As I write this at the beginning of April, I am left to wonder where March went. It was filled with chilled weather and ample amounts of snow. Even now the clutches of the wintry months have yet to soften their grasp.

Signs of progress within my portfolio abound, however. Since beginning to track of my portfolio on a monthly basis, I have made a steady march upward in terms of passive income earned. As a dividend growth investor, it is easy to fall back on autopilot and just accumulate dividends. That’s both the beauty and the risk of the strategy; it doesn’t require a lot of maintenance once you’ve set the foundation.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) | Div Increase (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 | |

| Johnson & Johnson (JNJ) | 76.56 | |

| Corby Spirit and Wine Ltd. (CSW.B) | 50.60 | |

| Fortis, Inc. (FTS) | 72.00 | |

| Canadian Utilities Limited (CU) | 84.54 | 7.48 |

| Canadian National Railway Company (CNR) | 8.06 | 18.13 |

| Hydro One Ltd (H) | 59.80 | |

| Chartwell Retirement Residences (CSH.UN) | 4.90 | |

| Metro Inc. (MRU) | 4.00 | 11.11 |

| Brookfield Renewable Partners L.P. (BEP.UN) | 128.86 | 5.10 |

USD Dividends

| Company | USD Payments ($) | Div Increase (%) |

|---|---|---|

| Waste Management, Inc. (WM) | 21.79 | 10.22 |

| McDonald’s Corporation (MCD) | 20.71 | |

| Yum! Brands, Inc. (YUM) | 13.93 | 16.67 |

| Yum China Holdings, Inc. (YUMC) | 3.98 | |

| PepsiCo, Inc. (PEP) | 7.89 | |

| Visa Inc. (V) | 2.13 |

Dividend Summary

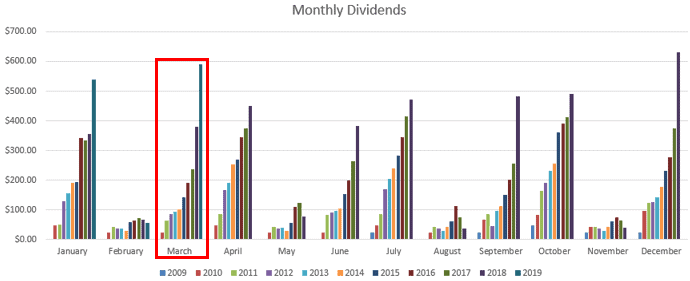

I was able to rake in $520.64 CAD and $70.43 USD from sixteen different companies, coming together for a currency-neutral total of $591.07. A year ago when I “only” brought in $379.76 in the same month, it would have seemed impossible to add over $200 of passive income to my total. It shows the strength of consistent purchases and doing my best to target companies I feel show opportunity despite depressed share prices. A regular commitment to accumulating assets pays off over time.

As has been the case in many of my recent monthly graphs, March again far exceeded previous totals:

Market Activity

It has become incredibly hard to find real value in the markets. Ever since the market bottomed in late December, the bounce back has been considerable. Given the lofty valuations of late, I haven’t made any purchases through March, though this makes for the second consecutive month of inactivity, marking a trend I’d rather not make a habit of.

The fact is that returns are impacted by the price we pay for our investments. It’s always better to buy at lower prices when they can be obtained. There are costs to my current course, however, in that I am not earning rising dividends on the dollars I have parked on the sidelines collecting some interest. The saying is that time in the market is more important than timing the market. I believe this to be true, and yet hesitate to pay too much for companies.

I feel I will make at least one purchase in April, if for nothing else than to keep the momentum I’ve been able to generate over the past year and a half in my portfolio.

Cash

I continue to earn 3% on my idle cash. It’s not a bad sum considering how low interest rates have been over the past decade. Still, I look at the interest earned here simply as a nice bonus since my real focus for passive income is from dividends paid by high quality companies.

Conclusion

It feels great to be able to increase my YOY totals by over $200, or ~56%. I dedicated myself to a heavy investment regimen through 2018 and the fruit of that labour is showing itself this year. Investing truly comes down to planting seeds and then harvesting in the future.

Having made no investments this month comes as a wake-up call that I need to get back to regular market activity. Even if the valuations of solid companies are high, it is always possible to nibble a bit while still keeping cash on the sidelines for real opportunities.

Full Disclosure: Long REI.UN, JNJ, CSW.B, FTS, CU, CNR, H, CSH.UN, MRU, BEP, WM, MCD, YUM, YUMC, PEP, and V

GRB –

Amazing results. Also – how are you earning 3%?! What financial institution are you using? Highly interested!

-Lanny

Hey Lanny,

The 3% comes from Tangerine Bank. Not sure you have access to it in the U.S., but it’s a solid online bank if you do. They routinely give me excellent rates on my parked cash!

Take care,

Ryan