over $100:

This is just the second time I’ve cracked the $700 figure in a single month and is the most I’ve ever earned. Indeed, it exceeds my December 2019 total by a few dollars, which was the month of my previous record. I’m closing in steadily on the $1,000 mark which is going to feel amazing when it comes.

It’s a strong sign of portfolio resilience that my results were so positive overall, considering I endured three dividend suspensions and one dividend cut, much of which I detailed in my May 2020 Portfolio Update. I earned cash flow from 21 companies within my portfolio.

Year To Date Progress

While I have been consistently tracking my dividends in monthly articles, I believe it is useful also to provide the higher-level-view within each monthly rundown. Here are the monthly tabulations:

| Month | Dividends ($) |

|---|---|

| January | 494.10 |

| February | 86.82 |

| March | 697.25 |

| April | 691.94 |

| May | 82.82 |

| June | 708.70 |

| Total | 2,761.63 |

I’m nearing the range of $500 per month based on how the year began and how it is trending at this stage.

Market Activity and Cash

For the third month in a row, I’ve continued building my cash reserves rather than investing in stocks. I went on a stock buying spree in March which left me low on dry powder—far lower than I like to be.

As much as I’d like to simply keep investing, it is good to be mindful of keeping a healthy buffer both for emergencies and also to take advantage of opportunities when they come.

The market may well continue simply rising and March could be left far in our rear view for good, but I can’t say I’m entirely trusting of this market rally.

The way I see it, I’m already firmly invested in the market and so I’m going to participate on the upside if we don’t get a pullback, but I want to be sure I have plenty of investable funds ready if the bottom falls out again.

We’re currently tracking toward the U.S. Presidential Elections which I suspect will only increase the level of volatility we’re seeing. There will be plenty of promises made along the way (some which might be kept, most which will likely be broken) which send stocks soaring or plummeting, as investors try to make sense of the longer term impacts to the daily news snippets.

Running and Personal Wellness

I set a personal goal at the end of May to run 80k through June. The final tally landed at 81km, so just over that mark. I was pretty much running 5km every other day, though some days were more when I needed to compensate for having taken an extra day off. The most I ran on a single session was 10km on June 16.

The Canada Geese were a bit of an impediment at times because they will cut off the running path occasionally and require me to walk or simply turn back. When their hatchlings come out and for the month or so thereafter, the adults are incredibly aggressive and will attack if you get too close, so it’s not viable to just run around them on a narrow path.

For July, I’ll aim for 60km. I’m not currently training to run a marathon (it has been a few years, actually), so it just feels nice to have a target to aim for which encourages me to get out of bed in the morning to stretch the legs and take in some fresh air.

As with investing, there are compound benefits to regular exercise. I do some of my best thinking when I am out routinely on the bike path, zoning out to the same sights along the way. I feel like I get many of the benefits of focused meditation by running; you don’t need to sit cross-legged with your eyes closed with yoga music in the background to settle yourself emotionally.

Running allows me to go deep on a topic—sometimes that topic is investing—without any distractions. Allowing the mind to wander is a beautiful thing, so long as you keep it focused within a positive framework.

Conclusion

Hitting the +$700 mark for the second time demonstrates that my portfolio’s cash-generating potential continues to rise.

The beauty of the dividend growth investing strategy is that even without adding fresh capital to the portfolio, these dividends can be reinvested back into the market; the portfolio itself becomes self-sustaining and grows of its own volition once certain levels have been achieved.

On the personal front, it feels great to be back on a regular routine of running in the morning. I had gotten away from it for around a year and committing to it once more is an energizing experience.

Thank you for reading.

– Ryan

Full Disclosure: Long REI-UN, KO, JNJ, CSW.B, FTS, CU, CNR, H, CSH-UN, BEP, BAM.A, BIP.UN, BIPC, ENB, WM, MCD, YUM, PEP, WMT, V, MSFT

Congrats on a record breaking month!! Ready to crush that next milestone??

Bert

Dividend Diplomats recently posted…5 Reasons Dividend Income is the Easiest Passive Income Source

Hey Bert,

You know it. Feels great watching the snowball roll and grow.

Take care,

Ryan

Congrats! June was a record breaking month for me as well!

Hey jimmbboe,

Glad to hear you had a great month as well. Plenty of good companies pay out in June.

Ryan

Nice Ryan

great to hear about your running. Funny about the geese. I’ve had them dive bomb me numerous times fishing.

Great month of dividends and love that jnj payment. That’s one I want to focus on growing.

keep it up

cheers!

Passivecanadianincome recently posted…3 Canadian Bank Stocks Ideal For Income Investors

Hey Rob,

I have no doubt—Canada Geese can be pretty ruthless when they feel you’re impeding on their territory.

Yeah, JNJ is one I picked up in 2010 and has turned out quite well. It was far out of favour with the general masses back then (Tylenol recalls and all that stuff), but I figured I’d dip in and stay the course. Turns out that can work well.

Take care,

Ryan