The last part of the year really got away from me, so I’m actually writing this in February 2024. I’ll have to make a few brief posts to get caught back up with these monthly updates.

Table of Contents

Dividend Summary

I earned income from eight companies, split evenly between Canada and the US.

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 23.49 |

| Chartwell Retirement Residence (CSH.UN) | 5.10 |

| A&W Revenue Royalties Income Fund (AW.UN) | 11.20 |

| Metro Inc. (MRU) | 6.05 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| AbbVie Inc. (ABBV) | 66.60 |

| Mastercard Incorporated (MA) | 3.40 |

| Apple Inc. (AAPL) | 3.60 |

| Abbott Laboratories (ABT) | 5.10 |

I earned C$45.84 and U$78.70, combining for a currency-neutral $124.54. In relation to my November 2022 dividend totals, this represents a growth rate of 14.25%.

The income this month was bolstered by a first-time contribution from Abbott Laboratories (ABT). This is a company I’ve wanted to own for around a decade, but never pulled the trigger. The dividend yield has always been low, but that’s a symptom of a rising share price.

I finally decided it was time to pull the trigger and put both sides of the family back together; ABT is the parent company that spun out ABBV, and I’ve owned the latter since 2018.

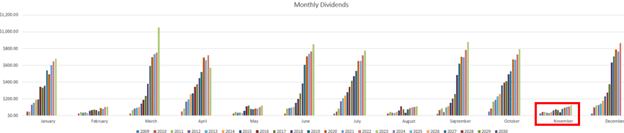

As always, the goal remains to keep the bars on the chart ascending:

Year To Date Progress

Crossing $6k puts me in striking position of the $7k target I set at the start of the year, given December’s historically strong finish:

| Month | Dividends ($) |

|---|---|

| January | 680.90 |

| February | 107.14 |

| March | 1,050.94 |

| April | 572.74 |

| May | 118.51 |

| June | 850.14 |

| July | 773.75 |

| August | 113.39 |

| September | 881.65 |

| October | 795.17 |

| November | 124.54 |

| Total | 6,068.87 |

It’s going to be a close finish, one way or the other as the year winds down. I’m thankful to have so much of the growth come organically from companies raising their dividends, along with reinvested dividends.

The dividend engine just gets stronger with time.

Market Activity and Cash

I made a single stock purchase this month.

I picked up 25 shares of Brookfield Infrastructure Partners L.P. (BIP.UN), marking the fourth tranche of the company purchased in 2023. I’ve covered them in detail many times, and my general thesis is that they are a mature company providing services that are vital to the global economy. What they produce is never going out of style.

The world will continue requiring larger amounts of energy, along with secure data centers, and BIP.UN is poised to service this for the decades to come.

Conclusion

My portfolio continues to hum along with the times. Even with just minor additions here and there, the compound growth is noticeable.

We shall see if December tips the scales just above $7k.

Thank you for reading. Full Disclosure: Long REI-UN, CSH-UN, AW-UN, MRU, ABBV, MA, AAPL, ABT