The past months have been marked by forest fires across Canada. This has led to a remarkably hazy Summer, marked by overcast skies.

On a personal front, I mostly took it easy through June. Not a whole lot of investing, but plenty of time cooking at the barbecue and relaxing around home.

Table of Contents

Dividend Summary

I received income from 24 companies in total; 17 paid in CAD while the remaining 7 paid in USD.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 23.49 | |

| Johnson & Johnson (JNJ) | 101.53 | 5.31 |

| Corby Spirit and Wine Ltd. (CSW.B) | 10.50 | |

| Fortis, Inc. (FTS) | 110.18 | |

| Canadian Utilities Limited (CU) | 105.42 | |

| Canadian National Railway Company (CNR) | 35.55 | |

| Hydro One Ltd (H) | 77.06 | 6.01 |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 130.84 | |

| Brookfield Renewable Corporation (BEPC) | 59.68 | |

| Brookfield Asset Management (BAM) | 2.11 | |

| Brookfield Corporation (BN) | 2.06 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 28.62 | |

| Brookfield Infrastructure Corporation (BIPC) | 18.73 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.40 | |

| Enbridge Inc. (ENB) | 22.19 | |

| Saputo Inc. (SAP) | 5.40 |

USD Dividends

| Company | USD Payments ($) | Dividend Change (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 29.75 | |

| McDonald’s Corporation (MCD) | 27.14 | |

| Yum! Brands, Inc. (YUM) | 20.06 | |

| Yum China Holdings, Inc. (YUMC) | 4.31 | |

| PepsiCo, Inc. (PEP) | 9.78 | 10.00 |

| Visa Inc. (V) | 5.74 | |

| Microsoft Corporation (MSFT) | 7.52 |

Dividend Earnings Totals

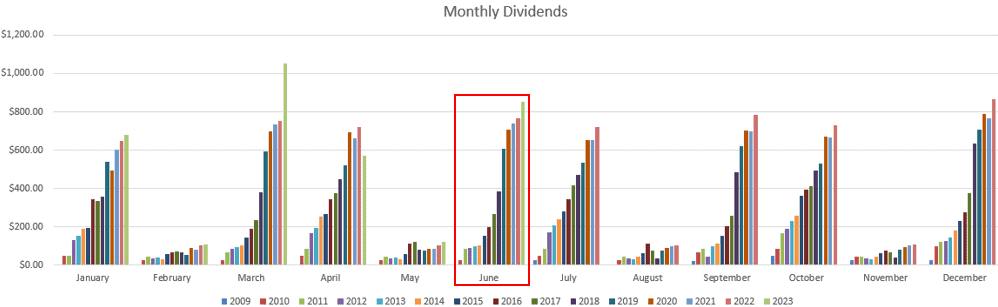

I earned C$744.86 and U$105.28, combining for a currency-neutral $850.14. This is the third time I’ve ever crossed the $800 threshold, and the second time this year alone.

The tide continues rising.

This sum represents an 11.11% increase over my June 2022 dividend totals. As I’ve stated before, being able to notch double digit growth rates is a great feeling. I typically aim for the 6–8% range, so anything above that is wonderful.

When I look back at the first two years I started investing in individual stocks—2009 and 2010—I had earned less than this single month alone.

Progress takes time. It requires patience and consistency.

Year To Date Progress

The green bar for June makes a noticeable jump higher after tepid growth over the past few years:

I’ve firmly crossed the $3k barrier with the first half of the year in the books:

| Month | Dividends ($) |

|---|---|

| January | 680.90 |

| February | 107.14 |

| March | 1,050.94 |

| April | 572.74 |

| May | 118.51 |

| June | 850.14 |

| Total | 3,380.37 |

I continue to target $7k for total dividends earned through 2023.

Market Activity and Cash

No purchases were made through June. It continued to be a month of holding cash and sitting aside.

It has been an interesting market as inflation has been rather persistent while markets have steadied. I’m still hoping for some real bargains as we approach the second half of the year.

Conclusion

Every bit of dividend growth helps. The dividend snowball requires a watchful eye, with steady hands. Tending a portfolio is about making a few good decisions and letting the companies do the heavy lifting.

Sales should be few and far between and only for extreme circumstances. Focus energy on making purchases of high-quality companies and get out of the way.

I look forward to the final stretch of the year with plenty of momentum to ride.

Full Disclosure: REI-UN, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, V, MSFT