Nothing overly remarkable to report about November, on the face of it. With the market still strong, I found one opportunity to double down on a stock I already own as we head into the final month of the year.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 |

| Chartwell Retirement Residence (CSH.UN) | 5.00 |

| Metro Inc. (MRU) | 4.00 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 40.02 |

Dividend Summary

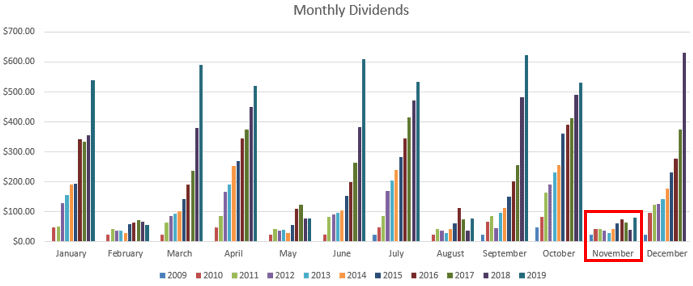

November brought in C$40.32 and U$40.02, combining for a currency-neutral total of $80.34. This is not unusual for the November payment period; it tends to be among the lowest on the dividend schedule for my portfolio.

Having said that, I was a bit surprised to note that this was actually my highest paying November on record:

Of the four companies I received income from, the only one I have any intention to consider adding more capital to would be ABBV. It has had a volatile year and, should the opportunity present (subject to available capital), I would consider increasing my stake.

Year To Date Progress

Heading into the final leg of the year, the portfolio is already sitting on record growth. The totals just keep growing:

| Month | Dividends ($) |

|---|---|

| January | 540.02 |

| February | 54.41 |

| March | 591.07 |

| April | 521.00 |

| May | 76.34 |

| June | 608.09 |

| July | 533.85 |

| August | 76.34 |

| September | 621.73 |

| October | 530.64 |

| November | 80.34 |

| Total | 4,233.83 |

As we open the book on December, my portfolio is poised to close out the year with ~$4,900 in total dividend income.

Market Activity

The market has continued to remain strong, discouraging me from making any sizeable investments. However, I did nibble with another purchase of Corby Spirit and Wine (CSW.B).

I added 70 shares for a cash outlay of C$1,094.95. On the quarterly dividend of C$0.22, I expect this to bring in C$15.40 per quarter or C$61.60 annually.

CSW.B has been my worst performing company I’ve ever purchased as far as capital appreciation is concerned ever since I bought it for the first time at the end of 2014. However, the company has no debt and has consistently maintained its lofty dividend. Further, I did receive special dividend payments in 2016 and at the beginning of this year, over and above the regular quarterly payout.

Generally speaking, I like being invested within the alcoholic beverage industry as people tend to be quite brand loyal when it comes to their choice of drink. They order what they would like by name and are unlikely to switch brands just because of a nominal price increase. That said, I do not presently have any intention of increasing my position further at this stage; I was more interested in averaging down in a company I feel should be relatively secure as far as maintaining current dividend levels.

Cash

As ever, I have continued adding to my cash position at my current interest rate of 2.75%. This special rate expires at the end of January 2020, though, and so I will need to eventually start thinking again about where to store my idle cash. Prevailing standard rates remain pitifully low.

Conclusion

November is habitually a slow dividend payment month and this comes as no surprise. At this stage, my focus is on the December payments which tend to be the highest of the year in my portfolio.

I have moved some capital to my investing account and am hoping for some end-of-year bargains to close out the season which would provide a springboard for a successful 2020.

Full Disclosure: REI.UN, CSH.UN, MRU, ABBV, CSW.B

GRB –

I hear you on the constant shuffle of cash position to try to ensure you are earning a reasonable rate for the idle amount. Currently have most of my cash with Ally at 1.70%. Done any research yet on where to go next?

-Lanny

Hey Lanny,

I may well give CIBC a call and see if I can get a promotional rate applied when switching cash over to them. Every now and then I will do that to help nudge things along.

1.70% with Ally is pretty decent as well. Ever try switching things back and forth between online banks to see if you’ll eventually automatically get offered a promotion?

Ryan