The tenth month of the year brought with it some incredible weather. The highlight, however, was a great road trip through Washington D.C. and Nashville. Driving nearly 4,000km for the expedition made it that much more enjoyable.

While on the adventure, dividends continued to pour in.

Table of Contents

Dividend Summary

October tends to be a CAD-only month for my portfolio, and this year was no exception.

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| The Toronto-Dominion Bank (TD) | 192.00 |

| RioCan Real Estate Investment Trust (REI.UN) | 23.49 |

| The Coca-Cola Company (KO) | 83.02 |

| BCE Inc. (BCE) | 212.85 |

| Canadian Imperial Bank of Commerce (CM) | 20.88 |

| The Bank of Nova Scotia (BNS) | 106.00 |

| TELUS Corporation (T) | 103.63 |

| Rogers Communications Inc. (RCI.B) | 27.50 |

| Canadian Pacific Kansas City Limited (CP) | 9.50 |

| Chartwell Retirement Residences (CSH.UN) | 5.10 |

| A&W Revenue Royalties Income Fund (AW.UN) | 11.20 |

I earned a total of C$795.17 through the period from 11 companies. Relative to my October 2022 dividends, this represents 9.32% growth.

Year To Date Progress

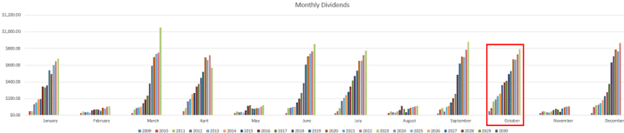

As always, the goal is simply to move the needle forward. When there’s clear growth month-over-month, it represents progress.:

With two months left to go, I’m already knocking on the $6,000 mark. This puts me within striking distance of my $7,000 goal for the year, which I’m now confident I’ll hit:

| Month | Dividends ($) |

|---|---|

| January | 680.90 |

| February | 107.14 |

| March | 1,050.94 |

| April | 572.74 |

| May | 118.51 |

| June | 850.14 |

| July | 773.75 |

| August | 113.39 |

| September | 881.65 |

| October | 795.17 |

| Total | 5,944.33 |

Market Activity and Cash

I made a single stock purchase in October with Brookfield Infrastructure Partners L.P. (BIP.UN). BIP.UN is a solid company with a global infrastructure footprint which spans the movement and storage of energy, water, freight, passengers, and data. Basically, they operate in fundamental areas which fuel and sustain the world’s economy and general activity.

The purchase this month represents my third cash outlay for the company’s shares in 2023 and is expected to add ~C$76.50 to my Projected Annual Dividend Income. It is presently one of my highest-conviction companies and one I plan to remain with over the longer term.

The 5–9% targeted distribution growth is juicy on top of the yield which commonly hovers in the ~5% range. This can be a healthy double-double for investors to stick it out over time.

Conclusion

I remember when having a single company earning $100 in any quarter was a novelty. Now, I have one crossing $200 and three more in the three-digit territory.

The dividend growth strategy comes down to patience and time in the market. If you can stick to high-quality companies and not get seduced by the high-fliers, a portfolio can truly grow like a money tree. Month after month, the fruit ripen and the branches extend further to bring a more bountiful harvest.

I may post some of the D.C. and Nashville photos when I get a chance.

– Ryan

Full Disclosure: TD, REI-UN, KO, BCE, CM, BNS, T, RCI-B, CP, CSH-UN, AW-UN