May turned out to be another month of generalized lockdown. The volatility of March appears to be held at bay thus far and it has become increasingly challenging again to find bargains.

The weather, however, turned warmer toward the end of the month and it seems there’s actually a chance we’ll get a summer to enjoy in the weeks to come. The temperatures have been in the 8°-12° Celsius range when I get out for a morning run, which is quite nice.

As for dividends, there have been a few ups and downs which I will detail below.

Table of Contents

Canadian Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 |

| Chartwell Retirement Residence (CSH.UN) | 5.10 |

US Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 44.14 |

| Mastercard Incorporated (MA) | 2.38 |

Dividend Summary

I received C$36.42 and U$46.52 this month in dividend income, totaling $82.94 in currency-neutral terms. As usual for May, this is a relatively low total as a result of most of my dividend payments coming in other months.

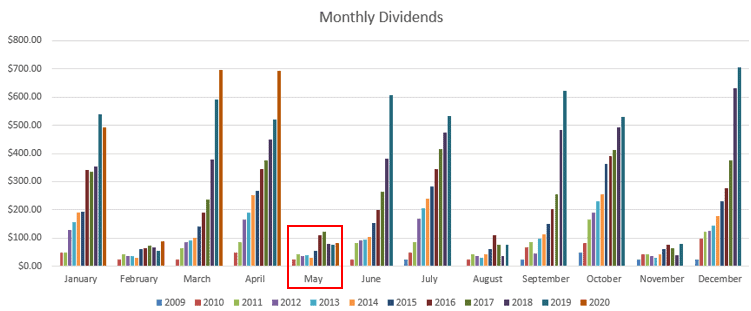

Here’s a quick look at how May has shaped up for me in the past:

So, it may not be a lot, but it’s still slightly higher than last year. Progress is progress, I suppose.

As the standout—although it was only for U$2.38—it felt great receiving my first dividend payment from MA. I purchased the stock twice in February. In terms of the futility of timing the market, it’s worth mentioning that I made my purchases right before the market fell off a cliff and so I didn’t get in at great prices. Yet, I’m still currently up overall because I didn’t sell when the dip occurred and prices have since recovered.

I don’t have any stock market activity to report this May in the form of buys or sells. I collected my dividends and sat on the sidelines as I haven’t seen any deals that have tempted me.

I have been expecting a bit of a lull after I managed to invest $10,000 in March which is a personal record. If the volatility picks back up, I’ll be content to put some more capital to work.

Dividend Progress – Year to Date

I was able to get just above $2,000 through the first five months of the year. It has been a solid start to the year, particularly considering the pandemic and oil glut:

| Month | Dividends ($) |

|---|---|

| January | 494.10 |

| February | 86.82 |

| March | 697.25 |

| April | 691.94 |

| May | 86.82 |

| Total | 2,053.05 |

I’m optimistic about the months to come as I have put plenty of money into the market over the past few months which will yield fruit in the second half of 2020.

Dividend News

Since late February, the torrent of negative investing headlines has been quite steady. If you didn’t know any better, you might think the world was actually coming to an end. From bankruptcies to temporarily shuttered stores to dividend cuts and suspensions, the impression has been that things have been all bad.

To put things more mildly, suffice it to say that it was the best of dividends, it was the worst of dividends. What I list below is the dividend news I’m aware of within my own portfolio through this recent period.

There have been plenty of other dividend cuts in the news, but I’ve been impacted only to a minor extent given that my portfolio consists primarily of high quality companies. When you stick to quality, you don’t need to fear the ups and the downs in the market.

Let’s start with the downside.

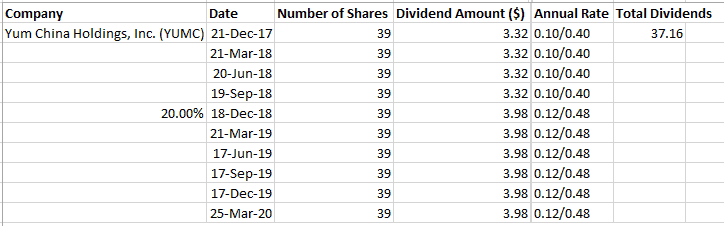

Yum China Holdings, Inc. (YUMC) Dividend Suspension

YUMC suspended its dividend payment. This one didn’t come as any surprise given that the entire pandemic kicked off in China, which is where—not surprisingly—YUMC does all of its business. When YUMC was spun out of Yum! Brands (YUM) back in October 2016, I never thought it should even begin paying a dividend because its mandate at the time was to capitalize on growth in the Chinese market and continue expansion.

