November was a busy, historically significant month. We witnessed one of the most hotly contested and intense U.S. elections on record. At the time of writing, it is still being actively appealed by the incumbent.

While the election and the ensuing drama have made for an interesting story to follow, it is important to remember that as investors we must also be mindful that the noise is… well, just noise.

Keep to what is important. Focus on what matters.

In my case, and for the purposes of this article, what matters is cold hard cash hitting my investment account. Every dollar represents future dollars to be earned through compounding.

My role as steward of this money is to keep it rolling over, month by month.

Table of Contents

Dividend Summary

I received payments from six companies through November. Each of those payments came from a different industry and represents the diversity of income that I like to see.

Healthy-but-not-excessive diversification can provide an additional buffer to the vicissitudes of the markets. This has proven itself once again to be vital, particularly in a year where the economy was brought to a virtual standstill for months at a time.

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 |

| Chartwell Retirement Residence (CSH.UN) | 5.10 |

| Metro Inc. (MRU) | 4.50 |

| A&W Revenue Royalties Income Fund (AW.UN) | 4.00 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 44.14 |

| Mastercard Incorporated (MA) | 2.38 |

I earned C$44.92 and U$46.52, coming together for a currency-neutral total of $91.44. While this is a low level of dividends relative to my other months, it is actually the most I’ve ever earned for a November. I’ll take that gladly—it’s important to celebrate all successes, right?

Here’s how the dividend graph looks:

The tower of income continues to layer on additional floors.

Year To Date Progress

With the big December dividends still yet to be paid, I’ve already surpassed my 2019 dividend total, coming in just shy of $5k:

| Month | Dividends ($) |

|---|---|

| January | 494.10 |

| February | 86.82 |

| March | 697.25 |

| April | 691.94 |

| May | 82.94 |

| June | 708.70 |

| July | 651.30 |

| August | 86.94 |

| September | 701.85 |

| October | 668.33 |

| November | 91.44 |

| Total | 4,961.61 |

Putting those dividends directly back into the market is what keeps the compounding train rolling.

I don’t spend any of the income that I list here on personal expenditures. I put every cent back into other high quality companies.

Market Activity and Cash

I made two stock purchases in November—each to initiate new positions.

I bought 1 share of Shopify Inc. (SHOP) for a total cost of C$1,304.95. I picked up 15 shares of BigCommerce Holdings, Inc. (BIGC) for U$1,027.40. My total cash outlay in currency-neutral terms comes to $2,332.35.

These purchases fall outside of my usual wheelhouse; neither company pays a dividend. However, I believe it is important for me to take a stake in some high-growth companies across the tech-sphere.

I’ve spent years building a foundation of dividend-paying companies and that will remain the bedrock of my portfolio, but deploying some of that cash flow into burgeoning industries is a prudent move at this stage.

Shopify

SHOP’s goal is to allow businesses to sell their products online to buyers anywhere. The company has billions of consumer interactions in its database from which to learn how better to position its offerings in the future by way of advanced machine learning.

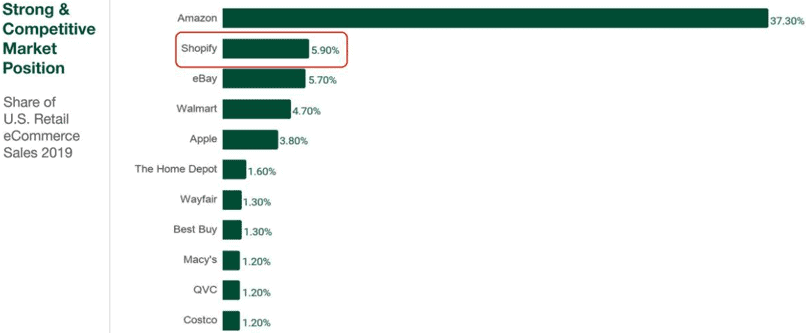

From their Q2 2020 Earnings Call Presentation, they were behind only Amazon.com Inc. (AMZN) in terms of their eCommerce sales market position:

The runway for growth remains huge as SHOP continues to build on its success at meeting the needs of online vendors.

BigCommerce

BIGC is a Software-as-a-Service (SaaS) company which enables online stores to simplify their point-of-sale systems. Some of the better-known companies currently doing business with BIGC include Ben & Jerry’s and Skullcandy.

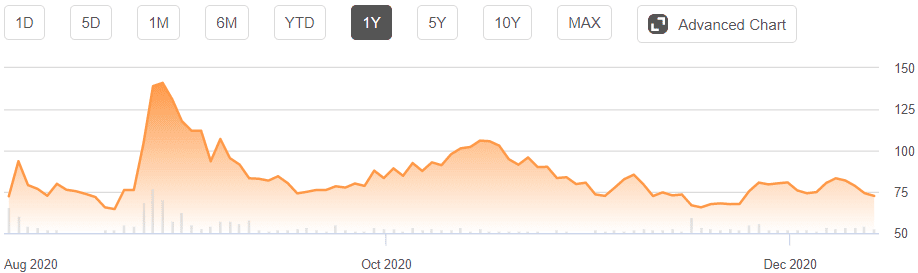

The company had its Initial Public Offering (IPO) on August 4 of this year. From there, the shares reached a peak of over U$140 in late August before falling off a cliff and back down to the levels they were at around the time they began trading in the secondary market:

Although it’s invariably difficult to value an IPO, I decided it was worth getting on board with this one early in the process as I wanted to have a piece of the growing market that the business serves.

Conclusion

I’ve already earned more through eleven months than I did in all 2019—Knowing this was achieved despite the COVID-19 pandemic again demonstrates the strength of the dividend-growth investing strategy.

High quality companies reward shareholders. It’s that simple.

Having said that, I’m excited to have socked away two companies in the eCommerce space. It’s hard to quantify just how much room there is for growth in that field. I plan to be a shareholder for years to come.

Thanks for stopping by.

– Ryan

Full Disclosure: Long REI-UN, CSH-UN, MRU, AW-UN, ABBV, MA, SHOP, AMZN, BIGC