April brought with it more talk of high inflation and concerns over the rocky geopolitical situation. The tragic war in Ukraine has continued to have ripple effects through the entire economy.

Amid this backdrop of a falling stock market, I’ve continued to make progress within my portfolio.

Table of Contents

Dividend Summary

My dividend income came from a combination of 9 Canadian and 3 US companies. As usual, these payments were derived from a healthy cross-section of industries.

CAD Dividends

| Company | CAD Payments ($) | Div Change (%) |

|---|---|---|

| Toronto Dominion Bank (TD) | 178.00 | |

| RioCan Real Estate Investment Trust (REI-UN) | 22.19 | |

| The Coca-Cola Company (KO) | 73.02 | 4.76 |

| BCE Inc. (BCE) | 202.40 | 5.14 |

| Canadian Imperial Bank of Commerce (CM) | 19.32 | |

| Bank of Nova Scotia (BNS) | 100.00 | |

| TELUS Corporation (T) | 70.39 | |

| Rogers Communications Inc. (RCI-B) | 27.50 | |

| Canadian Pacific Railway Limited (CP) | 9.50 | |

| Chartwell Retirement Residence (CSH-UN) | 5.10 | |

| A&W Revenue Royalties Income Fund (AW-UN) | 6.20 |

USD Dividends

| Company | USD Payments ($) | Div Change (%) |

|---|---|---|

| Walmart Inc. (WMT) | 7.14 | 1.82 |

* The TD dividend was paid in May, but I’ve included it this month as it is traditionally paid in April.

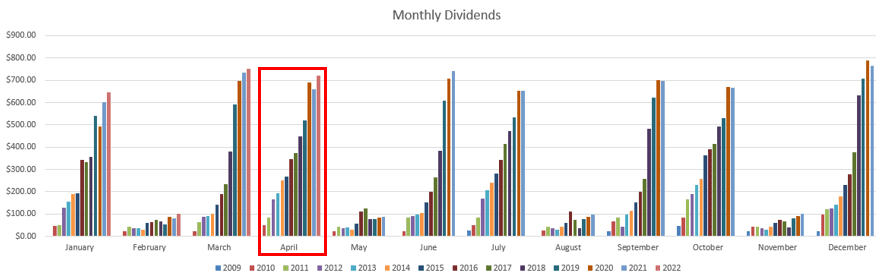

I brought in a solid C$713.62 and U$7.14, coming together for a currency-neutral total of $720.76. This is a 9.28% increase over my April 2021 dividend totals.

Standouts

As usual, there were a few companies with noteworthy dividend activity that is worth mentioning.

BCE

The biggest standout from this group is BCE which has crossed the psychological threshold of $200 quarterly. My first payment came from the company all the way back in 2011 and was for just over $75.

I made one additional lump sum purchase of the company along the way and also DRIPed a few shares, but mostly I’ve redeployed its income along the way. The increase in dividends have largely been funded by organic dividend increases.

BCE is a healthy reminder to me that there is great power in a solid starting yield, combined with ~5% dividend raises annually. Just let the company do the heavy lifting and don’t sell shares. Redeploy the capital and let compound growth take off.

WMT

When it comes to small dividend raises, nobody has WMT beat. The company has been doling out one cent bumps annually ever since I picked them up in 2015.

All the same, I do recognize that the company needs to compete heavily on eCommerce, so this is actually a sensible move. You need all the cash you can get when you’re fighting on the big stage against competitors such as Amazon (AMZN), Costco (COST), and Target (TGT).

This year also marks its 49th annual dividend increase. Next year it should be minted as a Dividend King as it crosses the 50-mark.

Year To Date Progress

Posting +9% progress with my dividend income is exactly what I need to be doing in order to hit my long-term goals. This is one very important measure of how I recognize portfolio success. Eventually, this cash flow is what will represent the foundation of my financial independence:

Through the first third of the year, I’ve pulled in $2,218.60:

| Month | Dividends ($) |

|---|---|

| January | 645.55 |

| February | 101.85 |

| March | 750.44 |

| April | 720.76 |

| Total | 2,218.60 |

As usual, the plan is to simply reinvest every penny of this.

Market Activity and Cash

I’ve been mostly keeping to cash in the past while, but I did manage to take advantage of a sharply dropping stock market. Most tech names have been getting absolutely crushed in the last while, which is the time to buy.

I picked up two shares of SHOP for a total cash outlay of C$1,229.83. Given that I was paying more for this for one share last year, this was an opportunity to average down.

It doesn’t concern me to see the price declining so rapidly. The entire market is getting revalued. Over the longer term, however, the growth story of SHOP remains firmly in place.

My time horizon for owning this company is going to be measured in years, perhaps decades. With this being the case, I don’t need to worry about seeing a little red in my portfolio along the way.

Conclusion

My simple answer to stocks dropping is to buy more. Whether that’s SHOP or any of my other high-quality companies, averaging down always feels great. I don’t mind being down in the short run in order to reap the rewards down the line. Deferred gratification is a lifestyle.

My overall goal is to be a net accumulator of assets and continue building my portfolio over time. Market drops are market opportunities, so long as you’re positioned to capitalize.

– Ryan

Full Disclosure: REI-UN, KO, JNJ, CSW-B, FTS, CU, CNR, H, CSH-UN, BEP-UN, BEPC, BAM-A, BIP-UN, BIPC, AW-UN, ENB, SAP, WM, MCD, YUM, YUMC, V, MSFT, AMZN