This was one of the wildest months I’ve ever experienced professionally. Very busy and time-sensitive work.

As a result, this post is coming a few weeks later than I would normally have liked to post it.

All the same—and as always—dividends flowed. Cash flow represents real, tangible income.

Table of Contents

Dividend Summary

Passive income flowed inbound from ten Canadian companies, along with one from the US.

CAD Dividends

| Company | CAD Payments ($) | Dividend Change (%) |

|---|---|---|

| The Toronto-Dominion Bank (TD) | 192.00 | |

| RioCan Real Estate Investment Trust (REI.UN) | 23.49 | |

| BCE Inc. (BCE) | 212.85 | 5.16 |

| Canadian Imperial Bank of Commerce (CM) | 20.40 | |

| The Bank of Nova Scotia (BNS) | 103.00 | |

| Canadian Pacific Railway Limited (CP) | 9.50 | |

| Chartwell Retirement Residences (CSH.UN) | 5.10 | |

| A&W Revenue Royalties Income Fund (AW.UN) | 6.40 |

I earned C$572.74 in April. This represents a considerable drop from prior periods, but this is only due to the timing of payments from various companies (i.e., from TELUS (T)) occurring in the prior month/quarter.

The ideal situation would be for companies to exclusively pay in a given month. However, many aim for the “last day of the month”, even if that means the actual payment flows to the following month in a typical situation. Not a huge deal, but complicates YOY analyses in the context of payments for specific months.

All the same, progress was achieved on the whole.

Year To Date Progress

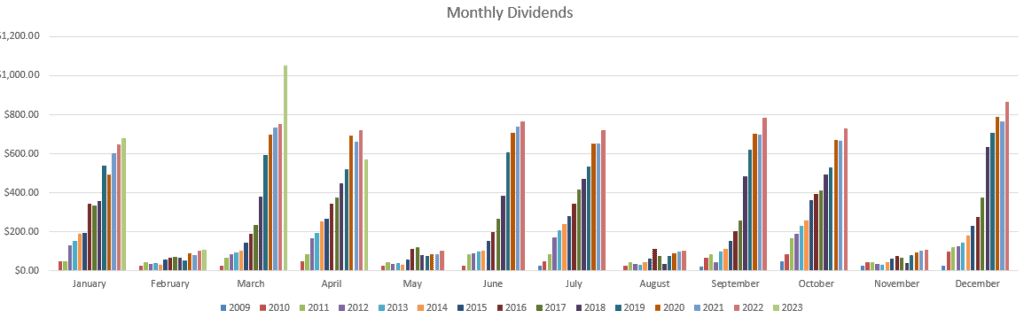

As noted above, the bar chart is a bit up-and-down this month, but there has certainly been YOY progress when taken on an holistic basis

I’ve also managed to reach nearly $2,500 in income through the first five months of the year:

| Month | Dividends ($) |

|---|---|

| January | 680.90 |

| February | 107.14 |

| March | 1,050.94 |

| April | 572.74 |

| Total | 2,411.72 |

Market Activity and Cash

I’ve remained on the sidelines as I’m not convinced the market is as healthy as many inflation-projections have suggested. Certainly, job markets have been hot, but banks continue to add to their provisions for a downturn. Mixed signals.

At the end of the day, I prefer a conservative position that keeps my portfolio healthy, secure, and prepared to snatch opportunities. I’m content with what I am cash flowing at the moment and would rather have dry powder on the sidelines than reach for yield.

Patience wins the day over the long term. I’m an investor, not a gambler. That’s how it should be and needs to be.

The Bank of Canada may or may not raise interest rates. That is far outside of my control.

The important thing is to remain well-capitalized internally. Never be left out in a downturn, needing capital.

Conclusion

Continuing with my dividend growth investment strategy is the bedrock of my portfolio. I intend to continue reinvesting as opportunities present.

I hope you’re all sticking to your plan and making the most of the market as it dips and dives.

– Ryan

Full Disclosure: TD, REI-UN, BCE, CM, BNS, CP, CSH-UN, AW-UN