As a dividend growth investor, the most important figure I track on an annual basis is whether my overall level of passive income has risen. While capital gains can prove fickle, particularly over short spans of time, dividend growth is driven as a direct result of business prospects and performance.

One metric that allows me to assess the efficiency of my dollars invested is Yield On Cost (YOC). This represents the dividend yield I am receiving on the money I originally invested. It is calculated by dividing the annual dividend by the price paid per share.

Table of Contents

My History With TD

I made my original and only purchase of Toronto-Dominion Bank (TD) in May of 2009. This was in the thick of the financial crisis and just shortly after the market bottomed a few months earlier on March 9. It was a time of trepidation and worries about the health of the global economic system. I should also note that this was the first purchase I had ever made of an individual equity and so while it was a time of widespread caution, it was with excitement that I dipped my toes into the open markets.

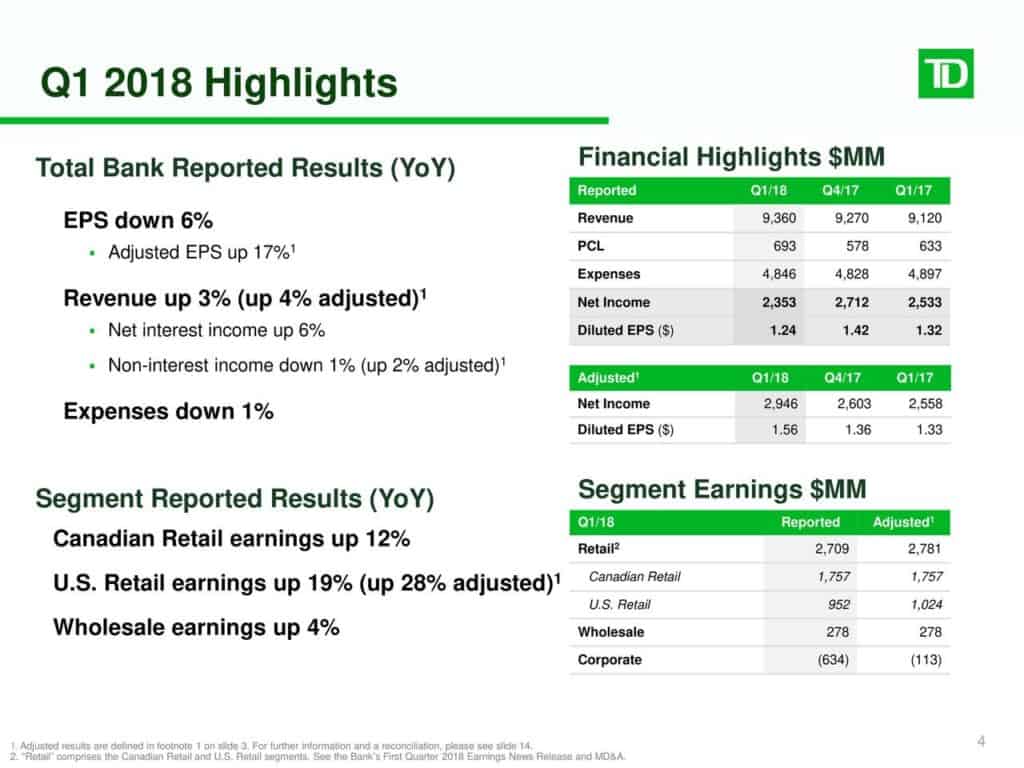

My thesis at the time was that Canadian banks quite generally are among the most stable in the world. In my view at the time and to this day, TD stood out as the best of breed with tremendous prospects to grow both organically and through its acquisitive appetite in the U.S.. Back in 2009, opportunities abounded for a well-capitalized bank to go shopping for distressed assets. While other Canadian banks and businesses have had mixed to poor results when venturing south, I felt TD was executing effectively and would reap the benefits for decades to come. Their latest report suggests this to be the case, as they clocked in with a 19% (28% adjusted) increase in year-over-year U.S. Retail earnings:

Source: TD’s Q1 2018 Earnings Call Slides

I covered TD’s standout performance in the U.S. in a previous article contrasting the Big Five Canadian Banks. While that was in 2015, TD has continued to widen the gap between it and its homegrown competitors when it comes to U.S. growth.

Yield On Cost

Please note that all figures here are in Canadian dollars.

When I picked up my shares in 2009, TD was trading at a split-adjusted cost of $24.96 per share. The split-adjusted annual dividend payment at the time was $1.22 ($0.305 quarterly). Based on these figures, my dividend yield at the time of purchase was 4.89%. For a stalwart such as TD, I was ecstatic to be getting in with such a hearty starting yield.

