A quiet month overall. I didn’t make any stock purchases, preferring instead to simply keep track of market developments and hope for some better prices in the months again.

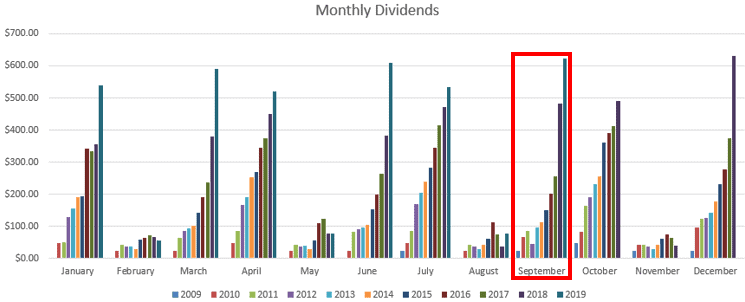

My income graph shows that September really notched its way up over last year’s totals.

Table of Contents

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 31.32 |

| Johnson & Johnson (JNJ) | 79.37 |

| Corby Spirit and Wine Ltd. (CSW.B) | 50.60 |

| Fortis, Inc. (FTS) | 72.00 |

| Canadian Utilities Limited (CU) | 84.54 |

| Canadian National Railway Company (CNR) | 8.06 |

| Hydro One Ltd (H) | 62.79 |

| Chartwell Retirement Residences (CSH.UN) | 5.00 |

| Metro Inc. (MRU) | 4.00 |

| Brookfield Renewable Partners L.P. (BEP.UN) | 130.09 |

| Brookfield Asset Management (BAM.A) | 3.18 |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 13.36 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| Waste Management, Inc. (WM) | 21.79 |

| McDonald’s Corporation (MCD) | 20.71 |

| Yum! Brands, Inc. (YUM) | 13.93 |

| Yum China Holdings, Inc. (YUMC) | 3.98 |

| PepsiCo, Inc. (PEP) | 8.12 |

| Wal-Mart Stores, Inc. (WMT) | 6.76 |

| Visa Inc. (V) | 2.13 |

Dividend Summary

I brought in C$544.34 and U$77.42, coming to $621.73 in currency-neutral dividends. I feel comfortable saying now that +$600 will be the new normal on my Mar-Jun-Sep-Dec payment schedule. While not all companies pay exactly quarterly, most keep a general rhythm as to the timings.

It was nice to have BAM.A and BIP.UN kicking in contributions this month for the first time. When I purchased them back in July, I had been hoping to average down on more shares if there was any weakness in the price. As it turns out, both have run for +10% in share appreciation since that time and effectively frozen me out of executing my plan. There are worse problems than owning some high-flying shares, I suppose.

On the BIP.UN front, the company announced a few days ago that it would be creating a Canadian corporation to attract greater levels of investment as it would provide more favourable tax treatment attributes. Unitholders are expected to receive 0.11 BIPC shares for each share of BIP.UN that they hold in the form of a special distribution. From my perspective, it is an immaterial event as far as wealth creation goes and ultimately create a bit more bookkeeping on my side since I track my dividends. The stock was up on the news, so apparently the market liked the idea.

Here’s a snapshot of my dividend progress:

Year To Date Progress

My progress throughout the course of the year has been very positive. September brought with it some excellent dividend results, adding to the rest:

| Month | Dividends ($) |

|---|---|

| January | 540.02 |

| February | 54.41 |

| March | 591.07 |

| April | 521.00 |

| May | 76.34 |

| June | 608.09 |

| July | 533.85 |

| August | 76.34 |

| September | 621.73 |

| Total | 3,622.85 |

I am on track to exceed my 2018 totals by around $1,000. I’d love to top that figure, and it will come down to the final months to see whether it comes to fruition.

Market Activity

The simplest thing I can say about the market is that it’s expensive. As much as I’ve been tempted lately to pull the trigger, so many stocks are near or at all-time highs. That’s my least favourite time to invest—I like to invest on value, not trade on momentum.

I’ve actually been looking outside of my usual wheelhouse and considering some tech names. Microsoft Corporation (MSFT) has been trading near all-time highs and strikes me as a particularly attractive investment opportunity on all metrics except valuation. I am hoping to see it come down so I can sock a few shares away in my portfolio. A great product offering, coupled with a growing—albeit low—dividend, has this one hitting my radar.

Cash

I’m still sitting comfortably, earning a 2.75% rate on liquid cash. I don’t mind sitting around a bit and hoping for another “December 2018” event to take place. This time I just need to be nimbler to take advantage.

Conclusion

This was a strong month for dividend income. Being paid to wait around for better prices is a great feeling.

As I read through internet forums and see others fretting about whether a Recession is coming and whether they should be buying or selling, I take comfort in holding firm to the sound strategy that dividend growth investing is. Being able to make money whether the market goes up or down is a vital component to high quality investing. It involves a mindset of patience, resilience, and opportunism when the time is right.

Full Disclosure: Long REI.UN, JNJ, CSW.B, FTS, CU, CNR, H, CSH.UN, MRU, BEP.UN, BAM.A, BIP.UN, WM, MCD, YUM, YUMC, PEP, WMT, V

No current position in MSFT, though I may consider initiating one in the near-term.

GRB –

2.75% on liquid cash is great, while the opportunities will present themselves. Nice work and looking forward to seeing you finish off 2019 strong!

-Lanny

Hey Lanny,

Yeah, it is at least some consolation to be getting a decent interest rate while waiting for better prices in the markets.

Same to you; looking forward to those end-of-year payments.

Take care,

Ryan