It seems I’ve fallen behind on tracking my dividends. Finalizing this article on July 11, I am able to reflect on how pronounced the differences have been from the beginning of the year to this portfolio update.

2021 began with a heavy push for COVID vaccinations and there was hope that would really turn the tide. Initially, that isn’t how things worked out and in Ontario we experienced prolonged lockdowns.

Nevertheless, businesses have recently begun to reopen, along with outdoor setups for restaurants. A semblance of normalcy may be on the horizon.

Either way, this doesn’t change anything when it comes to my investment thesis. And so, I persist.

Table of Contents

Portfolio Update Summary

I earned income from six companies in May. On the Canadian side, we have the three monthly distribution payers in my portfolio. The American companies are all what I would regard as high-growth companies across the tech/fintech and biopharmaceutical spaces.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 20.88 | |

| Chartwell Retirement Residence (CSH.UN) | 5.10 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 5.40 |

USD Dividends

| Company | USD Payments ($) | Dividend Change (%) |

|---|---|---|

| AbbVie Inc. (ABBV) | 48.62 | 10.17 |

| Mastercard Incorporated (MA) | 2.62 | 10.00 |

| Apple Inc. (AAPL) | 3.30 |

Dividend Totals

May saw totals of C$31.38 and U$54.54, coming together for a currency-neutral $85.92. This edges out what I reported on my May 2020 portfolio update by 3.59%. While that isn’t much growth, it’s still something and beats inflation.

This increase can be mostly attributed to Apple Inc. (AAPL), a company I opened a position with in February and then averaged down into in March.

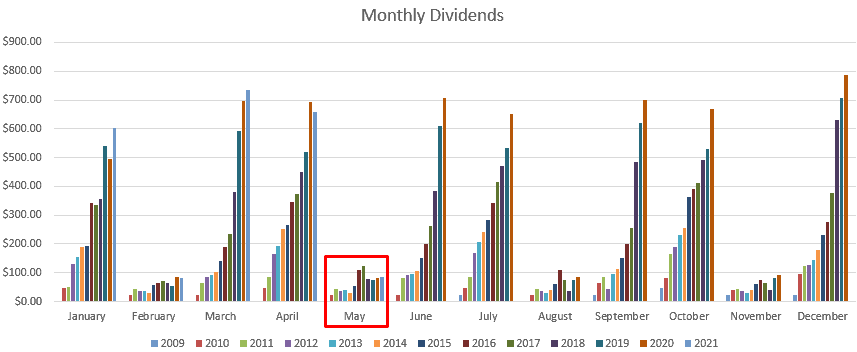

Here’s how the monthly dividend graph stacks up:

Year To Date Progress

The beauty of dividend growth investing shows itself when meaningful amounts of money start trickling in.

With May in the books, I’ve raked in over $2,150 since the start of the year:

| Month | Dividends ($) |

|---|---|

| January | 602.95 |

| February | 81.22 |

| March | 736.16 |

| April | 659.56 |

| May | 85.92 |

| Total | 2,165.81 |

While I continue to reinvest all cash flow received, this is money I could otherwise deploy for housing, transportation, or any other need that comes up. It provides optionality and some insulation against the ups-and-downs of life.

Market Activity and Cash

I have far less to report on this front than I normally do, at least as it pertains to the stock market. I didn’t buy any dividend growth companies in March. All dividends, instead, continued to just build up in my trading accounts. That cash will be ready for redeployment in the future.

With that said, I did make a number of purchases in some cryptocurrencies. As crypto prices declined, I decided to continue building out some positions.

For the first time, I initiated a position in Cardano (ADA). The ADA token is the digital currency for the Cardano blockchain network, which was developed by Charles Hoskinson, co-founder of Ethereum (ETH). The Cardano and Ethereum blockchains go beyond Bitcoin (BTC) as they allow deployment of smart contracts.

Related Post: Block Technology Explained

Smart contracts are computer programs that are designed to remove intermediaries (i.e., from financial transactions). With a smart contract that can execute based on set parameters, there is no need for trust between individuals. This is currently a new, burgeoning field, and I enjoy investing before full mainstream adoption.

Conclusion

May proved to be a month for biding my time. I didn’t make any splashes in the stock market, but rather kept to the sidelines.

Building out some cryptocurrency positions is a decision I made some time ago and plan to continue, particularly on large pullbacks. It’s not uncommon to see crypto up or down by 10% over a single 24-hour period, so I have no doubt opportunities will arise.

This month showed cracks in the global COVID situation, fortunately. As the warmer months take hold, we should see an improvement in overall quality of life.

Thank you for reading.

– Ryan

Full Disclosure: Long REI-UN, CSH-UN, AW-UN, ABBV, MA, AAPL, various cryptocurrencies.