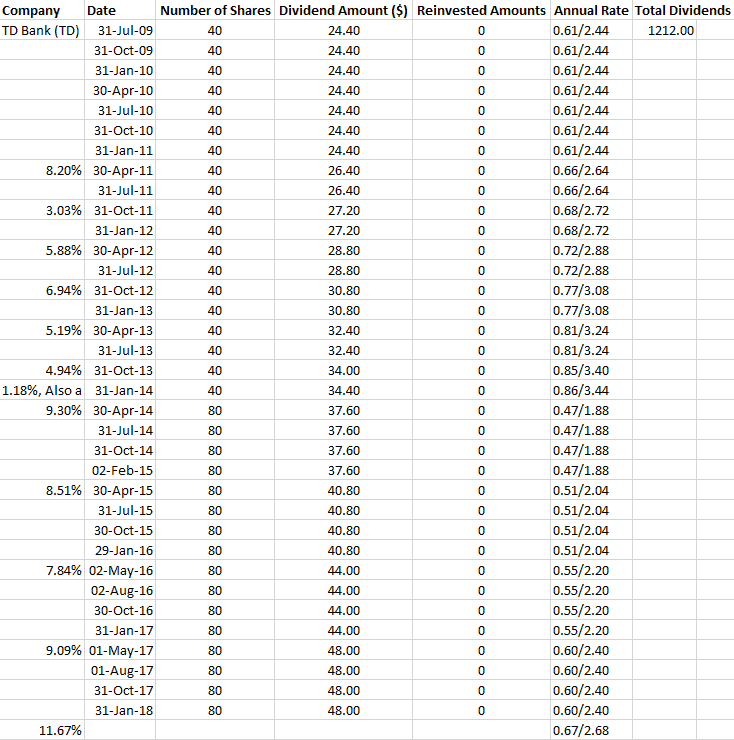

Since that time, TD has announced twelve dividend increases and one stock dividend (the equivalent of a two-for-one stock split). As a result, that initial $1.22 annual dividend has mushroomed to $2.68 ($0.67 quarterly). For investors looking to buy TD shares now, the dividend yield they can expect based on the current share price of just under $75 comes out to ~3.6%. Based on my initial purchase price, however, my YOC stands as a whopping 10.74%.

So, while it has taken just under nine years to double my YOC, it is worth remarking that TD did not increase its dividend over roughly the first two years of my share ownership as a result of the financial crisis, only lifting it for the April 30, 2011 payment and then steadily thereafter. The most recent increase of 11.67% is the biggest single bump I’ve experienced with the company, although through other periods the company was boosting the dividend multiple times per year and achieving a higher annual dividend growth rate than this.

Beyond the yield, TD has paid me dividends a total of 35 times between the first payment received on July 31, 2009, and the most recent payment on January 31, 2018:

This has amounted in $1,212.00 of total dividends. The original purchase cost me $1,997.00. In other words, I have already received over 60% of my original investment back passively through dividends paid. Each year I grow progressively closer to actually getting back every dollar I’ve invested in TD as the dividend continues to swell.

While the focus of this article is on rising income, I should also mention that the value of my shares have tripled over this period, bringing my original ~$2,000 outlay to ~$6,000 as TD has grown steadily. As nice as it is to see the value of my account increase, this also means investors would now need to pay three times as much to achieve the same level of income that my original purchase presently yields. As such, those of the dividend growth investing mindset actually prefer stock levels to remain lower in general or to at least capitalize on dips to lock in elevated levels of passive income.

Lessons Learned

If there is one chief lesson to take away from all of this, it is that doing well as an investor requires patience and the gumption to stick with your ideas. Success does not require a technical knowledge of chart analysis or the ability to day trade. All of the returns I’ve outlined in this article are the direct result of a single stock market purchase back in the summer of 2009. I quite literally did nothing else with the stock aside from track my dividends in a spreadsheet with a smile on my face as the numbers kept increasing.

Another lesson to be gleaned is that with investing, as in life, it often pays to swim against the tide. Warren Buffett recently spoke about this in his 2017 Letter to Shareholders:

What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals. A willingness to look unimaginative for a sustained period – or even to look foolish – is also essential.

When I drove my stake into the ground with my TD purchase, there were far more pundits declaring a potential dead-cat bounce in the markets than there were those predicting that the worst of the financial crisis was already over. I felt that despite the blood in the streets of Wall Street and Bay Street alike, it seemed obvious that life would eventually go on as it always has. People would need a place to store their deposits, acquire financing for a mortgage or a business opportunity, and continue using their credit cards and lines of credit. TD stood out as a sensible place to invest and stick with over the long haul.

Conclusion

To achieve the full benefit of dividend growth investing, it is important to identify high quality companies that will have staying power. Once the initial purchase is made, the next most important thing to do is be patient. As a company grows its dividend while retaining some earnings to likewise grow the business, shareholders stand to benefit from the double whammy of rising income and capital appreciation.

TD is my example of such a company and remains a sentimental favourite given it was my first purchase of an individual stock. My intended holding period for TD remains today the same as it was back in May 2009; I am never planning to sell my shares of TD. I hope to be writing another such article with them as the focus a decade from now and decades still hence.

TD’s recent announcement to boost its dividend by 11.67% was music to my ears not just because it is such a great increase but also because for me it represented a doubling of YOC which is a beautiful milestone to reach. Given their phenomenal success in the U.S. and continued, growing presence in Canada, I believe TD is poised to reward my faith in them for years to come.

Thank you reading.

Pictures courtesy of pixabay.com

Yield on cost is part of the magic sauce that makes dividend growth investing work so well long term. Most people don’t get this concept but it can be huge especially of you own a dividend grower for multiple decades. Thanks for sharing your TD example. Happy to be a fellow TD shareholder among other Canadian banks like BNS and RY. Man, do I love those Canadian banks.

DivHut recently posted…Dividend Income Update February 2018

Hey DH,

Absolutely. I’ve been looking forward to writing this article for a while now as the dividend growth was approaching a “double” for me. As you mention, TD is just one example but most of the Canadian banks fit this same mold.

Likewise glad to be sharing this one in our portfolios!

Take care,

Ryan