November was warm in the first half and turned to snow in the second. There’s no longer any question that Winter is Coming, as my truck window needs a good scraping each morning.

Similar to the split in the weather, there was both good and bad news through the month. I’ll cover both in the article below.

Table of Contents

Dividend Summary

I received payments from seven companies, one of them providing a boosted payout.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 20.88 | |

| Chartwell Retirement Residence (CSH.UN) | 5.10 | |

| Metro Inc. (MRU) | 5.00 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.20 | 3.33 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 58.50 |

| Mastercard Incorporated (MA) | 2.62 |

| Apple Inc. (AAPL) | 3.30 |

I raked in C$37.18 and U$64.42, coming together for a currency-neutral total of $101.60. This represents an 11.11% increase over my November 2020 totals.

November is typically a lower paying month for my portfolio. Still, getting a double-digit gain year-over-year provides some healthy compounding. These gains will be reinvested into other high-quality companies.

I would also add that the $101.60 in income actually represents a November record for me. It’s important to celebrate all wins, even the small ones.

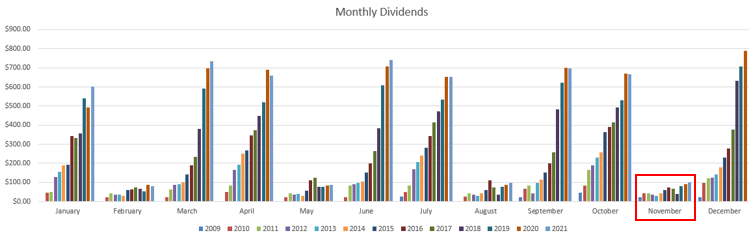

Here’s a snapshot of my November gains:

I know I’m on the right track when the bars in the graph get taller.

Year To Date Progress

The $5,119.05 YTD total amounts to a 3.17% increase over last year at this stage:

| Month | Dividends ($) |

|---|---|

| January | 602.95 |

| February | 81.22 |

| March | 736.16 |

| April | 659.56 |

| May | 85.92 |

| June | 739.71 |

| July | 652.45 |

| August | 96.40 |

| September | 697.46 |

| October | 665.62 |

| November | 101.60 |

| Total | 5,119.05 |

Given this represents only dividend income (i.e., excluded interest on idle cash), I should be in line for a close finish for the $6,000 mark I was eyeing this year. I’m looking forward to seeing how December shakes out.

November News

As mentioned, this turned out to be an eventful month overall. There were upsides and downsides along the way.

Canadian Banks Raising Dividends

The Office of the Superintendent of Financial Institutions (OSFI) is the regulator of banks in Canada. OSFI is an agency of the Government of Canada.

In March 2020 as the pandemic cratered the financial markets, OSFI announced that Canadian banks could not increase their dividends, executive compensation, or execute stock buybacks of their own shares. This month, they reversed that decision.

This is fantastic news. It means the Canadian banks can finally get back to rewarding shareholders as business permits.

As I write this on November 30, Bank of Nova Scotia (BNS) has already announced an 11.11% dividend increase. The rest of the Big Five will be providing their earnings later this week. I expect further dividend increases to follow.

The tide rises.

Featured on Tawcan

Get Rich Brothers was recently featured in Bob from Tawcan’s roundup of the best US Dividend Stocks. I was honoured to be included in the list of top Canadian dividend growth investment bloggers who were asked to participate.

The top three dividend growth stocks that I chose are as follows –

- Microsoft Corporation (MSFT)

- AbbVie Inc. (ABBV)

- McDonald’s Corporation (MCD)

I wanted to be sure my selections provided a blend of growth and yield, along with being companies I plan to hold for life. That said, I may pick another three companies if you ask me on another day; there are so many great ones to choose from.

For my rationale on each of the specific businesses, feel free to check out the Tawcan website I linked above.

Omicron COVID Variant

For news on the downside, a new COVID variant named “Omicron” has been discovered. Earlier this year we had already been dealing with the Delta variant, and now it feels like ground hog day.

The full weight of this variant has yet to be uncovered. There have been various reports that it may be more transmissible than other strains but that, hopefully, it may not be as deadly.

I provided my thoughts on dividend growth investing and COVID back in May 2020. At that time, I stated that I felt our best days were ahead. I still feel that way.

I also still feel that investing in high quality companies remains one of the best ways to compound wealth. There isn’t a variant of concern out there today or yet to come that will shake this faith.

Market Activity and Cash

My sole stock purchase of the month was Square, Inc. (SQ). This is a growing financial technology company. It provides contactless payment solutions for businesses of all sizes. The company has been innovating for quite a few years now and I believe has room to continue challenging the incumbents in its space.

While SQ doesn’t pay a dividend, this purchase fits with my overall theme of 2021. I have been broadening my portfolio’s base beyond established value companies, seeking to add more tech. The future is a digital one. I want to be on board for that ride.

Picking winners will always be challenging, but I’d rather be mostly right than entirely wrong. Being entirely wrong would be to avoid technology altogether.

In terms of cash, I have mostly continued building my cash stockpile. I remain of the mindset that there is a reckoning yet to come.

My preferred method to position for a stock market downturn is the following –

- Continue holding the companies I already own. Selectively reinvest dividends as opportunities present.

- Build a cash position to be poised for large deployments of capital. Be prepared to move quickly.

As a general rule, I avoid selling stocks even when the markets are high. I don’t like the guesswork of trying to time the top or the bottom. For my own peace of mind—and because I don’t believe anyone has a crystal ball good enough to time the market precisely—it is a more practical strategy to avoid rampant buying-and-selling.

Conclusion

I earned a record dividend income total for November. In what is traditionally a slow month, I was able to post a triple digit sum. Well earned.

Knowing the banks will be raising dividends gives me plenty of confidence as we head to the end of the year. The rest of this week should bear great news.

When it comes to COVID variants, always remember that the media sells fear. It generates clicks and sells magazines. It gives them something to talk about, write about, and make a big deal about.

Stay the course. Your own course.

Collect your dividends, reinvest them wisely for the future, and disregard the noise.

Full Disclosure: Long REI-UN, CSH-UN, MRU, AW-UN, ABBV, MA, AAPL, MSFT, MCD

Nice Ryan

Congrats on triple digits. Like you these are off months for us as well. Definitely got to love all these bank raises. It was a good week for sure and enbridge should have some good news for us next wk.

I agree about covid, ignore news it feeds off this

cheers man!

Passivecanadianincome recently posted…The $20,000 Goal I Forgot About

Hey Rob,

Yeah, amazing week for our Canadian Banks. Love seeing them back able to raise dividends again to juice our returns.

Take care,

Ryan