The beautiful changing leaves of September have all but wilted away. In times like these, the best solace is the regularly scheduled, proverbial dividend cheques as they hit one’s digital trading account.

Speaking of which, I’ve had several recent discussions with those concerned their energy bills will be rather high when the snow starts flying. My recommendation for this is always to simply own shares in the energy companies. Get paid while you’re paying and enjoy the ride.

Table of Contents

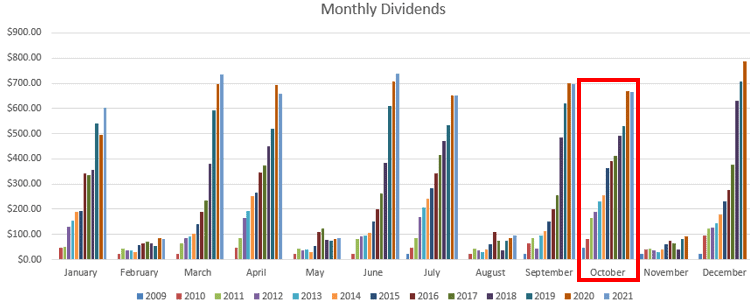

Dividend Summary

October brought cash flow from eleven high-quality companies. While there were no dividend raises, the income was predictable and steady.

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| Toronto Dominion Bank (TD) | 158.00* |

| RioCan Real Estate Investment Trust (REI-UN) | 20.88 |

| The Coca-Cola Company (KO) | 70.64 |

| BCE Inc. (BCE) | 192.50 |

| Canadian Imperial Bank of Commerce (CM) | 17.52 |

| Bank of Nova Scotia (BNS) | 90.00 |

| TELUS Corporation (T) | 67.98 |

| Rogers Communications Inc. (RCI-B) | 27.50 |

| Canadian Pacific Railway Limited (CP) | 9.50 |

| Chartwell Retirement Residence (CSH-UN) | 5.10 |

| A&W Revenue Royalties Income Fund (AW-UN) | 6.00 |

I earned C$665.62 through October. This is one of the periods where I only earn cash flow in Canadian dollars. My American companies tend to pay largely on the March-June-September-December quarterly schedule.

My income was down slightly from October 2020. I can attribute this to the following:

- My dividend from Saputo Inc. (SAP) was paid in September this year, instead of October.

- I received a special payment from AW-UN last October. This year I only received the regular monthly distribution.

All things considered, this still remains a strong period of dividend income.

* The TD dividend was truly paid in November. I chose to keep the payment in October as it has traditionally been paid.

Year To Date Progress

October posted some rather decent totals:

I’m at $5,017.45 in dividend payments with two months left on the calendar:

| Month | Dividends ($) |

|---|---|

| January | 602.95 |

| February | 81.22 |

| March | 736.16 |

| April | 659.56 |

| May | 85.92 |

| June | 739.71 |

| July | 652.45 |

| August | 96.40 |

| September | 697.46 |

| October | 665.62 |

| Total | 5,017.45 |

My passive income target this year was $6,000. I suspect this will now be an unlikely figure given two key factors:

- I have been focused this year on non-dividend paying technology investments.

- Interest rates have remained incredibly low. As a result, my sideline cash hasn’t been providing much for me aside from psychological comfort.

That said, I should come in remarkably close.

Facebook’s Metaverse

The biggest game-changing announcement of the month came in late October with Facebook (FB) changing its name to “Meta Platforms, Inc.” Along with this change came a video, mostly featuring Mark Zuckerberg, which outlined the company’s plan to focus on building the metaverse.

Their vision of the metaverse involves fostering social connections through both virtual and augmented reality. The concept is that any experience one might normally think exists only in “real life” may actually be extended digitally.

Here are some concepts that may be shaped by the metaverse:

- Home

- You would be able to develop a virtual space where you display your art (e.g., non-fungible tokens) and host social gatherings.

- Education

- You could virtually experience being in the same room as classmates and world-renowned professors.

- Exercise

- You could have an actual sparring match with a friend, all with the backdrop of being on another planet.

- Gaming

- First-person shooters where you’re hearing, seeing, and feeling everything around you.

- Social Interaction

- You could attend live concerts and after-parties, all without leaving your home.

I strongly encourage anyone reading this to actually watch the videos. It can be difficult to imagine exactly how this may shape our world in the years to come, but there is no doubt this is the trajectory we’re on.

There will be room for many winners in this future. The size of the pie will continue expanding, so it won’t be necessary to be perfectly right every time.

One of my focuses in the years to come will be to keep an eye out for prospects to invest within the ecosystem of the metaverse.

