Following a two-week vacation in Europe, September was mostly about catching back up on life. As always, it was also a great time to just relax and watch the seasons change.

Although the stock market took a dive, dividend payments remained on schedule.

Table of Contents

Dividend Summary

I earned cash flow in Canadian dollars from seventeen companies, with eight more sources paying in USD. This provides a healthy mix of income and allows me opportunities to further reinvest without worrying about foreign exchange.

CAD Dividends

| Company | CAD Payments ($) |

|---|---|

| RioCan Real Estate Investment Trust (REI.UN) | 22.19 |

| Johnson & Johnson (JNJ) | 94.19 |

| Corby Spirit and Wine Ltd. (CSW.B) | 12.00 |

| Fortis, Inc. (FTS) | 96.30 |

| Canadian Utilities Limited (CU) | 104.39 |

| Canadian National Railway Company (CNR) | 32.96 |

| Hydro One Ltd (H) | 72.70 |

| Chartwell Retirement Residences (CSH.UN) | 5.10 |

| Metro Inc. (MRU) | 5.50 |

| Brookfield Renewable Partners L.P. (BEP.UN) | 119.57 |

| Brookfield Renewable Corporation (BEPC) | 54.54 |

| Brookfield Asset Management (BAM.A) | 4.07 |

| Brookfield Infrastructure Partners L.P. (BIP.UN) | 14.16 |

| Brookfield Infrastructure Corporation (BIPC) | 7.55 |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.20 |

| Enbridge Inc. (ENB) | 21.50 |

| Saputo Inc. (SAP) | 5.40 |

* CSW-B and AW-UN actually made their payouts in October, but I’ve included here for consistency with other payment periods for tracking purposes.

USD Dividends

| Company | USD Payments ($) |

|---|---|

| Waste Management, Inc. (WM) | 27.63 |

| McDonald’s Corporation (MCD) | 24.64 |

| Yum! Brands, Inc. (YUM) | 18.90 |

| Yum China Holdings, Inc. (YUMC) | 3.98 |

| PepsiCo, Inc. (PEP) | 9.78 |

| Walmart Inc. (WMT)* | 7.14 |

| Visa Inc. (V) | 4.79 |

| Microsoft Corporation (MSFT) | 6.86 |

Dividend Earnings Totals

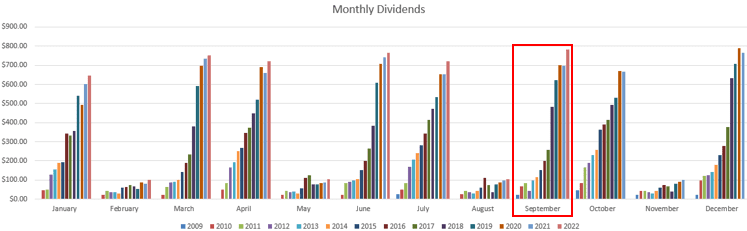

I earned C$678.32 and U$103.72, combining for a currency-neutral $782.04. In comparison with my September 2021 dividend earnings, this represents a 12.13% increase. This is the first double-digit percentage increase I’ve had in a month in a good while. It has been bolstered by companies finally getting back to their dividend growth as the pandemic wanes.

There weren’t any dividend raises in this period. This is typical for a September based on my investment portfolio’s company profile.

Year To Date Progress

As noted, this September’s dividend income represented a huge +12% bump year-over-year. The income bar graph keeps climbing higher:

On a year-to-date basis, I’ve raked in ~$4.7k with three months left on the books:

| Month | Dividends ($) |

|---|---|

| January | 645.55 |

| February | 101.85 |

| March | 750.44 |

| April | 720.76 |

| May | 103.31 |

| June | 765.11 |

| July | 721.84 |

| August | 103.31 |

| September | 782.04 |

| Total | 4,694.21 |

As I’ve noted previously, my goal for the year was to comfortably exceed $6,000. I’m well on track with October expected to come in above $700 and December above $800.

Interest Rates

The Bank of Canada (BoC) boosted interest rates by 0.75% this month. They’re set to release their Monetary Policy Report in October, detailing their economic outlook.

At this stage, it seems they were quite serious about front-loading the path to higher rates and lower inflation. I remain interested to see whether they’ll stick to this once the economy takes a serious downturn.

There are plenty of projections for a recession in the near future, though the exact timing and ultimate severity are anyone’s guess. If this were to occur, would the BoC continue with its stated goal of keeping interest rates elevated?

In any event, this economic backdrop should serve to weaken the stock market’s valuations. In this case, it should be a great time for stock buying.

Market Activity and Cash

I didn’t make any additional stock market purchases this month. I’ve been letting the dividends accumulate passively and so my cash position has been building.

At this stage, though, I am beginning to see some attractive opportunities. As the market has been declining, I’ve been eagerly watching those dividend yields rise. It is highly likely I’ll make a purchase in October; the question is which company to buy.

Conclusion

My dividend income this month came just five dollars short of my all-time record from December 2021. It demonstrates how much organic dividend growth I’ve received, along with proceeds from additional stock purchases.

This sets the stage for a strong finish to the year. I’ve had my eye on a +$850 December and that should be baked in at this stage.

Although most people prefer the warm months, I’m looking forward to the cooler temperatures settling in. It’s great weather for sleeping and also seems to slow down the pace of life itself.

– Ryan

Full Disclosure: REI-UN, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, V, MSFT