From my personal spreadsheet, here’s the brief and questionable history of the company’s dividend payments:

Needless to say, it’s not very inspiring data. First an increase for December 2018, then no increase the year after, and now ultimately a dividend suspension. Either way, it was one of my lowest dividend contributors within my portfolio, so it’s not causing much disruption as it stands.

Corby Spirit and Wine Limited (CSW.B) Dividend Cut

On May 13, CSW.B cut its dividend from $0.22 per share quarterly to $0.20. Despite posting strong results to this point, the Board of Directors felt it prudent to cut the payout slightly in order to preserve capital during this period of uncertainty.

Since first opening my position in CSW.B back in December 2014, the company had increased its dividend modestly from C$0.19 quarterly to C$0.22. It had also paid two special dividends (January 2016 and January 2019) along the way.

This minor cut to the current payment will drop my quarterly income by C$6.00.

A&W Revenue Royalties Income Fund (AW.UN) Dividend Suspension

As I mentioned earlier, AW.UN put its monthly distributions on hold for the time being. They announced on March 31 that they would be temporarily suspending payments as a result of declines in restaurant performance which results in a setback to the royalty payable to the company. This may well be the case until we see some of the COVID-19 restrictions relent.

On my modest stake in the company, this will result in a C$6.36 cut to my income on a monthly basis. When or if these payments will resume remains to be seen, but I can anecdotally say that the A&W in town seems to always have traffic flowing within the drive-thru when I pass by.

AbbVie Inc. (ABBV)

On a more positive front, ABBV finally closed its deal with Allergan, maker of Botox. Great to have that transaction in the books so they can simply focus on realizing the planned synergies rather than spending energy—and resources—on the acquisition itself.

While this isn’t explicit dividend news, it’s a positive sign for the company as the acquisition was geared toward ensuring ABBV’s dividend would be safe as competition ramps up from biosimilar drugs to its blockbuster Humira.

Hydro One Ltd (H) Dividend Increase

For the best ray of sunshine, H announced on May 8 that it would be increasing its quarterly dividend from $0.2415 to $0.2536, a 5.01% boost to the payment. On my 260 shares, that means my payment will increase from $62.79 to $65.94, an increase of $3.15 quarterly. I’ll take it.

Well-constructed stock portfolios should consist of a variety of top flight companies. Within my portfolio, I consider utilities to be foundational and irreplaceable. One thing I feel confident about is that society is going to need increasing amounts of energy in the decades to come to power all of the electronics we have become increasingly reliant on. Holding stock in utilities is just one of the ways that I plan to reap the benefits of the technology age.

Cash

As noted above, I didn’t deploy any capital this period which ultimately means I added to my cash position. Sometimes the easiest thing is to wait it out and take a breather every now and then. I suppose the crux of the matter is that I just don’t trust the market rally at this point.

While my distrust doesn’t preclude the possibility of deploying some cash in the near term, I feel comfortable collecting cash from my high quality companies in the interim.

Running – Personal Goal

I said in my last update that I wanted to run 50km for the month. I wound up putting in 56km through May which is not a large number by any means, but feels great since I haven’t committed to running over the past few years—my last full marathon was back in October 2017.

Through June, I’d like to hit 80km, which really just comes down to consistently getting out in the morning for 5-6km. There’s a beautiful bike path along the water where I live, so there truly aren’t any excuses for not lacing up the shoes and getting in the roadwork.

I wouldn’t say that I have any plans to run a half-marathon or marathon at this point, but that’s always an option later in the year if COVID-19 relents.

Conclusion

When I look at the dividend totals I’ve posted this year and how relatively unscathed my portfolio has been both in overall value and in cash flow received, I am reminded of the strength of the dividend growth investing strategy.

My focus is always in sustainable gains. For the most part, I have managed to avoid being seduced by high yielding companies with poor growth prospects and the importance of that has demonstrated itself over the past few months. As we move into June and the restrictions of the pandemic begin to be lifted, companies should be further helped by resumed economic productivity and consumer spending.

While there have been a few dividend suspensions and cuts along the way, I continue to expect my portfolio income for the year to still increase overall.

Thank you for reading.

– Ryan

Full Disclosure: Long REI.UN, CSH.UN, ABBV, MA, YUMC, YUM, CSW.B, AW.UN, and H