Stagflation and COVID-Related-Reopening

One of the key themes through October has been related to overall price inflation. Certain natural resources such as oil have been on a sustained run-up since the start of the year.

Here’s a look at crude oil WTI from the start of the year –

Source: MarketWatch

At this stage, some market pundits are ultimately predicting that we’re entering a period of stagflation, which is characterized by high inflation and poor economic/jobs growth.

Inflation

One of the levers that central bankers can use to tamp down inflation is to increase interest rates. The trouble at this stage is that many low- to middle-class households are massively indebted. As a result, it isn’t as easy as simply raising rates, or else governments would be faced with the bigger problem of a housing crisis.

The oversized mortgages currently out there are, in many cases, one symptom of low interest rates in the first place.

Economic Growth and Jobs

We are in the midst of a new age when it comes to workplace employment.

COVID has ravaged the world and accelerated the work-from-home trend by at least a decade. Governments have enforced lockdowns and enacted record levels of stimulus for those sidelined.

This has created conditions where many have chosen to remain on government support rather than look for work. It’s hard to blame them when it’s uncertain how long they may remain employed if they do find a job.

It’s tough to raise a family and pay a mortgage (see above) under the threat of new restrictions potentially sidelining you again.

Likewise, those that have been working from home are finding that they enjoy their freedom. Those returning to work are, in many cases, renegotiating the terms of their employment. We will certainly see more hybrid work models in years to come.

All of this strains the jobs market and the tenuous economic situation we are seeing globally.

The full impact of COVID is yet to be understood. What we do know is that its effects will be felt for decades to come.

Market Activity and Cash

I haven’t been too excited about any deals in the markets. I’ve been looking for opportunities and finding it better to remain patient.

The following assets seem inflated:

- Equities in the stock market.

- Cryptocurrencies.

- Real estate.

As a result, I continue to stockpile cash with the hopes of any reasonable pullback. Exuberance is an expensive trait when it comes to investing. I see high tides as a time to trim the chaff in a portfolio, if anything.

Buying often on weakness and perhaps selling occasionally on strength has proven a solid strategy over the years.

Conclusion

This was a period where my portfolio effectively held the line. There wasn’t any remarkable progress over prior totals, but my companies continue paying with consistency. The bills are getting paid on time.

Sometimes that’s enough.

Every dividend dollar that hits the account is a source of atomic energy. In the hands of the right investor and redeployed effectively, each dollar has the potential to deliver generational wealth.

Facebook doubling down on the metaverse marks a new phase in our digital lifecycle. The company has the resources, vision, and user-base to make a real push for this.

Beyond the metaverse, other concepts like cryptocurrency are broadening the Web 3.0 infrastructure. As these themes shake out, a huge wealth transfer is going to take place. It’s already taking place. The only question is whether you’re position to take advantage of it.

When we look back in a decade, so much of the change will then appear obvious. Every bit as obvious as it currently seems opaque and, in some cases, incomprehensible.

Reinvest your dividends with the future in mind.

– Ryan Full Disclosure: Long TD, REI-UN, KO, BCE, CM, BNS, T, RCI-B, CP, CSH-UN, AW-UN

Definitely a lot going on with the metaverse, web 3.0, defi, NFTs, etc. etc. Hard to keep up with the pace of technology and the rate of change. For me, I’m mostly focusing on staying the course with my BOOMER index funds while dabbling down these speculative avenues.

Impersonal Finances recently posted…The Power Of Compound Work

Hey IF,

Yeah, nothing wrong with Indexing. It’s actually what I’d most recommend to someone looking to get into investing. Keeps things simple and has been shown to provide the best returns for the vast majority.

Take care,

Ryan

nice month ryan.

I dunno about this whole meta verse thing.. we did skype etc before, nothing really replaces being in the same room with friends and family. I guess we will see, first player shooters would be improved for sure.

doesn’t your ko position pay in usd?

The market hasnt been really interesting but when we do see pullbacks on companys they are pretty huge – lmt, lightspeed etc

With so many new investors though I wonder how far things will fall once they start. I see ppl on fb always complaining when their stocks drop by like 1-2%. Like come on. =)

keep it up Ryan!

Hey Rob,

Yeah, the real technology to make the metaverse seamless is still a decade out. I think that’s where we’re trending, but it’s far from a sure thing as far as who the big winners of this will be.

I have my KO in CAD, so it pays dividends in CAD. I’ve considered switching it around, but never have… I don’t really mind, truly.

Absolutely — the earnings releases this season have shown huge double digit single-day moves on many companies.

Haha no doubt. Any new investor from the past decade has never seen a protracted downturn. It has been pretty much up and up, aside from that brief dip in March last year.

Take care,

Ryan