September is always a beautiful month. The leaves begin to turn and the weather cools down in the evening for comfortable sleeping.

It’s also a great month for passive income by way of dividends, which just happens to be my specialty.

Table of Contents

Portfolio Update Summary

I earned Canadian cash flow from 17 sources and US dollars from 8 more.

Please note that my JNJ dividends are received in CAD within my portfolio, so that is how I display them in the chart below.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 20.88 | |

| Johnson & Johnson (JNJ) | 84.24 | |

| Corby Spirit and Wine Ltd. (CSW.B)* | 10.50 | |

| Fortis, Inc. (FTS) | 90.90 | |

| Canadian Utilities Limited (CU) | 103.35 | |

| Canadian National Railway Company (CNR) | 27.68 | |

| Hydro One Ltd (H)** | 69.24 | |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| Metro Inc. (MRU) | 5.00 | |

| Brookfield Renewable Partners L.P. (BEP.UN) | 109.22 | |

| Brookfield Renewable Corporation (BEPC) | 26.83 | |

| Brookfield Asset Management (BAM.A) | 3.62 | |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 12.87 | |

| Brookfield Infrastructure Corporation (BIPC) | 1.29 | |

| A&W Revenue Royalties Income Fund (AW.UN)** | 6.00 | |

| Enbridge Inc. (ENB) | 20.88 | |

| Saputo Inc. (SAP) | 5.40 | 2.86 |

USD Dividends

| Company | USD Payments ($) |

|---|---|

| Waste Management, Inc. (WM) | 24.44 |

| McDonald’s Corporation (MCD) | 23.03 |

| Yum! Brands, Inc. (YUM) | 16.58 |

| Yum China Holdings, Inc. (YUMC) | 3.98 |

| PepsiCo, Inc. (PEP) | 9.14 |

| Walmart Inc. (WMT) | 7.02 |

| Visa Inc. (V) | 4.08 |

| Microsoft Corporation (MSFT) | 6.19 |

Dividend Totals

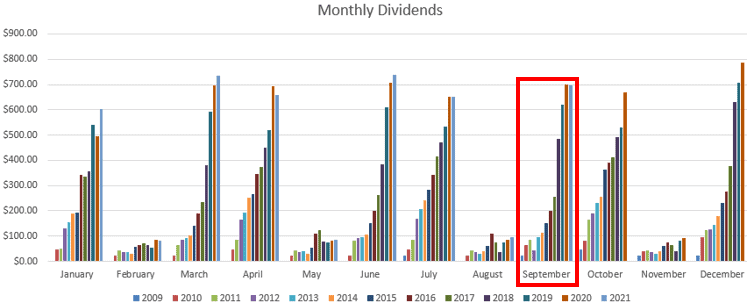

I earned C$603.00 and U$94.46, combining for a currency-neutral $697.46.

This is money that simply fills my account up and waits to be redeployed. One of the great joys of dividend growth investing is how simple it becomes once you have the snowball rolling.

* My Corby dividends are much lower than usual as I needed to sell some stock due to a TFSA overcontribution. I decided to trim Corby as they’ve had a rocky period through the pandemic with dividend payments. I intend to keep what’s left of my position in the company.

** I included Hydro One and A&W in my September figures even though they officially paid in October. It’s one of those odd situations where a company pays outside of its normal period.

Due to the Corby stock sale, my September tally came in slightly below September 2020:

I’m doing a quick skim of that article from last year and at that time my area was firmly in the midst of lockdowns. It wasn’t possible to eat-in at restaurants, among other restrictions.

It feels nice to now be much on the other side of lockdowns with them unlikely to persist. I’m optimistic that we’ll get through the colder months in good shape, with 2022 looking much brighter.

Year To Date Progress

I have brought in $4,351.83 in dividend income year-to-date:

| Month | Dividends ($) |

|---|---|

| January | 602.95 |

| February | 81.22 |

| March | 736.16 |

| April | 659.56 |

| May | 85.92 |

| June | 739.71 |

| July | 652.45 |

| August | 96.40 |

| September | 697.46 |

| Total | 4,351.83 |

Compared to the $4,201.84 from last year, I’ve posted a 3.57% growth rate. Considering the reduction in dividends from my partial sale of Corby stock, this is a decent increase.

I also have to consider the fact that the past year has been marked by much investment in non-dividend payers. I’ve been broadening my investment portfolio and the slower rate than historical norms demonstrates this.

Market Activity and Cash

I didn’t buy any stocks this month; have been keeping my eyes open for opportunities, but haven’t found many that I found attractive.

I do have a solid coffer set aside at this stage based on accumulated dividends. It feels fine in this period to sit it out a bit.

Should we get any significant market turmoil, I won’t hesitate to back up the truck and load up on shares.

Chinese Real Estate Concerns

One of the pressing stories this month was about the potential collapse of Evergrande, a Chinese real estate developer. While I suspect most people had never previously heard of this company, news reports were insistent that there could be widespread financial contagion if it began failing to pay suppliers, finish projects, and so on.

As we (humans) continue on our current path of globalization, there will always be scares like this. It gives the media something to sink their teeth into.

Sometimes the risks are worth considering, but they’re usually transitory and barely worth a breath.

What I always ask myself is how any sort of event is going to impact the long-term viability of the companies in my stock portfolio. So, in this case, here are a few questions I might ask myself:

- How will Evergrande defaulting on its obligations impact the taste of consumers? Will it prevent consumers from purchasing snacks and drinks from PepsiCo five years from now?

- Will a teetering real estate market in China put any sort of dent in the growth trend of the digitization of cash? In other words, do I expect this to impede the future prospects of Visa?

- Will people stop buying Apple iPhones or products from Apple’s AppStore because of this?

I believe that the use of high-quality mental models can help with separating the wheat from the chaff.

Thus far, I’ve never been scared off of my high-quality companies. I believe capitalism is here to stay and I intend to keep increasing my stake in it.

Conclusion

This was another month of posting solid dividend totals. Inching around the $700 mark gives me plenty of capital to continue putting to work when prices permit.

Patience remains the name of the game. I am ready to invest considerable amounts of cash when the market gives me a few soft pitches.

With Evergrande and any event like it, always remember to keep your head. The media sensationalizes stories to get clicks. That’s how they sell ads and drive their revenue. Take advantage of this as a shareholder, but don’t buy into the fearmongering as a consumer.

As always, keep your eye on what matters most. Focus your investment dollars on quality and let time help with the compounding.

Full Disclosure: Long REI-UN, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, MRU, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, PEP, WMT, V, MSFT, AAPL

great stuff Ryan

Love that jnj payout. This is one I keep debating growing atm as the healthcare sector seems to be one of the cheapest sectors at the moment. I have mixed views on the bankruptcy play though.

Great analogy of evergrande. Its just noise, stick to the plan.

Keep it up

cheers.

Passivecanadianincome recently posted…September 2021 Passive Income Update – Time’s Flying!

Hey Rob,

Yeah, JNJ is one I was fortunate to pick up around 2011 when it was out of fashion. They were having plenty of issues with product recalls (e.g., Tylenol) and the pundits said the company has lost its way. Now look at it.

Absolutely, stick to the plan.

Take care,

Ryan